Understanding where your money goes is an important step to take for improved financial management. Tracking your expenses in a budgeting and expense app will give you clear insights into your spending habits, allowing you to make smarter decisions and stick to your budget.

In this guide, you can learn some simple and effective ways to regularly track your expenses to take control of your finances and set yourself up for success.

The importance of expense tracking

Expense tracking simply involves writing down your purchases. Keeping track of where your money goes will give you a clear view of your financial health, helping you build stability and make better money decisions.

One major advantage of tracking your expenses is clearly understanding your spending habits. When you record each purchase, you’ll get a complete picture of where your money goes, and it’ll be easier to find opportunities to make minor adjustments that could add up to serious savings.

Tracking your expenses will also help you build a realistic monthly budget. It's hard to plan effectively without knowing exactly how much you're spending. Guessing can lead to overspending or unexpected shortages, so using real data can be an effective solution that gives you a solid foundation to set clear, achievable limits.

Simple methods for tracking your expenses

The process may sound tedious, but you can make it as simple as possible. There are plenty of straightforward expense tracking methods that could fit different preferences and lifestyles, so there’s no reason not to try this.

Whether you prefer traditional approaches or modern tech, the key is to find a method that works for you and stick to it. Here are some effective ways to track expenses, each with its own advantages.

Mobile apps

Tech can make tracking easier and faster. Budget apps like Albert offer automated solutions that can save you time and cut down on errors in your tracking. Albert can automatically import and categorize your transactions by securely linking to your financial accounts.

With a budget tracking app, everything is at your fingertips in real time, so tracking your spending becomes effortless. Albert’s features, like detailed spending breakdowns, budget creation, and bill reminders, give you a complete toolkit for managing your finances on the go.

This means you won’t need to wait until you get home to update your budgeting spreadsheet or check in with your spending — you can do it wherever you are and make smart financial decisions whenever the moment needs it.

Notebooks or journals

If you like a hands-on approach, using a notebook or journal can be a simple and effective way to track your expenses. Writing down each expense by hand can be a helpful way for you to connect with your spending habits. This method is very intentional and requires active participation, which can boost your awareness and encourage more mindful spending, but might also make it impractical and too time consuming for many people.

Physically writing down expenses can help reinforce accountability. To get started, simply pick a notebook dedicated to tracking your expenses, organize it by date, and include categories for different types of spending — you can even color code your expense categories to simplify things.

Make sure you take the time to update your notebook often. Review your entries at the end of each day or week to identify patterns or areas for improvement that you can carry over into the future.

Find what works for you

The best method for tracking expenses is the one you’ll stick with. Whether it’s the simplicity of a notebook or the convenience of an app like Albert, consistency is key to making tracking a successful habit.

Step-by-step guide to tracking expenses

A structured approach is important for any kind of financial habit. Having structure will make the process manageable and effective and set you up for consistency.

By following a clear plan, you’ll ensure that you cover all the essentials without getting bogged down in unnecessary details. A systematic approach can help build a strong foundation for your financial future.

Gather your financial information

Start with the basics of budgeting by collecting all your financial data — look at your bank transactions on your online banking account, monthly statements, credit card bills, receipts, utility bills, or any other records of spending.

Organizing these documents, either digitally or physically, will give you a full picture of your financial activity.

This is an area where an app for budgeting and expenses can come in handy. An app like Albert can simplify the process (and make it far quicker) by securely linking to your accounts and automatically pulling in and categorizing your transactions.

This takes the manual work out of the equation, saving you time and reducing the risk of missing anything important — or even small expenses that can quickly add up.

If you make a lot of cash purchases, you may want to use a combination of methods, such as digital tools for your card transactions paired with manual tracking for cash purchases. This ensures no expense is left behind.

Categorize your expenses

Once you’ve gathered your financial info, the next step is organizing it. Divide your spending into categories so it’s easier for you to see where your money is going. Standard expense categories include essentials like housing, utilities, groceries, transportation, and discretionary expenses like dining out, entertainment, and hobbies.

Your needs and wants can also be broken down into fixed and variable expenses.

Organizing your expenses in this way will allow you to spot patterns and adjust your spending if you need to. For instance, if dining out takes up more of your budget than expected, you can decide to cut back. It can also help you set a more balanced, realistic budget going forward.

Set budget goals

Once you understand where your money is going, you can start setting budget goals. Setting limits for each spending category can help you control your spending and prioritize your financial objectives — whether that’s saving for a big purchase or debt repayment.

When setting budget goals, keep them realistic. Consider your income, fixed expenses, and lifestyle needs. Setting overly restrictive goals can be discouraging, so aim for targets you can realistically achieve.

Also, remember to review your budget regularly. Life changes and your budget should, too. Regular check-ins help ensure your financial plan aligns with your goals and circumstances.

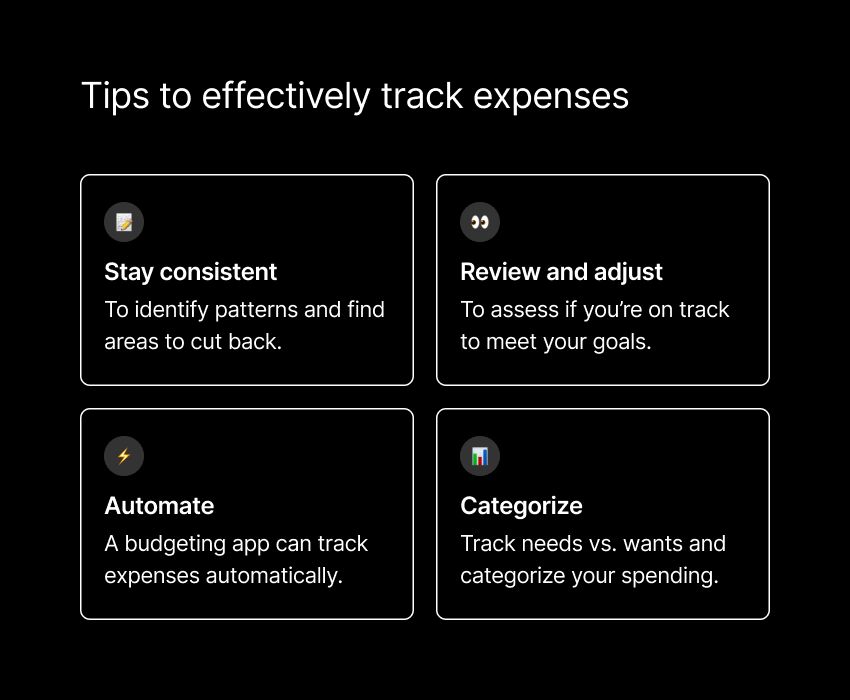

Tips for effective expense tracking

To start tracking your expenses is an important step toward better financial control. But to make the most of this habit, you need to approach it strategically. You can do a few things to improve both the accuracy and effectiveness of your tracking.

Stay consistent

Consistency is crucial. Tracking your expenses sporadically will probably lead to incomplete data, making it harder to spot patterns and understand your overall financial picture. To stay on track, try to build expense tracking into your daily routine.

Set a specific time each day to review and record your spending. This will help ensure that transactions are fresh in your mind and minimize the risk of forgetting or misreporting them. Over time, this will become a habit you barely have to think about.

On the other hand, a budgeting app like Albert can automate much of the process by tracking your transactions in real time, which means less effort on your end. With updates and reminders, you’ll stay engaged with your finances, even on busy days.

Review and adjust

Like most helpful money habits, expense tracking is an ongoing process. Regularly reviewing your spending will help you stay on course and adjust as needed. Regularly reviewing also allows you to assess whether you're meeting your financial goals and where you may need to course-correct.

Schedule your monthly or quarterly reviews to evaluate your progress and look for any spending patterns that don’t align with your budget. For example, if your entertainment spending is rising, you can adjust your limits or find lower-cost alternatives.

Additional tips

Automate where possible: Automation reduces manual entry and errors. Use an app to automate spend tracking, bill payments, and budget categories.

Set realistic goals: It’s important to set goals you can actually achieve. Setting unrealistic targets can lead to frustration, so be honest about what you can manage.

Prioritize expenses: Separate your needs from your wants. Make sure your essential expenses like rent and debt payments are covered first before spending on discretionary items.

Stay flexible: Life’s unpredictable. Leave room in your budget to handle unexpected costs without throwing off your plan.

The key takeaway here is to view this as a process that evolves. Stay open to learning and adapting as you get better insights into your financial habits. The more you refine your approach, the better your financial health will be over time.

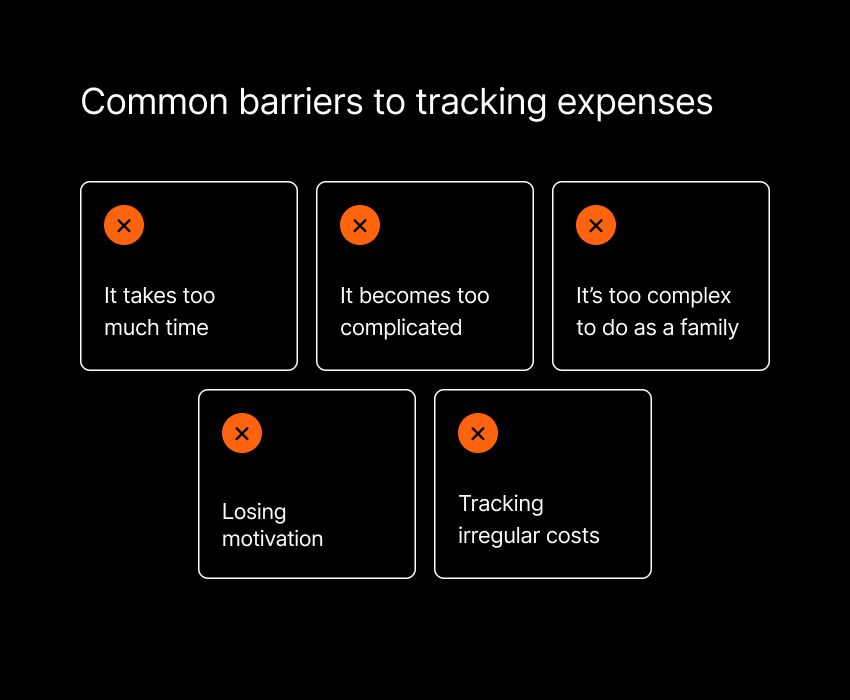

Common challenges and how to overcome them

Tracking expenses can bring significant benefits, but it’s not always easy. Awareness of common obstacles and how to address them can help you stick with the process. Here are some challenges and practical strategies to overcome them.

Irregular expenses

Irregular expenses like annual insurance premiums, vehicle registrations, or unexpected medical bills can throw off your budget. Since these aren’t part of your regular monthly costs, they can easily be forgotten or overlooked.

To stay on top of these, try to anticipate them in advance. Review your past expenses to spot any non-recurring costs, and note down when they’re scheduled to come up again.

Once identified, calculate the yearly total and break it down into a monthly amount to save. Setting aside this amount each month allows you to be prepared when the expense comes up.

Overcomplication

For some people, trying to track every detail can lead to burnout. While getting granular data can be insightful, overcomplicating the process often leads to frustration, boredom, and abandoning the habit altogether.

To avoid this, rather keep things simple. Use broad categories to capture the main areas of your spending without getting lost in the weeds. For instance, group all your dining out expenses into one "Dining Out" category instead of separating them into individual subcategories like fast food, coffee, and restaurants.

Time Constraints

Busy schedules can make it tough to track expenses consistently. This is another reason to keep things as simple and fuss-free as possible. If you’re pressed for time, then manual tracking in a journal may not be a good fit for you.

Instead, rely on a budgeting app with spend tracking automation features like those in Albert. This can help you save time and ensure your data is accurate without extra effort.

Lack of Motivation

Tracking expenses doesn’t typically offer any immediate rewards, so it’s easy to lose motivation. In the beginning, you may even feel discouraged if you notice that your spending habits don’t align with your goals and values.

However, this can also be overcome with commitment. Use any issues you’ve picked up as motivation to make changes and set yourself some short-term milestones to celebrate as you achieve them. These small wins can help you keep yourself motivated and on track.

Impulse Spending

Unplanned purchases can quickly derail your budget, especially if you don’t track them. If you regularly spend outside of your category limits, there are a few things you can do.

Try to implement a waiting period before making non-essential purchases. This will give you time to assess whether the purchase aligns with your financial goals. You could also consider transferring the amount you would have spent into a savings account — at the end of the month, assess how much you have saved and celebrate this as a win.

Shared or Family Expenses

Tracking shared expenses can be tricky when multiple people are involved. In these cases, it’s important to communicate clearly with others about your goals, plans, and what you can reasonably afford to spend in various areas.

Consider using a budgeting app for couples that lets you and your partner track joint spending, and use your app insights as a foundation for regular budgeting meetings.

Taking control of your finances through expense tracking

All in all, tracking your expenses is a very helpful way to take better control of your financial life. When you closely monitor your spending, you can feel more confident and manage your finances better.

It may seem like a chore at first, but embracing this practice will empower you to make informed decisions, set and meet financial goals, and build a more secure future.

⚡️Try budgeting and tracking expenses with Albert today with a 30-day trial to take control of your finances.