Budgeting isn’t a strategy designed only for high-earners. In fact, for those living on a tighter budget, taking charge of your finances can be even more important.

Working with a budget on a low income can be challenging, but it plays a major role in helping you achieve financial stability no matter your income.

You need to have a clear understanding of your financial situation, which will involve assessing your income and tracking your expenses. A budgeting tracker can help simplify this process and keep you organized.

By focusing on your essential needs and making informed choices, you can create a budget that helps you rather than hinders you.

Understanding your financial situation

Understanding your financial situation is essential for successful budgeting. Knowing your income and expenses helps you make informed decisions about how to allocate your money. This knowledge lays the groundwork for effective money management and long-term stability.

Assessing your income

Start by taking a close look at all the money you earn. This includes your salary, any government benefits, and income from side gigs. Grasping your total income is crucial for planning how much you can realistically spend and save each month. Don’t overlook any small income sources — they contribute to your overall financial picture.

Also, think about how stable your income is. If you have a secure job, you can expect a consistent income. But if your earnings fluctuate, it's important to plan accordingly. Knowing where you stand helps you set realistic financial goals and adjust your budget when necessary.

Tracking your expenses

Tracking your expenses is key to understanding where your money actually goes. Take some time to list all your monthly expenses – this includes fixed costs like rent and utilities, as well as variable costs like groceries and entertainment.

By keeping track of your expenses, you can identify areas where you may be overspending.

Seeing this isn’t always pleasant, but it forces you to face reality and make adjustments to your spending habits.

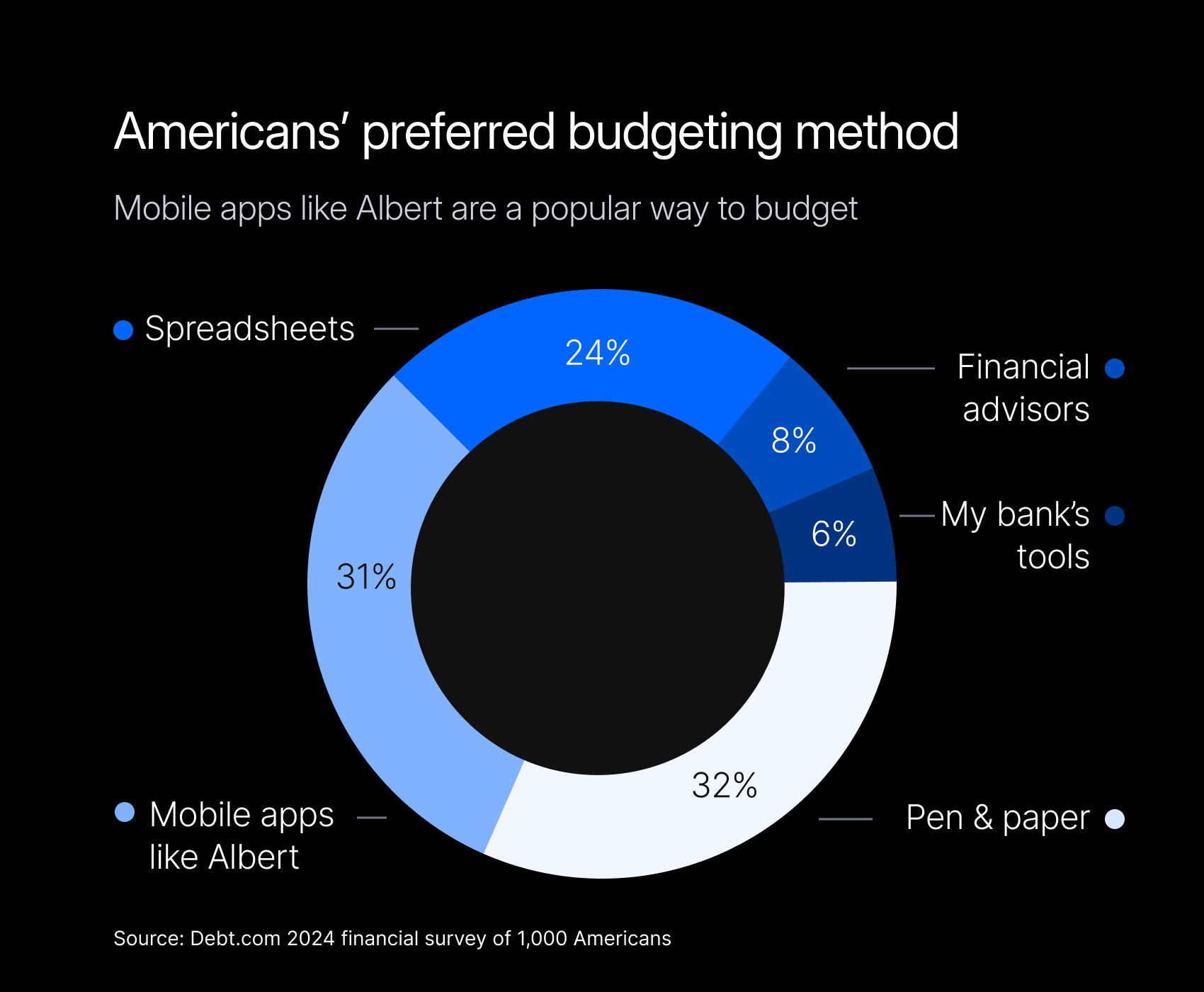

Consider using budgeting apps like Albert or a simple spreadsheet to help with this task. Regularly reviewing your expenses keeps you within budget and helps you avoid unnecessary spending. Remember, even minor changes in your spending habits can significantly improve your financial health over time.

Setting clear financial goals

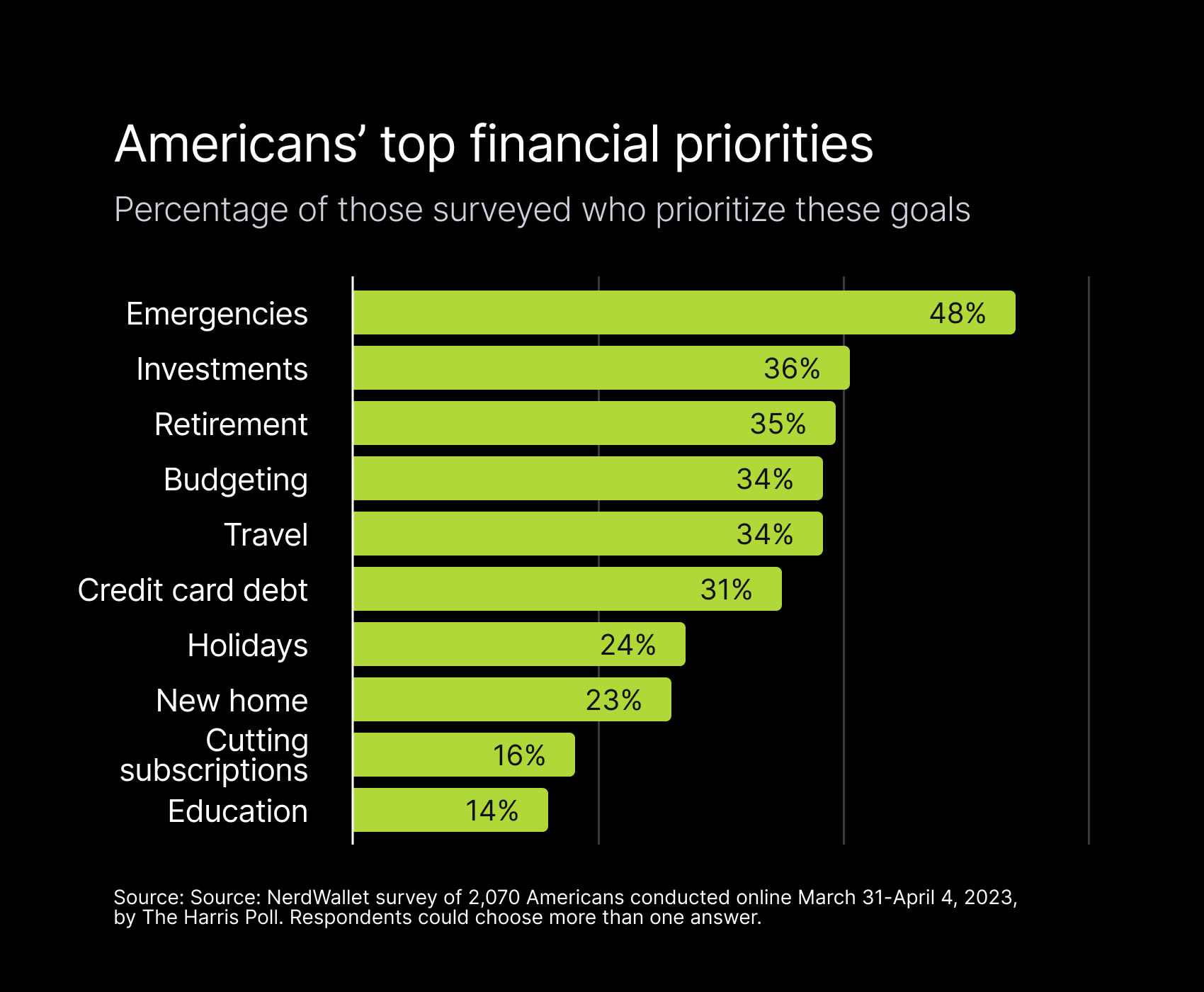

Setting clear financial goals is like putting a roadmap in place for your budgeting journey. You need to figure out what you want to achieve with your money, both now and down the road.

When you have specific goals, it’s easier to stay motivated and stay on track with keeping your financial choices in line with what you truly want.

Short-term goals

Short-term goals are the little milestones you aim to hit within a year. Think of things like saving for a small emergency fund, paying off a minor debt, or setting aside cash for something specific you want to buy soon. These goals are essential because they offer quick wins, giving you that boost of motivation to keep pushing forward.

To set these goals, follow these steps:

Identify what’s important: Reflect on your immediate needs and any upcoming expenses you can anticipate.

Make goals specific: Instead of saying, “I want to save money,” aim for something concrete like “I want to save $500 in the next three months.”

Track your progress: Regularly check in on your savings and spending to see how you’re doing.

Adjust as needed: If you’re falling short, reassess your spending or timeline to get back on track.

Achieving these short-term goals can really build your confidence and set you up nicely for tackling those bigger, long-term objectives.

Long-term goals

Long-term goals are all about where you see yourself financially in several years. These could include saving for retirement, buying a home, or building a solid emergency fund. While they require a bit more planning and commitment, they’re crucial for securing your financial future.

To set long-term goals, consider these steps:

Think about your future: It may sound far off, but picture where you want to be in ten years. Think about retirement, major purchases, or significant life changes you’re after — these all have financial significance.

Break down your goals: Take those big goals and divide them into smaller, manageable steps. For example, if you’re saving for retirement, figure out how much you need to save each month to hit your target.

Set milestones: Create specific milestones to track your progress toward each goal.

Review regularly: Regularly assess your goals and adjust them as your financial situation changes.

Long-term goals act like a compass on your financial journey, guiding your decisions and helping you stay on track toward your aspirations.

Creating a simple budget plan

When living on a budget, creating a simple budget plan is essential for managing your money effectively. It’ll help you figure out what you spend, identify areas where you can cut back, and allocate your income in a way that makes sense.

A well-structured budget not only helps you meet your needs but also allows you to save for the future and treat yourself occasionally without breaking the bank.

List your essential expenses

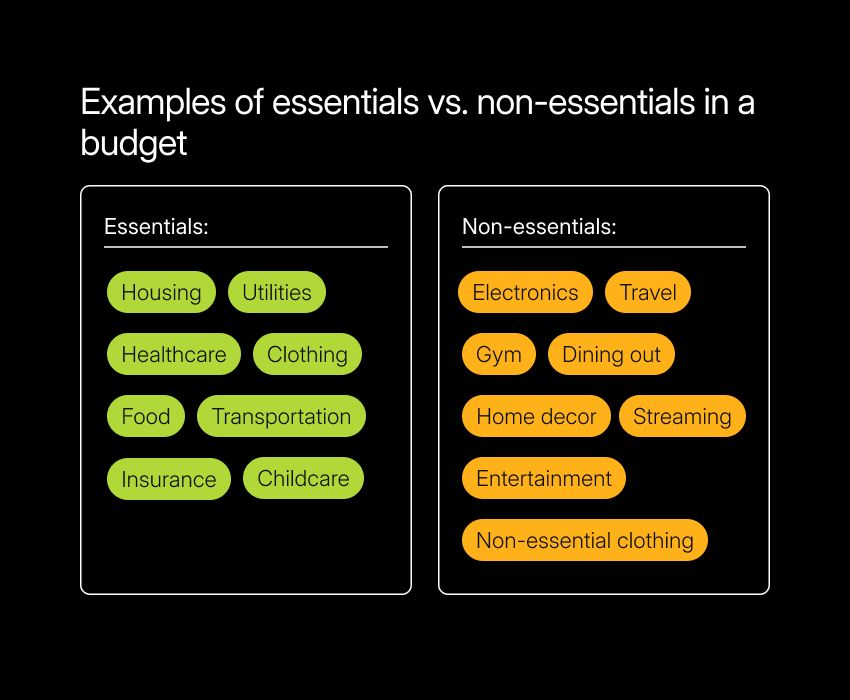

The first step in creating your budget is to list your essential expenses. These are the non-negotiable costs that you need to cover for basic living, like housing, utilities, groceries, and transportation. Knowing what these expenses are helps you prioritize your spending — they need to be front and center.

To get started:

Write down your monthly bills: Include everything necessary for your daily life.

Categorize your expenses: Split them into fixed expenses and variable costs. Fixed costs, like rent or mortgage, are stable each month, while variable costs, like groceries or utilities, can change.

Look for savings opportunities: Once you have a clear picture of your essential expenses, consider ways to reduce them. Maybe you can save on groceries by meal planning or negotiate a better deal on utilities.

By cutting down on essential expenses, you’ll have more room in your budget for savings and other priorities.

Identify non-essential spending

Next up is identifying your non-essential spending. These are the expenses that aren't crucial for your survival, like dining out, subscription services, or entertainment. Knowing where your money goes can help you make smarter choices about what to cut back on.

To tackle this:

Review your monthly spending: Take a look at your bank statements and highlight non-essential transactions.

Consider frequency and impact: Think about how often you’re spending on these things and how much they affect your overall budget.

Find a balance: Reducing non-essential spending can free up cash for savings or debt payments, but you don’t need to eliminate all your fun.

Set a monthly limit: Consider putting a cap on your non-essential spending. This way, you can still enjoy a treat without overspending.

Make sure to check in on this regularly to keep your spending on track and aligned with your goals.

Allocate your income wisely

Allocating your monthly income wisely means deciding how much of your earnings to spend, save, and invest each month. You’ll need to strike a reasonable balance between your needs and wants while moving closer to your financial goals. A thoughtful allocation plan keeps you from overspending and encourages saving.

Here’s how to get started:

Decide on percentages: Determine what portion of your income goes to essentials, savings, and non-essentials. A popular guideline is the 50/30/20 rule: allocate 50% for essentials, 30% for discretionary expenses (your wants), and 20% for savings. You can adjust these percentages to better fit your low-income situation.

Automate your savings: To make sure you’re setting aside money, consider automating your savings. You could consider automating savings so that a set amount is immediately sent into savings when your salary lands in your bank account.

Review and adjust regularly: Keep an eye on your allocations and tweak them as your income or expenses change.

Strategies to save money

Saving money on a low income can be extra challenging, but it’s a crucial part of any budget plan.

It’s important to create a financial cushion for emergencies so you feel prepared for whatever life may throw at you. Starting small is an excellent step, and luckily, there are plenty of effective strategies to save money, even if you’re working with a limited income

Use coupons and discounts

One of the simplest ways to save is by using coupons and discounts. This involves actively looking for deals on things you want to buy so you can get what you need (like groceries, clothes, and household goods) for the lowest possible price.

Start by collecting coupons from newspapers, online sources, or store apps. Many stores now offer digital coupons that you can apply at checkout, making it extra easy to save.

Don’t forget about loyalty programs, especially at stores where you regularly spend money — they often offer exclusive discounts or points on your purchases, which can lead to major savings over time. Plan your shopping around deals and try to maximize your budget as far as possible.

Remember, it’s only a bargain if you actually need the item. Splurging on things just because they’re on sale can be tempting, but it won’t move you closer to your financial goals.

Save on utilities and groceries

Another major area to think about is your utility and grocery expenses. These costs are essential, but they can quickly add up and go beyond what you need to spend, so finding ways to minimize them can really help your budget.

For utilities, try making simple changes like turning off lights when you leave a room, using energy-efficient appliances, and adjusting your thermostat. Small adjustments can lead to noticeable savings if you’re mindful and consistent.

When it comes to groceries, planning your meals and creating a shopping list can help you shop smarter and less impulsively. Buying in bulk when possible, choosing store brands over name brands, and opting for local markets can also save you money.

While it might take a little extra effort, regularly reviewing your bills and spending habits can reveal more and more opportunities to cut back.

Find free or low-cost entertainment

You should always be on the lookout for free or low-cost entertainment options to keep your social life lively without breaking the bank.

You may be surprised at the variety of community events available — free concerts, festivals, and outdoor movie nights can be great fun and don’t need to cost much. Many streaming services have free trials or discounts, so you can enjoy movies and shows as well, without the hefty cable bill.

Many libraries offer free programs, workshops, or book clubs, and local parks often have low-cost activities or classes to explore, while hosting a game night at home can be a fantastic way to spend time with friends and family indoors.

All in all, saving money doesn’t have to feel like a chore or mean you need to stay at home bored all the time. By being a little creative and resourceful, you can enjoy a fulfilling life without overspending — embrace it as a challenge.

Increasing your income

Increasing your income can offer you more financial flexibility and help you reach your goals faster. While cutting expenses is essential, finding ways to earn more money can significantly enhance your financial situation.

Fortunately, there are several ways to boost your income, even if you're working with limited time and resources.

Explore side gigs

Side gigs are a fantastic way to earn some extra money while keeping things flexible. They can be tailored to your skills and interests, so you can make some extra cash without the stress of a full-time second job.

Here are a few ideas to get you started:

Freelancing: Whether it's writing, graphic design, or virtual assistant work, you can often do these jobs from home. Check out platforms like Upwork or Fiverr to find clients looking for your skills.

Local gigs: If you prefer hands-on work, think about dog walking, babysitting, or lawn care. These opportunities usually require minimal upfront investment and can be a fun way to earn extra cash.

It’s a good idea to dedicate a set amount of time each week to your side gig to manage your workload and avoid burnout. It’s also wise to keep track of your earnings and expenses to make sure that the gig is financially worth your time and energy.

Look for overtime opportunities

Another way to boost your income is by looking for overtime opportunities at your current job. Many employers will pay for overtime hours, especially during peak seasons. Taking advantage of these opportunities can give your paycheck a nice bump without the need to juggle a second job.

If you want to work overtime:

Discuss overtime hours with your employer: Let them know you’re eager to take on extra hours and ask about any upcoming opportunities.

Be proactive about signing up for overtime: Take opportunities to work extra hours as soon as they become available.

While working overtime can be beneficial for your wallet, it’s essential to maintain a healthy balance in your personal life. Make sure you don’t overcommit and burn yourself out.

Staying on track with your budget

Keeping your budget in check is crucial if you want to meet your financial goals. You should be regularly reviewing your spending, making adjustments when necessary, and staying committed to your plan.

It may sound obvious, but consistency and a bit of discipline will go a long way in successful budgeting.

Regularly review your budget

Taking the time to regularly review your budget will help you accurately track your progress and make sure you’re not going overboard with spending. This will entail checking how your actual spending stacks up against what you originally planned.

Set aside a bit of time each month to dive into your budget:

Compare your actual spending with your planned budget to spot any discrepancies.

Look for areas where you might be overspending and think about ways to cut back.

By reviewing your budget, you also create a chance to adjust for any changes in your income or expenses.

Whether you’ve had a pay raise or been dealt some unexpected expenses, keeping your budget flexible helps it stay relevant and effective. Plus, regular reviews help keep you accountable and focused.

Adjust as needed

Being willing to adjust your budget is essential for it to stay effective and relevant to your current circumstances. Life is full of surprises, whether it’s a new job or some unplanned expenses, and you might need to tweak your budget along the way.

When you’re reviewing, think about any lasting changes in your income or expenses. Then, think about how these shifts impact your budget and adjust your spending accordingly. You may need to reallocate some of your money or find new ways to save.

Keep an open mind about making changes that support your financial goals. This can feel tough when you face financial setbacks, but ultimately, keeping your budget in line with your goals is the most important thing.

Tools and resources for budgeting

Having the right tools and resources at your disposal can make the budgeting process so much easier and more accessible. They’re there to help you stay on top of your finances, guide you along the way, and stick to your plan so you can reach your financial goals with minimal stress and hassle.

Budgeting apps and software

Budgeting apps and software can be a gamechanger when it comes to managing your money. They offer everything from expense tracking to goal setting with milestones, all from the convenience of your phone or computer.

Apps like Albert come with easy-to-use interfaces and budgeting features that make your money-managing routine feel like less of a chore. There are plenty of apps that sync with your bank accounts to give you real-time updates on your spending, insights into your spending patterns, and suggestions on how to improve.

If you decide to use an app, make sure to update your information regularly, and you’ll have a solid tool to help you stay on track with your budget and learn new financial skills on the go.

Community resources and assistance

Sometimes the best resources are right there in your community. Local non-profits often offer financial literacy workshops or even free counseling sessions, giving you practical advice on budgeting and money management.

There are also government assistance programs that can help with essential expenses if you’re on a tight budget, such as:

Food assistance to help reduce grocery expenses

Utility bill support to ease the burden of monthly bills

Free tax preparation services to save on tax-filing costs

Getting involved in your community can also connect you with people who might be able to offer support and advice. Consider attending some local events or joining online forums where you can swap budgeting tips and maybe even learn about new opportunities.

A strong support network can make all the difference, no matter what your income looks like.

Achieving financial stability on a low income is possible

Achieving financial stability on a low income is definitely possible, especially when you’ve got the right strategies in place and some commitment. By getting a handle on your financial situation, setting some clear goals, building a budget that actually works for you, and finding ways to save, you can keep things under control and feel good about where you’re headed.

Increasing your income and sticking with your budget plan are just a few more ways to keep moving toward stability. Remember, every small step really does add up over time. Stay committed, reach out for help when you need it, and be sure to celebrate even the small wins. With patience and the right approach, financial stability isn’t just a goal—it’s within reach.

⚡️ Learn how Albert can help you take charge of your finances and meet your personal goals.