Your step-by-step guide to start budgeting. Managing your money doesn’t have to be complicated.

Last updated: 01/10/2025

Budgeting for beginners can feel overwhelming and intimidating. You may not know where to begin. Creating a custom budget can give you the freedom to prioritize what truly matters to you and spend within your means at the same time. This guide will show you how to budget in a way that is simple, realistic, and tailored to your goals.

Key takeaways

Tracking your current monthly income and expenses is the first step to taking control of your money.

A budget is more than a way to fix bad spending habits—it’s your blueprint to reaching your short- and long-term financial goals.

Budgeting isn’t a one-time task, and it’s important to check in on your progress and make adjustments as your life and priorities change.

How Budgeting Can Help You Take Control of Your Finances

Budgeting gives your money a clear purpose. Instead of wondering where your paycheck went each month, you’ll know exactly where every dollar goes. Here are some ways budgeting can enhance your life.

One of the biggest benefits of budgeting is that it helps you avoid overspending. Having a clear plan makes you less likely to make impulse purchases that can throw you off track.

Budgeting provides a clear picture of your income and expenses, allowing you to identify areas where you can cut back and save more each month.

By enabling you to spend less and save more, budgeting helps you build an emergency fund. Life is unpredictable, and unexpected expenses can occur at any time. Having a budget allows you to regularly set money aside, creating a financial cushion that can prevent you from going into debt when the unexpected happens.

Budgeting allows you to set and achieve financial goals. Whether you’re saving for a vacation, paying off debt, or investing for the future, a budget can help you stay on track. If you map your progress and seek expert advice, you can stay motivated and on course.

Finally, budgeting reduces financial stress. Knowing that you have a plan in place allows you to enjoy life without constantly worrying about money.

How to make a monthly budget

Creating a monthly budget might sound daunting, but it's one of the best first steps you can take toward financial stability. A monthly budget is like a financial blueprint—it shows you exactly how much money is coming in, where it’s going, and how you can optimize your spending.

Whether you're trying to eliminate debt or save for a big expense, learning how to budget can help you achieve your financial goals.

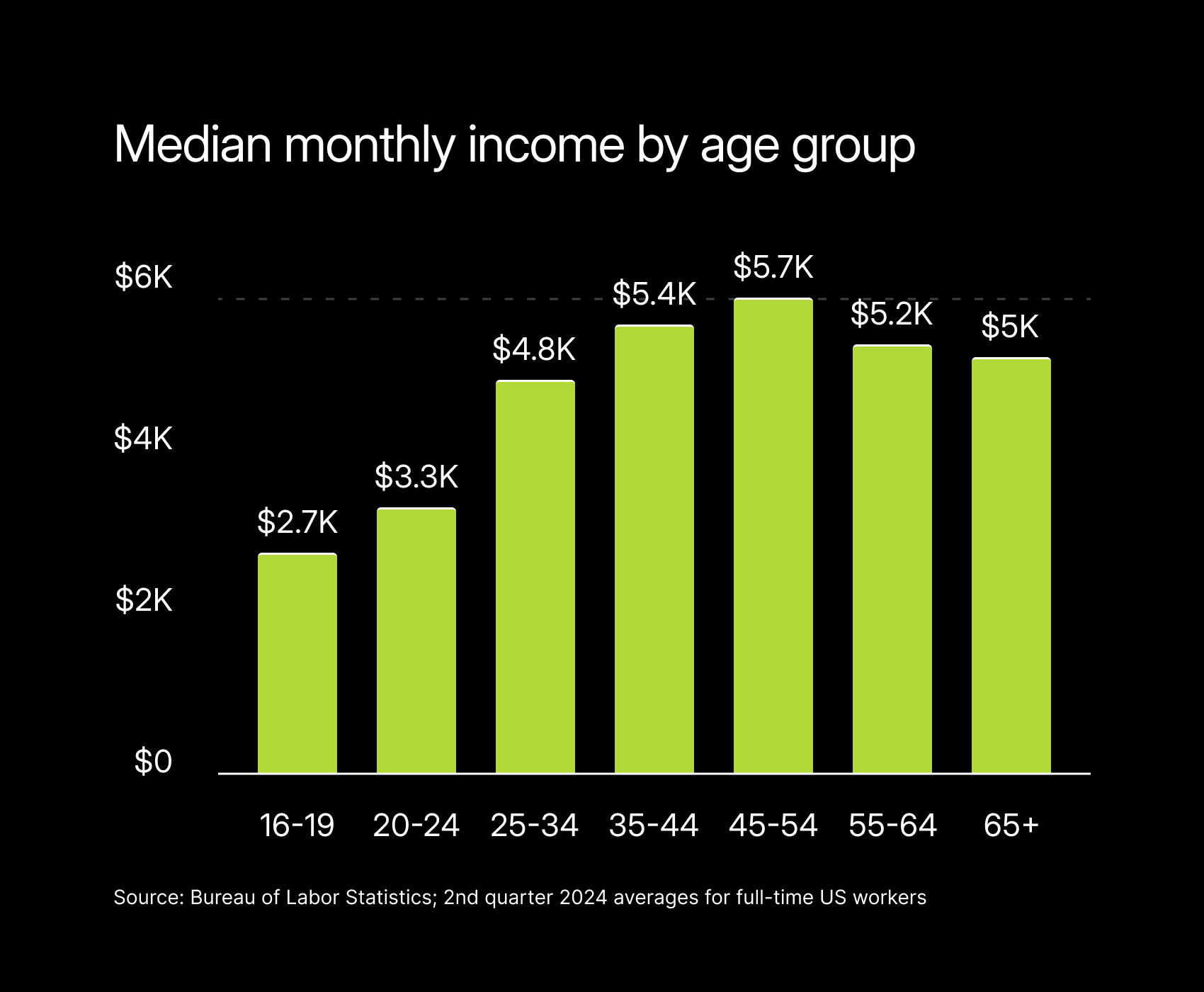

1. Calculate your monthly net income

The foundation of any successful budget is knowing exactly how much money you have coming in each month. This involves calculating your monthly net income. Your net income is the amount of money you take home after taxes, deductions, and other withholdings are subtracted from your gross income.

Start by adding up all sources of income, including your salary, freelance work, side gigs, and any other regular earnings. Be sure to use your net income—the actual amount deposited into your bank account—rather than your gross income to avoid overestimating how much you can spend.

If your income fluctuates due to variable work hours or freelance projects, calculate an average monthly income based on your earnings over the past six months to give yourself a realistic picture of what you can expect each month.

2. Identify all of your monthly expenses

The next step is to identify where your money is going each month. This involves identifying all of your monthly expenses, which can be broken down into two main categories: fixed expenses and variable expenses.

Fixed expenses are the costs that remain the same every month. These might include rent or mortgage payments, car payments, insurance premiums, subscription services, and any other bills that are consistent month after month. Because these expenses are predictable, they form the backbone of your budgeting approach for fixed expenses.

Variable expenses are those that fluctuate from month to month. These include groceries, utilities, transportation costs, entertainment, and dining out. Although these expenses can vary, they are the areas where you have the most control and flexibility.

To get a complete picture, it’s important to account for all spending. Start by listing all of your fixed expenses, then move on to estimating your variable costs based on recent spending. This comprehensive approach will help you understand your spending habits and identify areas where you can cut back or allocate funds more effectively.

3. Set financial goals

Financial goals are the driving force behind your budget, giving you a reason to stay consistent and motivated. Financial goals can be divided into two categories: short-term and long-term.

Short-term goals are those you plan to achieve within the next year or so. They might include building an emergency fund, paying off credit card debt, saving for a vacation, or purchasing a new piece of furniture.

Short-term goals can often be broken down into smaller, more manageable steps. For example, if you want to save $1,200 for a vacation in six months, you’ll need to set aside $200 each month.

Long-term goals are those that take more time and planning, and typically span several years or decades. These might include saving for a down payment on a house, funding your retirement, or paying off a student loan.

Long-term goals require patience and consistency, and they often involve larger amounts of money. Setting milestones along the way can help you stay on track and will make the process less daunting.

When setting financial goals, it’s important to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. This approach ensures that your goals are clear and attainable, increasing the likelihood that you’ll achieve them.

Budgeting and saving will become a habit over time, especially when you have a little help from Albert.

4. Formulate a plan

Once you've set your goals, the next step is to formulate a plan that ties everything together. This plan will serve as the framework for your monthly budget as it helps you allocate your money in a way that supports your goals and covers your needs.

Start by subtracting your total monthly expenses from your net income. This will give you a clear picture of how much money you have left after covering your essentials.

If you have a surplus, you can allocate this extra money toward your financial goals, such as savings or debt repayment. If you find that your expenses exceed your income, you’ll need to make adjustments. These might involve cutting back on nonessential spending or finding ways to increase your income.

Next, prioritize your spending based on your goals. If paying off debt is a top priority, allocate more of your budget toward debt repayment. If building an emergency fund is your primary goal, focus on saving. Your plan should reflect what matters most to you.

Be realistic when formulating your plan. Consider your lifestyle, habits, and any upcoming expenses that might impact your budget. Flexibility is key—your budget can be adjusted as your circumstances change.

5. Track your spending

Tracking your spending is a great place to start. Documenting every transaction, no matter how small, is essential to staying on top of your budget. This might sound tedious, but it’s one of the most important habits you can develop.

Whether you use a budgeting app, spreadsheet, or simple notebook, the goal is to record every dollar spent. This helps you identify any discrepancies between your budget and actual spending. It also brings awareness to your financial habits, highlighting areas where you might be overspending or where you could cut back.

6. Make adjustments as needed to stay on budget

No budget is set in stone, and unexpected expenses are bound to come up. The key to staying on budget is being flexible and making adjustments as needed.

For example, if your car suddenly needs repairs, you’ll have to find a way to cover that cost without overspending. This might mean reducing your spending in other areas, such as entertainment, to balance things out.

Making adjustments isn’t about depriving yourself; it’s about maintaining control over your finances. Regularly review your budget and track your spending to see if you’re staying within your limits. If you notice that you consistently overspend in certain categories, it’s time to reallocate funds or revise your budget to better reflect your actual expenses.

7. Create a new budget each month

A new month can mean different expenses and fluctuations in your income, so it’s important to create a fresh budget that reflects these changes. While your overall financial goals might stay the same, the details of your budget should adapt to account for things like holidays, birthdays, anniversaries, planned vacations, and unexpected events.

Additionally, changes in your income (such as a pay raise) or shifts in your expenses (like increased bill payments) should be factored into your new budget.

Budgeting isn’t a one-time task—it’s an ongoing process that evolves with you. By making it a monthly habit, you’ll be better equipped to handle whatever the next month throws your way, keeping you in control of your financial journey.

Determining your priorities

Creating a budget isn’t just about tracking money—it’s about making intentional decisions that align with your goals. Determining your priorities helps you allocate your money in a way that reflects what matters most to you to ensure that your spending supports both your needs and lifestyle.

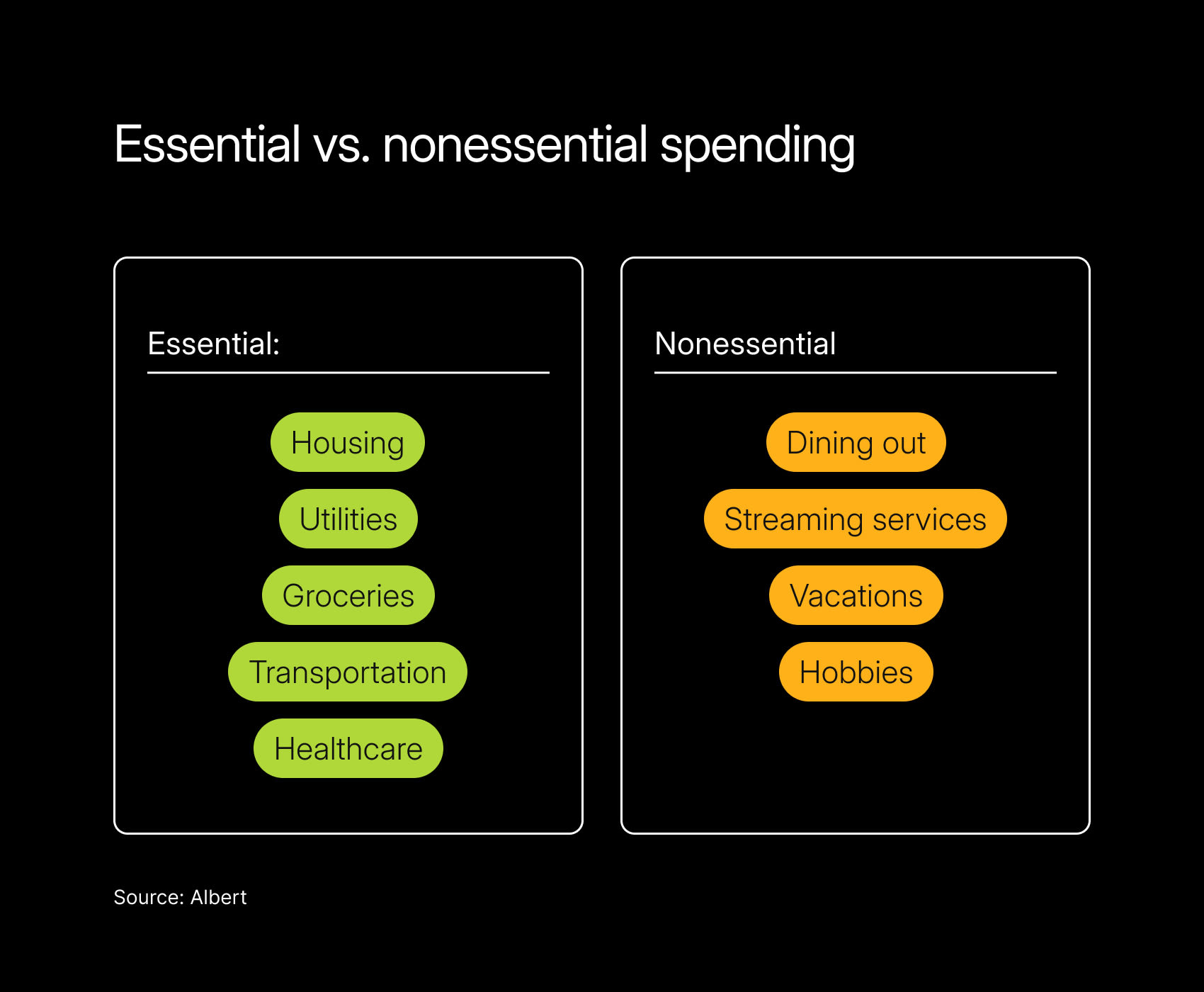

Begin by sorting your expenses into two categories: essential and nonessential. Essential expenses, such as rent or mortgage, utilities, groceries, and insurance, should be covered first.

Next, allocate funds toward financial goals like saving for emergencies, retirement, or paying off debt.

Finally, direct any remaining resources to nonessential or discretionary spending. This includes categories such as restaurants, travel, and hobbies.

Essential spending vs. nonessential spending

Understanding the difference between essential and nonessential spending is necessary for effective budgeting.

Essential spending includes necessities such as housing, utilities, groceries, transportation, and healthcare. These are expenses that are required to maintain your basic standard of living.

Nonessential spending covers discretionary purchases like dining out, streaming services, vacations, and hobbies. While nonessential expenses add enjoyment to your life, they are not strictly necessary for day-to-day survival.

Prioritizing essential spending ensures that your critical needs are met first, while nonessential spending can be adjusted based on your financial goals and circumstances.

Include “fun money” in your budget plan

Budgeting doesn’t have to be all about restriction; it’s important to include a little “fun money” in your plan. Fun money is a designated amount set aside for personal enjoyment, such as treating yourself to a coffee, going to the movies, or splurging on a new gadget.

By allocating a specific portion of your budget to fun money, you allow yourself the freedom to indulge without guilt while remaining on track with your overall financial goals.

Curbing frivolous spending

Frivolous spending—impulse buys and unnecessary expenses—can quickly add up and derail your budget if left unchecked. To curb frivolous spending, start by identifying your spending triggers, such as shopping when you’re bored or stressed. Also, look at where you tend to waste money.

Set strict limits on discretionary purchases, and consider implementing a 24-hour waiting period before making large nonessential buys. This cooling-off period can help you make more deliberate decisions and reduce the likelihood of impulse spending.

Types of budgeting plans

When it comes to managing your money, there's no one-size-fits-all solution, but there are several proven strategies that cater to various financial needs and preferences.

Whether you are a meticulous planner or prefer a more flexible approach, understanding the different types of budgeting plans can help you choose the right one for your financial journey.

Zero-based budgeting

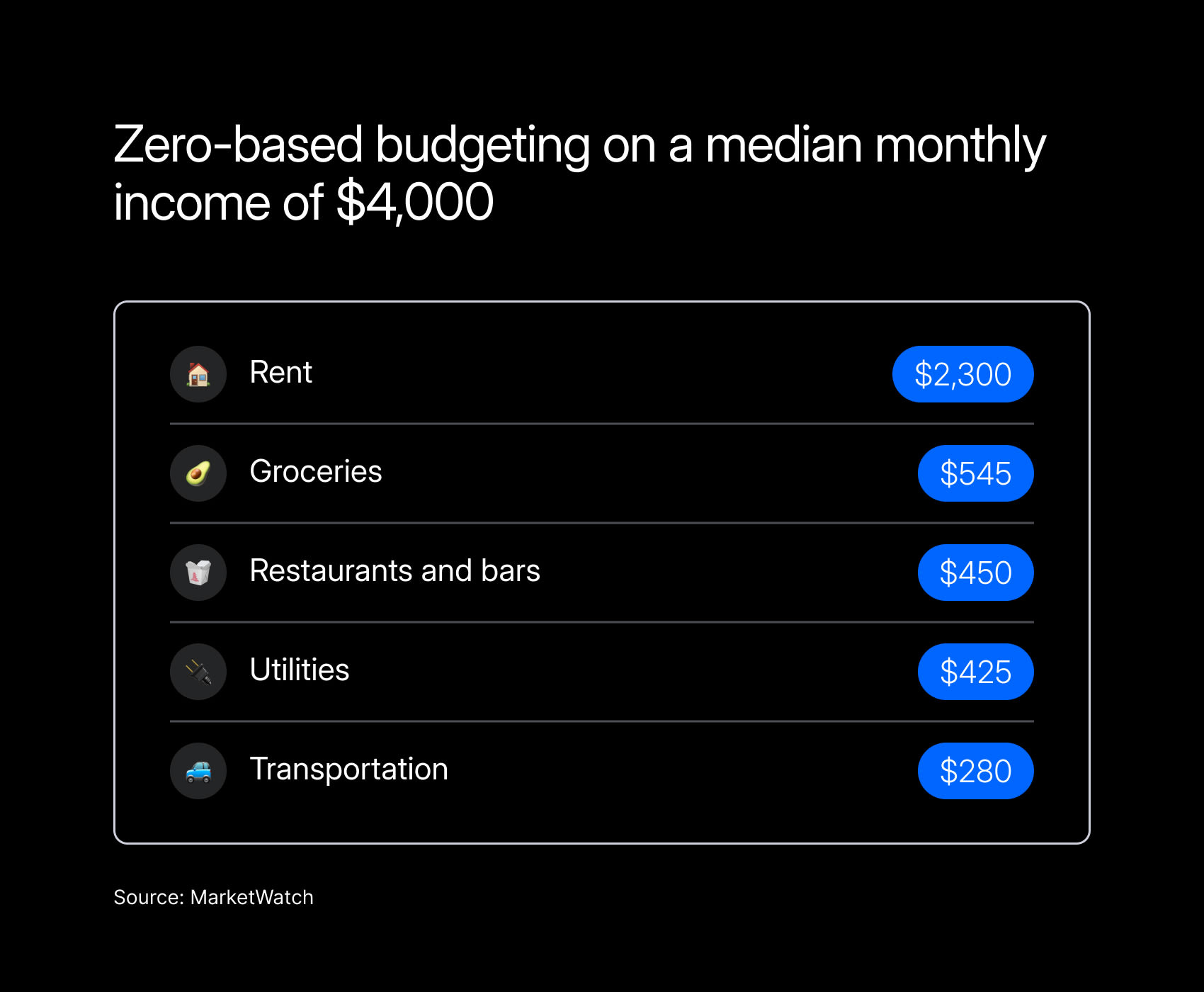

Zero-based budgeting starts with a simple principle: Every dollar you earn is allocated to a specific expense, savings, or debt repayment, leaving no money unassigned.

At the end of the month, your budget should "zero out," meaning that your income minus your expenses equals zero. This method helps prevent overspending and encourages careful planning and precise tracking to ensure that every dollar is used purposefully.

50/30/20 budgeting

The 50/30/20 budgeting plan divides your income into three categories: 50% for needs (such as housing and utilities), 30% for wants (such as dining out and entertainment), and 20% for savings and debt repayment.

This straightforward approach simplifies budgeting by providing a clear framework for allocating your income, making it easier to balance your essential expenses with your discretionary spending and financial goals.

Envelope system

The envelope system involves allocating cash for different spending categories, such as groceries or entertainment, and placing it into separate envelopes.

Once the cash in an envelope is spent, you can't use more from that category until the next budgeting period. This method helps control spending by making you more mindful of your limits. It is especially useful for managing variable expenses.

Pay yourself first budgeting

Pay Yourself First budgeting focuses on prioritizing savings and debt repayment by setting aside a portion of your income as soon as you receive it. This method treats savings like a fixed expense, ensuring that you contribute to your savings goals before covering other expenses.

By paying yourself first, you build a habit of saving consistently and ensure that your financial goals are a top priority.

Line-item budgeting

Line-item budgeting involves detailing every single expense in your budget. This method provides a comprehensive view of your spending by listing each expense individually, which can help identify areas where you might be overspending.

While it requires more effort to track and categorize each expense, it offers precise insights into where your money is going and helps you manage your finances more effectively.

Priority-based budgeting

Priority-based budgeting focuses on allocating funds based on the importance of various expenses and goals. Start by identifying your top financial priorities, such as essential bills or debt repayment, and allocate your resources accordingly.

This approach ensures that your most critical needs and goals are funded first, and any remaining funds can be distributed to less urgent categories.

Budgeting apps

Budgeting apps offer a modern solution to financial management by automating many aspects of budgeting. These apps track your spending, automatically categorize expenses, and provide insights into your financial habits.

They can sync with your bank accounts, making it easier to monitor your budget in real time and adjust as needed. Budgeting apps are particularly useful for those who prefer a tech-savvy approach.

When you choose Albert for successful budgeting, the app will track your income, current spending trends, subscriptions, and weekly progress toward savings and investing goals.

Albert provides real-time alerts to unusual transactions and data breaches, bill negotiation, and credit monitoring. When you need guidance, Albert’s financial experts are always available to answer your questions.

How to budget money on low income

Budgeting on a low income can be challenging, but with careful planning and discipline, it’s possible to budget effectively and still find room in your budget for the things you want. The key is to focus on essential spending, prioritize needs over wants, and seek ways to stretch your dollars.

Start by creating a detailed budget that accounts for every penny. Prioritize essential expenses like housing, utilities, groceries, and transportation. Look for ways to reduce costs, such as cutting unnecessary subscriptions, cooking at home instead of eating out, and shopping for discounts or using coupons.

Set realistic financial goals, even if they’re small, like building an emergency fund or paying off a bit of debt each month. Consider searching for additional income sources, such as part-time work or freelance gigs, to supplement your budget, and don’t rule out government assistance if you really need it.

Budgeting when your income fluctuates

Managing a budget can be particularly tricky when your income varies from month to month, but with the right strategies, you can still achieve financial stability. The key is to plan for the highs and lows by creating a flexible budget that adapts to your fluctuating income.

Start by identifying your baseline—this is the minimum amount you need to cover your essential expenses like rent, utilities, and groceries. Build your budget around this baseline to ensure that your core needs are met even during lean months.

When your income is higher, prioritize saving the extra money in a dedicated emergency fund. This fund will help you cover expenses during months when your income dips.

Adopt a conservative approach to your spending. Focus on essential purchases, and avoid committing to large, fixed expenses that could strain your budget during low-income periods.

How to budget as a couple

Budgeting as a couple requires teamwork, communication, and a shared vision for your financial future. To succeed, both partners need to be on the same page about their financial goals and spending habits.

Start by having an open conversation about your individual financial situations, including income, debts, and savings. Discuss your short-term and long-term financial goals, such as saving for a house, paying off debt, or planning for retirement.

Once you have a clear understanding of where you both stand, create a joint budget that reflects your combined income and expenses.

Decide how you’ll manage your finances—whether you’ll combine all your accounts, keep them separate, or use a hybrid approach.

Allocate money for both shared and individual expenses. This allows each partner to have some financial independence while still working toward common goals. Regularly review your budget together to track progress and make adjustments as needed.

Automating your budget

In today’s digital age, managing your finances can be easier than ever with the help of automation. Budgeting apps, bank budgeting tools, and other financial software can streamline the budgeting process, making it more efficient and less time-consuming.

Budgeting apps like Albert automatically track your income, expenses, and savings by syncing with your bank accounts and credit cards.

These apps automatically categorize your transactions, helping you see exactly where your money is going and alerting you when you’re nearing your spending limits. They also allow you to set financial goals and track your progress over time.

Many financial tools also offer built-in budgeting tools that provide similar features, such as transaction categorization, spending analysis, and goal tracking.

Budgeting tips for beginners

Starting a budget can feel overwhelming, but with a few simple tips, you can achieve success. Here are practical suggestions that will help you build a budget that is both effective and easy to maintain.

Start small and be realistic: Begin by tracking your expenses for a month to understand your spending habits. Use this insight to gradually build a budget that reflects your income, spending patterns, and goals.

Use the 24-hour rule: To avoid impulse purchases, wait 24 hours before buying any major nonessential items. This cooling-off period helps you determine whether the purchase is truly necessary.

Review and adjust regularly: Regularly review your budget to assess how well it’s working. Adjust as needed to accommodate changes in your financial situation.

Prioritize an emergency fund: Make building an emergency fund a top priority. Even small contributions add up over time, providing a financial safety net for unexpected expenses.

Automate savings and bills: Automate savings and bill payments to simplify your budgeting process. This ensures consistency in saving and paying bills on time, and reduces the risk of missed payments.

Seek Help and Stay Accountable: If you have budgeting questions, you can seek guidance from a financial expert or use budgeting tools such as Albert. Consider enlisting an accountability partner—someone who helps keep you on track and motivated.

Common budgeting mistakes to avoid

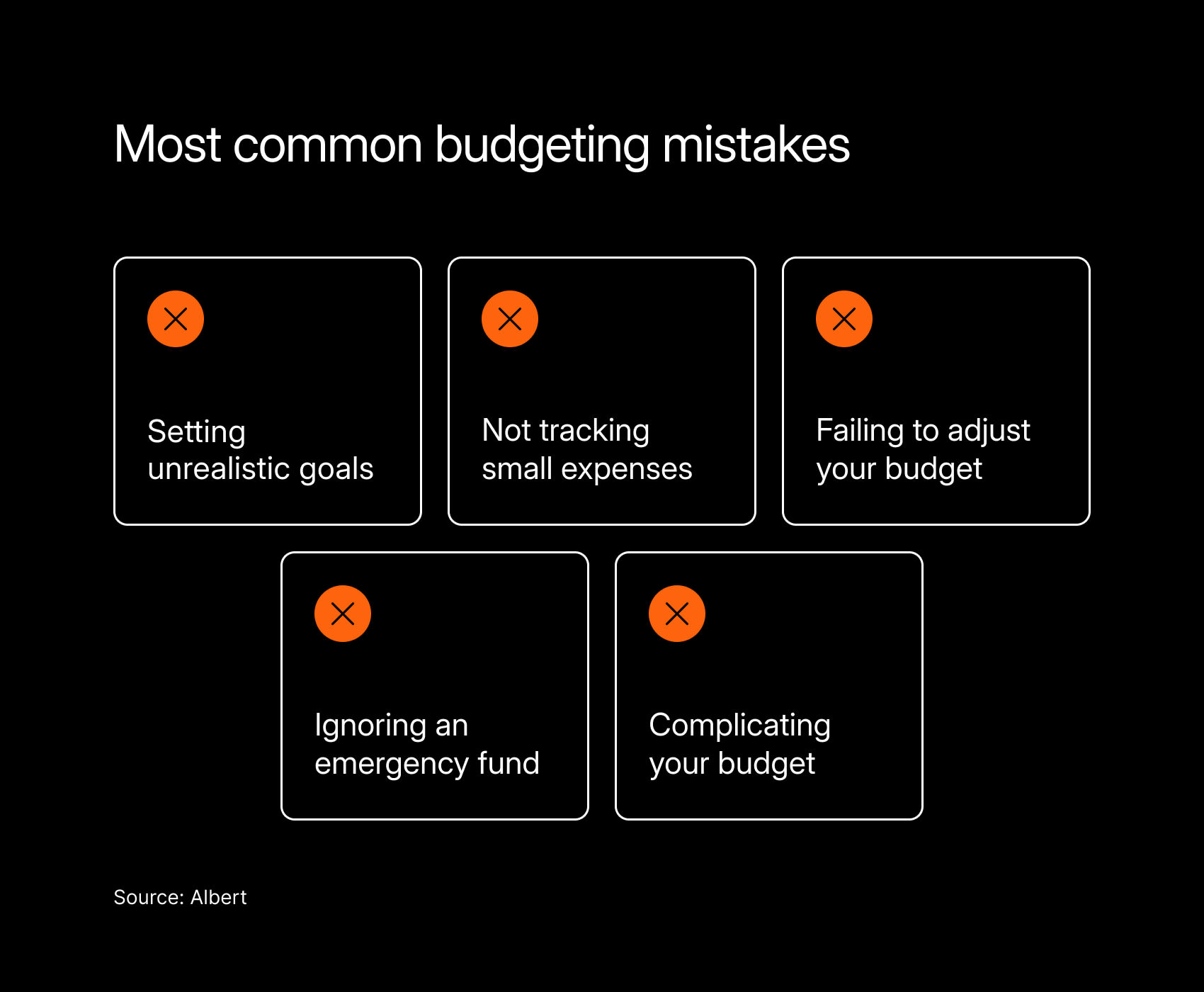

Even if you have the best intentions, it can be easy to stumble when starting a budget. That’s why understanding budgeting 101 is key to avoiding these common mistakes:

Setting unrealistic goals: Aiming too high or expecting instant results can lead to frustration and burnout. Set achievable, realistic goals to maintain motivation and see steady progress.

Neglecting to track small expenses: It can be tempting to overlook small purchases, but they will add up quickly. Be diligent in tracking every expense, no matter how minor, to get an accurate picture of your spending.

Failing to adjust your budget: Life is unpredictable, and your budget should reflect that. Don’t stick rigidly to a plan that no longer suits your needs—adjust your budget regularly to accommodate changes in your income or expenses.

Ignoring an emergency fund: Skipping the step of building an emergency fund can leave you vulnerable to falling into debt. Prioritize setting aside money for unexpected expenses to protect your budget from getting off track.

Overcomplicating your budget: A budget doesn’t need to be overly complex. Avoid creating a plan that’s too detailed or difficult to manage. Keep it simple and focused on your primary goals.

What to do if you blow your budget

Blowing your budget can be discouraging, but it’s how you recover that matters most. The key is to not panic and take constructive steps to get back on track.

First, assess where things went wrong. Identify the areas where you overspent, and determine whether it was due to a one-time expense or a recurring issue.

Next, revise your budget for the rest of the month. Look for areas where you can cut back to compensate for the overspending. If possible, consider temporarily reallocating funds from elsewhere to cover the shortfall.

Finally, use this experience as a learning opportunity. Adjust your budget going forward to better accommodate your spending habits or unexpected expenses.

Budgeting is an ongoing process, and occasional setbacks are normal. The important thing is to stay committed, make adjustments as needed, and keep moving toward your financial goals.

Start your path to financial freedom

Learning how to budget is a powerful step toward financial freedom. You might face challenges, but with persistence and the right strategies, you can gain control over your finances and work toward your long-term goals.

Budgeting isn’t about restricting your life; it’s about making intentional choices that align with your priorities. By staying committed to your budget, regularly revisiting your plan, and making adjustments as needed, you’ll develop the financial habits that lead to stability and peace of mind.

Your path to financial freedom starts with understanding the basics. Embracing budgeting for beginners is the first step toward achieving a secure financial future.

⚡️ Financial freedom doesn’t have to be an elusive dream. Learn how Albert can help you take charge of your finances and meet your personal goals.