Getting a handle on your finances starts with budgeting, and it’s easier than you might think. Budgeting is creating a personalized plan for what you’ll do with your money.

Beyond just creating a plan, budgeting also involves tracking your income, managing your expenses, and setting aside money for future long-term goals. Using a budgeting app can simplify this process by providing real-time insights.

Understanding how budgeting works will help you to make smarter financial decisions, steer clear of debt, and pave the way toward financial peace of mind. The idea is simple, and a few practical steps and strategies can help you get there. Here’s how to take control of your finances.

What is budgeting and why is it important?

Budgeting is really the foundation of managing your personal finances effectively. At its core, it involves putting together a plan that outlines your income and expenses to make sure that your spending aligns with your financial goals.

When you start budgeting, you’ll have complete control over your money, reduce your financial stress, and take your future into your own hands.

But budgeting is more than just crunching numbers. It’s a type of resource management, and it takes some thought and strategy. Creating a budget helps you:

See exactly where your money is going

Spot areas where you might need to make adjustments

Create a sense of financial responsibility and accountability

Feel prepared for unexpected expenses

Understanding the importance of budgeting also means recognizing its impact on long-term financial health. A well-planned budget can lead to improved savings, better investment opportunities, and a clearer path to achieving your life goals. It cultivates discipline and encourages mindful spending, which are essential habits if you want to reach financial success.

Understanding the basics of budgeting

So, what’s budgeting all about? It’s essentially planning how to use your money wisely. It helps you figure out if you have enough to cover your needs and wants. If money is tight, budgeting allows you to prioritize what’s most important, balancing your income with your spending to avoid financial headaches.

Having a well-structured budget gives you a closer look into your spending habits and helps you to make smarter choices. You can use your budget as a foundation to set and work toward financial goals, whether it’s saving for that dream vacation or building up an emergency fund, keeping you motivated along the way.

Budgeting also allows you to easily identify areas in your life where you might be overspending. This way, you can make necessary adjustments to focus on what truly matters to you.

Not only does this practice reduce financial stress, but it can also help you feel more secure. Life happens, and we all want to feel prepared for whatever comes our way. By setting aside some money for savings and emergencies, you’re preparing yourself for the unexpected while still keeping your future aspirations front and center.

Benefits of creating a budget

Creating a budget comes with various benefits, and it’s a good idea for almost anyone. Here are some of the biggest advantages:

Financial clarity: When you use a budget, you get a clear view of your financial situation, showing where your money goes and how much is left for savings or spending.

Reaching your goals: You can use your budget to help you set specific financial goals, like saving for a vacation or purchasing a car, and create a plan to reach them.

Identify overspending: You can spot areas where you might be overspending, allowing you to adjust your spending habits and focus on what truly matters.

Encourage savings: Budgeting helps you set aside money for savings and unexpected expenses, reducing financial stress and enhancing your security.

Make informed decisions: When you know what’s going on in your bank account, you can make smarter financial choices.

Build a stable future: Budgeting helps you take control of your finances, leading to greater stability and confidence in your financial journey.

How to get started with budgeting 101

Starting your budgeting journey can feel a bit daunting, but it simply boils down to understanding your current financial situation and identifying your goals.

Doing this groundwork will allow you to set yourself up for success in managing your spending and saving effectively.

Assessing your financial situation

Before starting a budget, it's important to know your financial situation. This involves understanding your income, expenses, and financial obligations.

Identify your income: List all your sources of income, such as salary, bonuses, and any side gigs, to get a clear picture of your total earnings.

List your expenses: Break down your monthly expenses into two categories:

Fixed expenses: These are consistent each month, like rent or mortgage payments

Variable expenses: These fluctuate and could include groceries, utilities, and dining out

Analyze your spending patterns: Review your income and expenses to pinpoint areas where you might be overspending.

Calculate your discretionary income: Subtract your essential expenses from your income. The leftover amount is your discretionary income, which you can allocate to savings, debt repayment, or enjoyment.

Setting clear financial goals

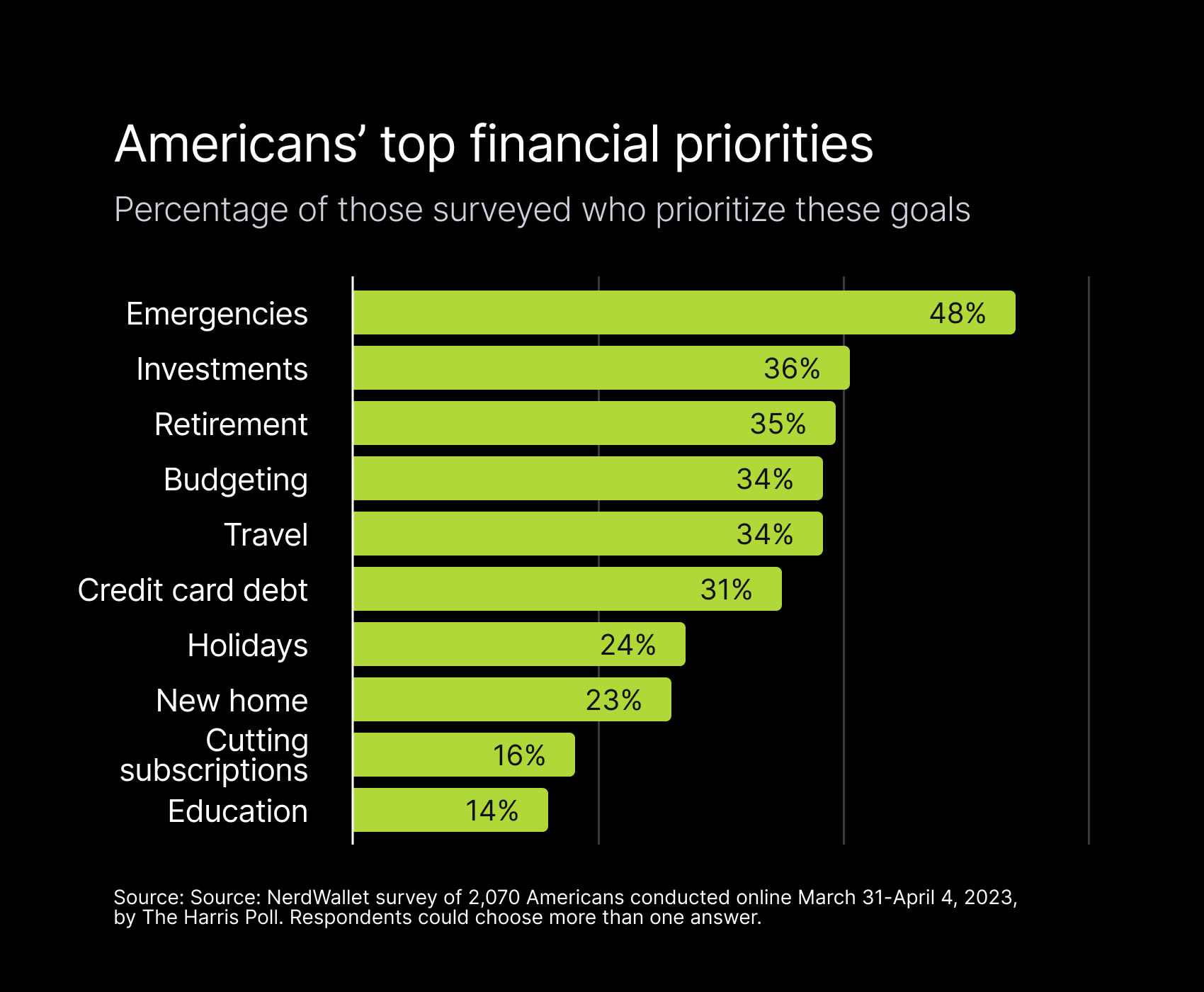

Setting clear financial goals is an essential part of effective budgeting.

Goals provide direction and motivation for all of your financial decisions, guiding your plans and actions. Your aspirations are up to you and can include anything you really need or want — from short-term plans, such as saving for a weekend getaway, to long-term objectives, like preparing for retirement or buying a home.

To set effective goals, use the SMART criteria:

Specific

Measurable

Achievable

Relevant

Time-bound

This will help you make sure your goals are clear and attainable.

For instance, instead of saying, "I want to save money," a SMART goal would be: "I want to save $5,000 for a car within the next 12 months."

This makes the goal specific, measurable, achievable, and relevant to your needs, and it gives you a set timeframe for you to work towards it. Having this level of clarity not only helps you stay motivated but also keeps you accountable.

Creating your budget plan

Coming up with a well-developed budget plan allows you to allocate your money wisely and ensure you’re living within your means. This is how to get started:

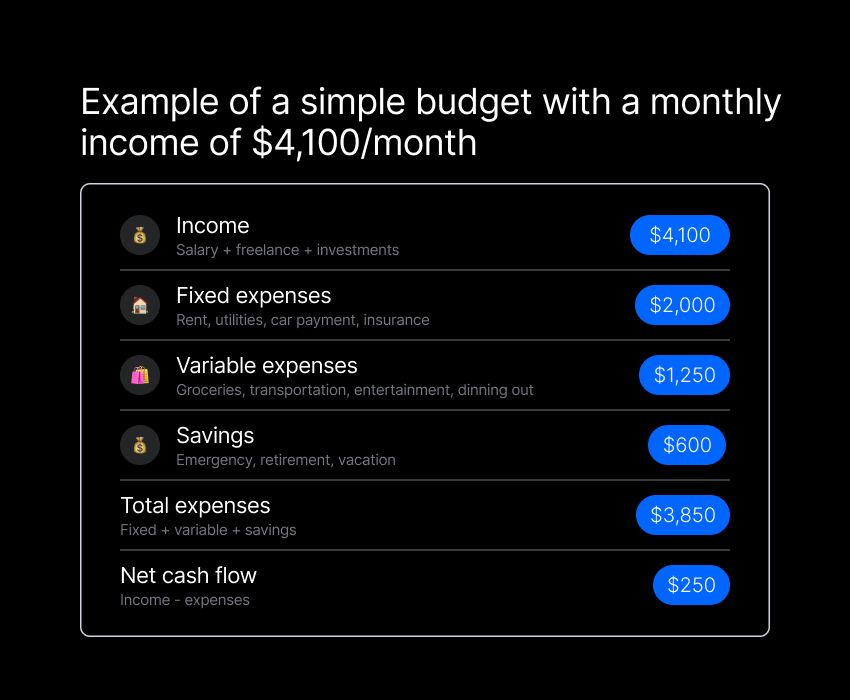

Tracking your income

The first step in creating a budget plan is to track your income. This means identifying all the sources of money coming in, whether it’s your salary, side hustles, or any other regular earnings.

Having a clear picture of your total income is crucial — you can’t accurately plan your expenses until you know what you’re earning.

Be sure to note down how much you receive from each source so you can create a budget that truly reflects your financial situation. Once you have a clear understanding of your income, you can move on to tracking your expenses.

Categorizing your expenses

Organizing your spending can shine a (sometimes unpleasant) light on your spending habits and highlight areas where you might be overspending. Don’t worry, because having this information will only empower you to make smart and necessary changes.

Start by distinguishing between fixed expenses — like your rent or mortgage, which remain steady each month — and variable expenses, such as groceries and entertainment, which can fluctuate.

This classification gives you a clearer understanding of how your spending aligns with your income and helps you pinpoint where adjustments might be needed.

After you’ve listed out and categorized your expenses, take a moment to work out your discretionary income. This is the money left after covering your essential costs, and it’s a great opportunity to decide where you want to allocate your leftover money, be it towards savings, debt repayment, personal enjoyment, or other financial goals.

Adjusting for savings and emergencies

Don’t forget to adjust your budget to make room for savings and emergencies. Setting aside a portion of your income for the future is essential.

Think about saving for both short-term goals, like a weekend getaway, and long-term needs, such as retirement.

Additionally, creating an emergency fund is a wise move, no matter what your income level may be. This fund will be your financial security blanket, ready to cover any unexpected costs like car repairs or medical bills. Aiming to save about three to six months’ worth of living expenses will provide you with the security and peace of mind you need.

By following these steps and regularly reviewing your budget plan, you’ll be well on your way to mastering your finances and achieving your financial aspirations.

Tools and resources for budgeting 101

The world of budgeting can feel overwhelming, but having the right tools and resources on your side will make the process smooth and simple.

The following tools can provide structured ways to track your income and expenses, set financial goals, and monitor your progress.

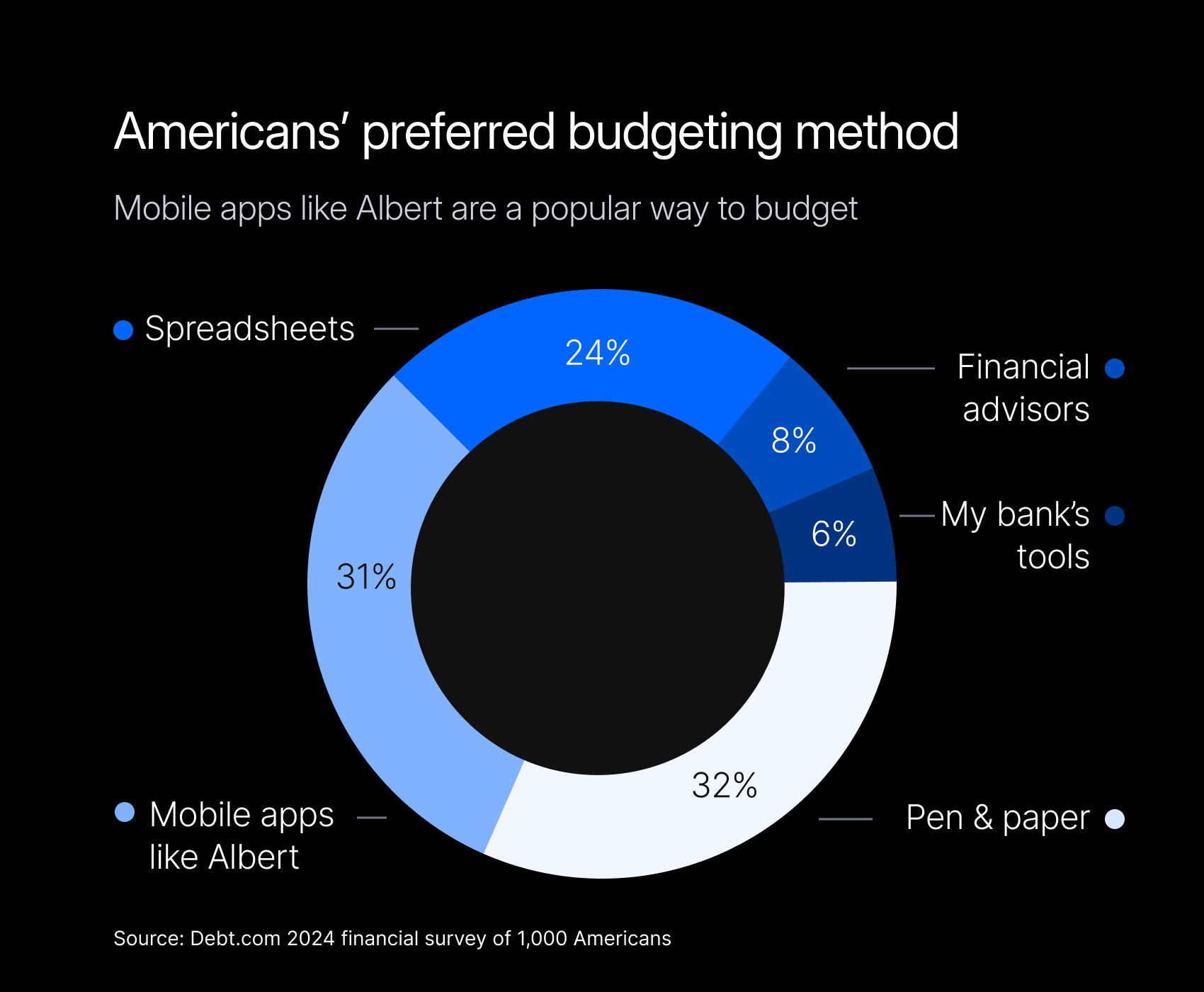

Budgeting apps and software

Apps and software make many aspects of modern daily life more simple and automatic – managing your financial health included. Budgeting apps and software make it incredibly easy to manage your finances.

These tools bring the element of convenience and allow you to easily track your income and expenses, set goals, and keep an eye on your financial progress.

Many apps seamlessly sync with your bank accounts, automatically categorize your transactions, and offer real-time overviews of your spending patterns. Automation can save you time and effort, letting you focus on the data in front of you and use it to plan and adjust accordingly.

Some apps also provide personalized insights and recommendations tailored to your financial situation, helping you optimize your budget and work toward your financial goals.

For example, Albert’s budgeting features have user-friendly interfaces and automated calculations, making it easier to track your expenses and monitor your progress. This is especially beneficial for anyone who prefers a more hands-off approach to budgeting. The process is simplified but just as effective.

Using spreadsheets for budgeting

On the other hand, if you prefer a more hands-on approach, spreadsheets can be an excellent option for budgeting. They’re completely customizable to fit your unique financial situation perfectly.

With your own spreadsheet, you have the flexibility to manually input your income and expenses, categorize them, and analyze your spending patterns in a way that feels right for you.

One major benefit of spreadsheets is their adaptability. You can tailor your spreadsheet to suit your specific needs, creating detailed categories for your unique expenses, tracking multiple income sources, and keeping a close eye on your financial progress.

This level of control and transparency can help you to make more informed decisions about your finances.

Of course, using a spreadsheet does require some effort and discipline. Regularly updating your income and expense entries and reviewing your spending patterns will be an essential part of your weekly routine.

But if you stay organized and committed, a well-maintained spreadsheet can be a practical and flexible budgeting solution, especially for those who enjoy working with numbers and want to stay engaged in their financial health.

Common budgeting mistakes to avoid

Keeping an eye on common budgeting mistakes can save you from unnecessary financial headaches and help you reach your goals more smoothly. Many people trip up in their budgeting process without even realizing it, so being aware of these missteps can make a big difference in maintaining a healthy financial lifestyle.

Overlooking small expenses

One of the biggest mistakes in budgeting is overlooking small expenses. While they might seem insignificant at first, they can really add up and derail your budget. It’s essential to track every expense, no matter how tiny, to get a clear picture of where your money is going.

Think about it: daily coffee runs, spontaneous clothing purchases, or those subscription services you forgot you signed up for can quickly become costly. Being mindful of these little costs will help you pinpoint areas to cut back and save some cash.

Setting limits on discretionary spending or finding budget-friendly alternatives for non-essentials can also really help. This proactive approach not only keeps you on track but also brings you closer to your financial goals.

To make sure these small expenses don’t slip through the cracks, consider doing regular budget reviews. Compare your actual spending to what you planned and see if there are any discrepancies so you can start making changes as soon as possible.

Not reviewing your budget regularly

Another common slip-up is not reviewing your budget regularly. Remember, your budget isn’t a “set-it-and-forget-it” deal; it needs some TLC. Life changes, and so do your financial goals, so it’s important to revisit your budget and tweak it as needed.

Regularly checking in on your budget means keeping track of your income and expenses and making sure they align with what you originally planned. This way, you can catch any areas where you might be overspending and make adjustments before it becomes a problem. Plus, you can update your budget to reflect any changes in your income or goals and avoid any surprises.

Tips for sticking to your budget

Sticking to your budget is crucial for hitting your financial goals and keeping your finances in check. You have to stay committed to your plan if you want it to work, which requires making wise choices along the way.

Here are some tips to help you stay on track and make meaningful progress toward your objectives.

How to handle unexpected costs

Handling unexpected costs is a key aspect of sticking to your budget. Unexpected expenses can disrupt your financial plan if you're not prepared, so having a plan is important.

Prepare for the unexpected: Recognize that life can throw curveballs, and being ready for surprise expenses is key to sticking to your budget.

Establish an emergency fund: Set aside a portion of your budget specifically for emergencies. Your emergency fund is your financial safety net and will save you when you least expect it.

Aim for a sufficient cushion: Try to save enough to cover three to six months' worth of living expenses in your emergency fund. This will protect you if you lose your job unexpectedly.

Revisit your budget when needed: If an unexpected cost comes up, don’t hesitate to review your budget first. Identify areas where you can cut back to free up some funds for these surprises.

Stay proactive: By keeping an eye on your budget and making adjustments as necessary, you can manage unexpected expenses without compromising your financial goals.

Involving family members in budgeting

Involving your partner or family members in budgeting can make a real difference in sticking to your plan. When it comes to finances, teamwork can be incredibly beneficial, especially in households where finances are shared.

Start by having some open conversations about your financial goals and what’s important to each family member. This way, everyone is on the same page and invested in making the budget work. Encourage candid discussions about spending and saving habits, and brainstorm about how you can support each other in reaching those financial goals.

Involving everyone means sharing responsibilities as well. This can include tracking expenses, reviewing the budget together, and finding creative ways to cut costs.

Taking a more collaborative approach will make budgeting easier and build a deeper commitment to your joined plans.

Taking control of your finances with budgeting 101

Budgeting is more than just a financial chore. It’s a really powerful strategy to help you manage your cash and reach your goals.

When you have a solid grasp on the foundations of creating a good budget, setting clear objectives, and using tried-and-true strategies, you stand a much better chance of becoming financially savvy, stable, and secure.

Remember, budgeting isn’t a one-time effort; it’s a dynamic process that needs regular reviewing and adjustments to stay in tune with your finances.

⚡️ Take control of your finances with Albert – sign up today and start budgeting smarter!