We reviewed 5 of the best money management apps for 2025 that let you budget as a couple.

Managing money as a couple can be both a challenge and a rewarding experience, depending on how you approach it. With the right budgeting tools, you’ll be able to manage your joined finances in a seamless and stress-free way.

Budgeting apps exist to help simplify your financial life, offering clear insights into spending habits, savings, and shared expenses. These apps make it easy to track daily costs and set long-term financial goals, all while keeping both partners in the loop.

Using integrated apps to handle your budgeting can help encourage more open conversations about money, which is important for a strong partnership. Budgeting apps for couples are designed to provide personalized advice and support, helping you both understand your finances better and make informed decisions together.

Whether you’re just starting out or looking to fine-tune your existing strategies, budgeting apps are fantastic resources for couples who want to get clear on their money mindset, set goals together, and make smarter decisions.

Top 5 best budget apps for couples

Choosing the right budgeting app can be a game-changer in how you manage finances as a couple. These top five apps each bring something unique to the table, from goal tracking to shared expense tools, helping you stay aligned on your financial goals.

Albert

Albert is a complete money manager, in one powerful app. You and your partner can both edit a shared budget, track your joint spending, and manage cash flow together. Budgeting is just the first in a long list of features the app offers, including investing and identity protection. What makes Albert stand out is its team of advice experts — they’re real people you can text anytime to get answers to any financial question.

⚡️ Try Albert today and get a 30-day trial plus 50% off for 2 months

Key features

A shared budget: Couples can both link spending accounts to Albert, and the app will create a shared budget for you, automatically.

Easy customization: You and your partner can set spending limits, categorize transactions, or mark bills as recurring to keep your budget organized.

Track joint spending: View transactions and balances for all of your accounts and all of theirs in one place.

Real-time alerts: Albert alerts you right away if it detects any large or unusual transactions or suspicious activity on your account.

Lower bills: Albert negotiates to lower bills for you, saving customers an average of $200 per year on bills.

Protect yourself: The Albert Protect feature guards you and your identity with 24/7 fraud monitoring and protection.

Customizable financial goals: Set financial goals for big dreams, like vacations or homeownership.

Personalized advice: Get tailored guidance from human financial experts, which can be especially helpful for long-term planning.

Investing with as little as $1: Start investing with small amounts, building wealth over time.

Why choose Albert?

Albert combines budgeting and investing with financial guidance, making it a strong option for couples who want a versatile and all-in-one financial management tool. Its personalized approach and access to financial experts set it apart from any other app.

YNAB (You Need A Budget)

YNAB encourages proactive budgeting, making it ideal for couples aiming to take a hands-on approach to money management.

Key features

Zero-based budgeting: Couples allocate every dollar to a specific purpose, providing complete control over finances.

Real-time syncing: Ensures both partners can access up-to-date information from any device.

Goal tracking: Allows couples to set and track specific financial goals with visual progress reports.

Educational resources: Includes workshops and tutorials to improve budgeting skills.

Debt payoff tools: Features dedicated to reducing debt, perfect for couples focusing on debt elimination.

Why choose YNAB?

YNAB’s structured, goal-oriented approach can be highly effective for couples dedicated to taking control of their budget, though it requires a paid subscription and may involve a learning curve.

Goodbudget

Goodbudget is based on the traditional envelope budgeting method, making it a straightforward option for couples who prefer visual financial management.

Key features

Envelope budgeting: Funds are allocated to virtual envelopes, creating clear boundaries for different spending categories.

Shared budgets: Syncs between partners to keep everyone on the same page.

Expense tracking: Manually enter or import transactions for easy tracking.

Financial reports: Provides detailed spending reports, making it easy to understand spending patterns.

Debt tracking: Features for managing and planning debt repayments.

Why choose Goodbudget?

Goodbudget offers simplicity and flexibility, though it lacks automatic transaction syncing unless entered manually or via file import. It’s a good fit for couples who value clear, envelope-style budgeting.

Honeydue

Honeydue is designed specifically for couples, with unique features to support shared financial responsibilities.

Key features

Shared expenses: Track and split shared expenses, keeping financials transparent.

Bank account syncing: Connects with multiple financial institutions for comprehensive tracking.

Customizable notifications: Alerts for various financial activities help both partners stay informed.

Chat feature: In-app messaging lets couples discuss transactions and budgets within the app.

Privacy controls: Provides options for each partner to decide which information to share.

Why choose Honeydue?

Honeydue’s design for couples fosters communication and collaboration around shared finances. It’s also free, though it may lack some advanced budgeting tools offered by other apps.

Mint

Mint is a widely used budgeting app that simplifies money management for couples with a comprehensive range of tools.

Key features

Expense tracking: Automatic syncing with bank accounts to categorize expenses, giving couples an easy way to understand their spending.

Budget creation: Mint lets couples set up category budgets and sends alerts when they approach their limits.

Bill payment reminders: Ensures that both partners stay on top of upcoming payments and avoid late fees.

Credit score monitoring: Couples can monitor credit health with free credit score access.

Investment tracking: Mint also tracks investments, providing insights into portfolio performance.

Why choose mint?

Mint’s comprehensive features and user-friendly design make it popular among couples who want an all-in-one financial management tool, though it does include advertisements that may be distracting to some users.

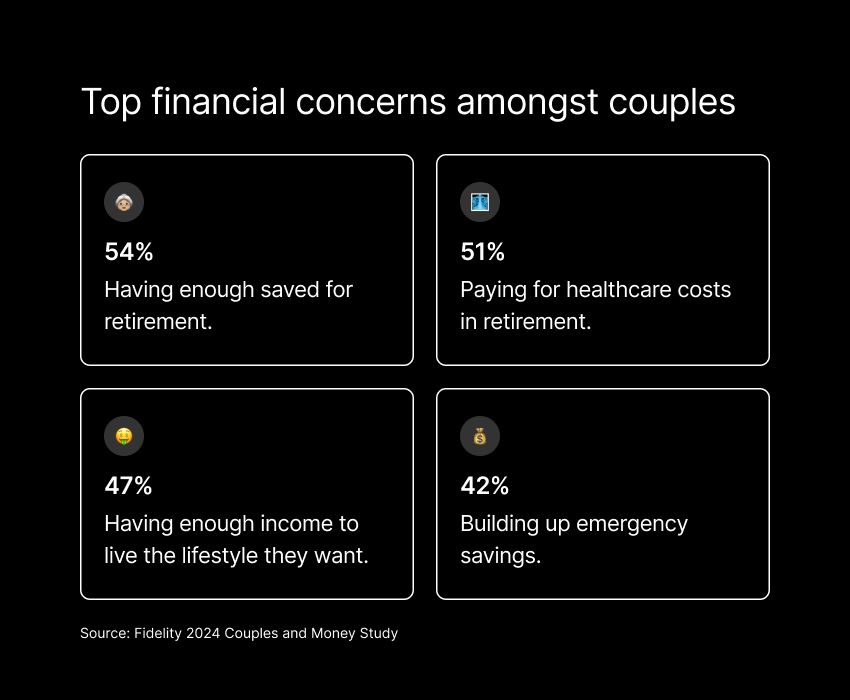

Why couples need budgeting apps

Money can be a sticking point in many relationships, and when partners treat their finances with care, they’re more likely to feel comfortable and confident in their money matters.

Creating a joint budget can give couples a clear picture of their income, expenses, and savings, allowing them to make more informed financial decisions. This can help lower financial stress, eliminate arguments about money, and build a sense of teamwork. Using a budgeting app for all of this makes tracking and goal setting simple.

These apps exist to streamline financial management for individuals and couples. They offer tools for things like expense tracking, goal setting, and even deeper, more detailed financial analysis, helping you stay organized and accountable. Couples can cut costs and save, and engaging in these habits together can benefit the relationship over the long haul.

Specifically designed to be user-friendly and cater to all different kinds of individuals, budgeting apps are typically a much better option than your average spreadsheet. Many apps include collaborative tools like shared accounts and synchronized updates with your bank accounts, encouraging transparency and open communication — two essential ingredients for a successful financial partnership.

How budgeting apps simplify financial management

Budgeting apps can help streamline financial management for couples in several ways:

Centralized platform: Budgeting apps are a one-stop shop for all your financial information. You can input income, categorize expenses, and generate reports to get a clear view of your financial situation all in one place.

Automation: The automation of tracking income and expenses saves you time and helps to minimize errors. Say goodbye to the hassle of manual entry and missing transactions.

Real-time updates: Many apps sync directly with your bank accounts and credit cards, ensuring you always have the most up-to-date information. This keeps you informed and helps you make timely financial decisions.

Personalized insights: These apps analyze your spending habits and provide tailored spending insights, helping you identify areas where you can cut back and allocate more funds toward your goals.

Goal setting and tracking: You can easily set financial goals within the app and monitor your progress. Celebrating milestones together fosters a sense of accomplishment and keeps you both motivated.

User-friendly design: Designed for various financial literacy levels, these apps are easy to navigate. Whether you're a budgeting beginner or a seasoned planner, you’ll find features that meet your needs.

Collaborative features: Many apps allow for shared accounts and synchronized updates, promoting transparency and encouraging open discussions about household finances — a vital part of any successful partnership.

Key features to look for in budgeting apps for couples

When it comes to choosing a budgeting app, couples should focus on features that really enhance their financial management experience. The right features can turn an average app into a powerful tool that supports your financial journey to budget as a couple.

Some useful features to look out for include:

Shared accounts: Look for apps that allow both partners to link multiple accounts or share the same account. This feature promotes transparency and collaboration by ensuring both of you have access to the same financial information, reducing misunderstandings and building trust.

Expense categorization: A good budgeting app will let you categorize your expenses, making it easier to track where your money is going and helping you spot areas for improvement, and custom categories are even better. Understanding your spending patterns can lead to more accurate budgets that reflect your financial priorities.

Goal-setting and tracking: Setting financial goals is essential, and a solid app should offer goal-setting features and ways to track your progress. Visual representations like charts or graphs can make monitoring your goals more engaging and motivating, helping you stay on track together.

Beyond features, there are some other essential considerations you’ll want to look into, such as a user-friendly design you actually enjoy using, customization, and solid security.

User-friendly interfaces and customization options

A user-friendly design is essential, and it should allow both partners to navigate the app easily. Clear designs and simple navigation will make managing joint finances smooth, and helpful tutorials will be beneficial to make setup a breeze.

Customization options are equally important. Every couple’s lives, preferences, and financial needs are unique, so look for an app that lets you personalize categories, set alerts, and adjust budget settings to suit your goals. More customization means an app that’s more effective for you as individuals.

Lastly, apps that are compatible with both mobile and desktop devices bring a level of flexibility, keeping both partners up to date on finances, whether you’re on the go or sitting down for a serious couple’s budgeting meeting.

Security and privacy considerations

When it comes to managing your money, especially on any online platform, strong security and privacy are essential. Choose finance apps that prioritize safeguarding your data with features like encryption and two-factor authentication.

In the same vein, it’s important to review the app’s privacy policy and data practices. If you can, choose an app that doesn't share or sell financial info without your consent and is transparent about how they use your data.

By opting for a budgeting app that values security and privacy, couples can manage bills and other expenses confidently and focus on reaching their financial goals without worrying about their safety.

How to choose the right budgeting app for you and your partner

Choosing the right budgeting app as a couple can be a game-changer for your finances, helping you align your spending and saving habits while working toward shared goals. But picking the right app will take some thought and planning.

Start by evaluating the app’s core features. Does it offer shared accounts, easy expense tracking, and goal-setting options that suit you both? Security is key, too, so look for apps with strong privacy policies, encryption, and data protection to keep your financial details safe.

You’ll also want to consider how user-friendly and customizable the app is. Finding an app that’s easy to use and works across multiple devices can make a big difference in how naturally you both adapt to using it. You’ll want to enjoy the experience — not feel frustrated and confused.

Making an informed choice together helps set the stage for effective financial management and a stronger financial partnership.

Tips for successfully using budgeting apps as a couple

Once you’ve picked the perfect app and you’re ready to get started, here are some helpful tips for getting started with couples’ budgeting:

Start with open communication: Talk about your individual financial priorities and any shared goals you have to make sure your budget is aligned from the get-go.

Set clear objectives: Define your financial goals together, such as saving for a trip, paying off debt, or building an emergency fund. Set target amounts and timelines to keep you on track.

Check in regularly: Schedule regular time to sit together to review your budget, assess progress, and make adjustments as needed. This could be weekly or monthly.

Celebrate milestones: Use app features to track and celebrate small wins along the way to stay motivated and support one another.

Engage with shared features: Use joint accounts and expense tracking to share your financial habits with one another. Communicate about what’s shared, be transparent, and trust one another.

Collaborate and build trust: Spend time actively managing your finances together to create a successful financial relationship and a secure financial future.

Start budgeting together today

If you want to start budgeting together as a couple, finding a great app to help you handle it is key. Choosing an app with shared account capabilities, customizable expense tracking, goal-setting features, and strong security measures can enhance any couple's financial management experience and streamline money management.

The budgeting apps we’ve highlighted here offer valuable tools for joint financial success. By embracing tools like these, couples in any life stage and circumstance can develop a more transparent and collaborative financial plan. Not only will this alleviate financial stress, but it can bring you closer to your partner, too.

⚡️ Take control of your finances together—try Albert for smarter budgeting today.