Building a budget as a couple is one of the best ways to reach the goals you share with your partner.

Using one of the best budgeting apps for couples ensures both sides understand their monthly income, expenses, and financial priorities. Open conversations about money are essential — whether it’s splitting monthly bills, saving for the future, or planning for larger expenses.

While potentially challenging, the process can create a sense of teamwork where each partner feels involved and valued. You can confidently work toward a secure and fulfilling financial future together with a clear and collaborative approach.

Why budgeting is important for couples

Managing money together is a very important part of any committed relationship. Budgeting will help couples handle finances and strengthen their connection by building trust and transparency.

When both partners are on the same page financially, it can reduce stress and set the stage for a stable future.

A joint budget aligns your financial goals, making it easier to plan for major life events like buying a home, traveling, or starting a family. By understanding your whole financial picture, you and your partner can prioritize spending and saving in a way that supports your shared aspirations.

Budgeting also helps build a safety net for life's unpredictability and can support strategic debt management for your household. This preparedness and a proactive approach can reduce anxiety and provide peace of mind, knowing there’s a plan for financial surprises and a move toward financial freedom.

A budget tracker for couples can help you and your partner get a clear view of your spending plan, day-to-day transactions, and financial goals so you can easily manage your money in one place.

Building a strong financial foundation

Creating a strong financial foundation is an important part of achieving the goals you share with your partner.

A joint budget will help you align your spending and saving habits, helping you hit important milestones as a couple. It also provides the opportunity to build an emergency fund together, factoring in both incomes and expenses, offering peace of mind during unexpected situations.

Budgeting together can encourage more open conversations about income, debts, and financial goals. These discussions can help couples identify areas for improvement. For instance, if one partner has student loans and the other is debt-free, they can plan a strategy for paying down the loans faster. Working together can help build mutual support and shared responsibility within a relationship.

Avoiding financial conflicts

Unfortunately, money is one of the leading causes of disagreements in relationships. Unclear financial expectations, different spending habits, and undisclosed debts can lead to tension between you and your partner.

A clear budget can counter this by setting defined boundaries for spending and saving, ensuring that both partners understand the overall financial picture.

Regularly reviewing your budget together can help you address any issues early on. If overspending is spotted in one area, adjusting your budget or cutting back as needed is easier this way.

This proactive approach can minimize resentment and promote cooperation. When you communicate openly about your finances, you can more easily avoid misunderstandings and build a stronger connection with your partner.

Steps to create a budget together

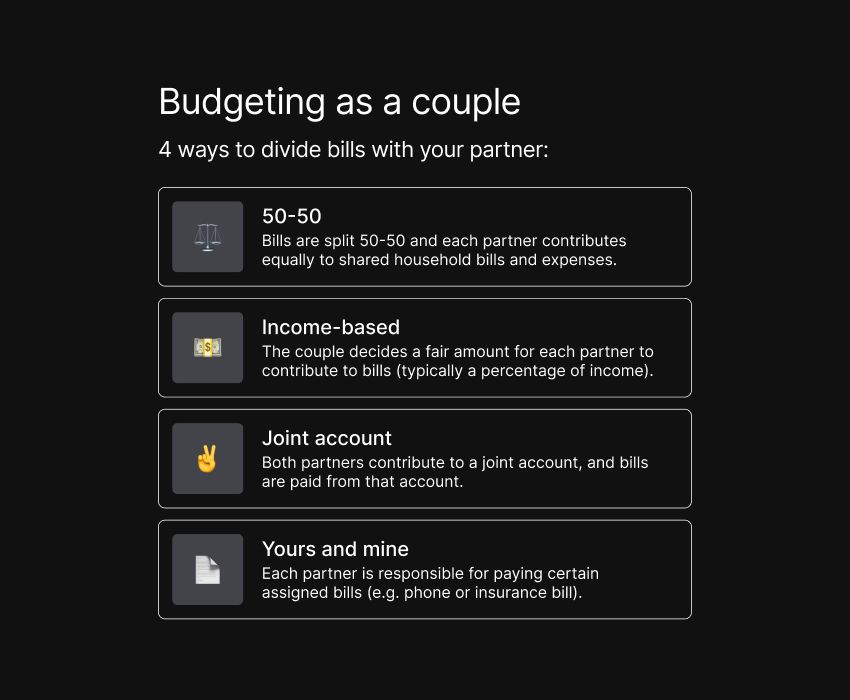

Creating a budget that incorporates two incomes (and two sets of financial obligations) can seem challenging. However, breaking it down into clear, manageable steps will simplify the process.

This process will require some open communication, honesty, and willing collaboration. Here’s how to get started.

Discuss your financial goals

Start by having an open conversation about your individual and shared financial goals. Whether you want to save for a house, pay off debt, or plan a vacation, understanding each other’s priorities can help create a unified vision for your money.

Talk about short-term goals, like building an emergency fund, and long-term plans, like your retirement savings.

Setting clear goals will give you both focus and motivation. It ensures that you’re both working toward the same outcomes and understand why sticking to the budget is crucial. Being aligned will make large financial decisions and small daily habits easier to handle.

List all sources of income

Once you understand what you’re working toward, create a clear list of all your income sources, including salaries, bonuses, freelance work, investments, and any other earnings.

Knowing your total household income is essential for crafting an accurate budget. Be sure to account for net income — after taxes and deductions — for a clearer picture.

Understanding your income will allow you to allocate your funds more effectively, ensuring there’s enough for both of your expenses, savings, and investments. If one partner’s income fluctuates (e.g., through commission or freelance work), consider building a buffer into the budget to handle the ups and downs.

Also, keep potential income changes in mind. If either of you are expecting a raise or a new job opportunity, factor that into your budgeting plan. Knowing exactly how much money is coming in will help set realistic spending limits and promote better financial stability.

Track your expenses

To understand where your money goes, you need to track your spending carefully.

Start by reviewing your bank statements, credit card bills, and receipts from the last few months. Categorize all your expenses into different areas like housing, utilities, groceries, transportation, entertainment, and anything else that applies.

You can also use a budgeting app like Albert that automatically categorizes your transactions and pinpoints areas where you could cut costs. This can make the entire budgeting process quicker, easier, and less of a chore.

Whichever method you choose, this exercise will help you identify your spending patterns, making it easier to spot where you might be overspending. For example, if dining out is taking up a large portion of your income, recognizing this trend will help you make better decisions going forward.

Set spending limits

You can start setting spending limits for each category when you have a clear picture of your income and expenses. Make sure that your total expenses don’t exceed your combined income.

Always start by allocating your funds to essential expenses first, then distribute the remaining income toward savings, investments, and discretionary spending.

Setting spending limits requires compromise and open communication, but it will make reaching your goals far easier. Keep in mind that both partners will need to agree on amounts allocated to each category to avoid disagreements and challenges in the future.

Budgeting tools can be helpful to track spending and stay within your limits — Albert will even automate the monitoring and bill-tracking side of things to make it easier.

Make sure that you and your partner regularly review your spending limits so you can identify overspending and adjust your budget as necessary.

Effective communication about money

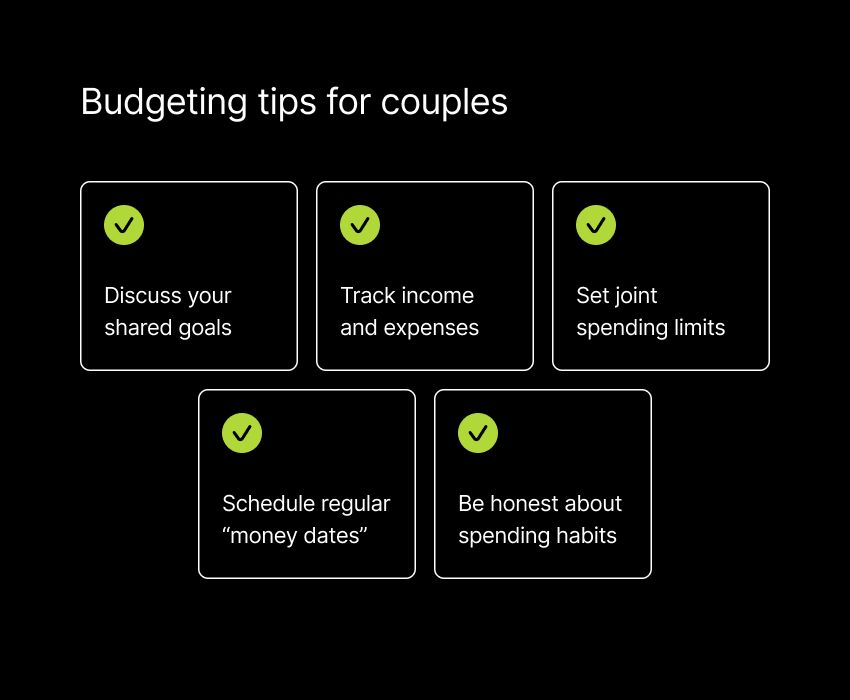

Open, honest conversations about money are key to a healthy financial partnership. While discussing finances can be uncomfortable, it's essential for keeping things on track and working toward shared goals.

Good communication builds trust and transparency so you and your partner are aligned on your joint financial picture. An open dialogue will help address any concerns, set priorities, and keep you focused on a bright financial future.

Set regular budget meetings

Schedule regular budget meetings to make financial discussions part of your routine. Whether you choose weekly or monthly, scheduling time to review your budget will keep you both accountable. These meetings give you a chance to check your progress, adjust limits, and address any issues.

Regular check-ins also help catch minor problems before they become big ones. And don’t just focus on the problems — take a moment to celebrate wins, whether it’s hitting a savings goal or paying off a debt. Talking about your money regularly will keep you both engaged and focused on your financial goals.

Beyond budget reviews, these meetings are the perfect time to discuss bigger financial goals and dreams. Sharing future plans helps ensure that you’re still aligned on what matters most.

Be honest about spending habits

Honesty about your spending habits is essential for building trust. If one partner tends to make impulse buys, acknowledging it openly is the first step in finding a solution. Personal allowances for discretionary spending help balance freedom with responsibility, keeping your overall budget on track.

Full transparency about debts and other financial obligations is also important. Share details about your credit card balances, loans, or any liabilities so that you both have a complete financial picture and there aren’t any surprises.

Keep your conversations supportive and collaborative, and make sure that the environment is one of teamwork and accountability.

Planning for future financial goals

Looking ahead to what you want to achieve will keep you motivated in your budgeting. Whether you plan on buying a house, starting a family, or saving for retirement, clear goals will guide your saving and investment choices.

Saving for emergencies

An emergency fund is a must for financial security. Between the two of you, aim to save up to three to six months’ worth of living expenses to cover you in the face of things like medical bills or job loss. Setting up automatic transfers into a separate savings account will make it easier to ensure consistent progress.

Planning for retirement

It’s never too soon (or too late) to start planning for retirement. Take some time to talk with your partner about what you want your retirement to look like and estimate how much you’ll need to save.

Consider contributing to employer-sponsored retirement plans, IRAs, or other investment options.

Regular contributions, paired with compound interest, can significantly grow your retirement savings. Working with an expert can help you create a strategy that aligns with your joint goals.

Make sure to review your retirement plan from time to time. You may want to adjust contributions or tweak your investment strategy as your lives change and evolve. Staying proactive will keep your plan on track and ensure long-term financial security for you and your partner.

Common budgeting challenges and solutions

While budgeting is essential for managing your finances, couples often face challenges along the way. Recognizing these obstacles and having strategies in place will help ensure continued financial success.

Handling unexpected expenses

Unexpected costs — like car repairs, medical bills, or home maintenance — can disrupt even the best-laid budget. To minimize the impact, it’s important to build a buffer into your budget or maintain an emergency fund.

When something unexpected happens, review your budget together and adjust your spending in other areas if necessary. Open communication is key to finding solutions.

This is why it’s important to regularly review your budget and ensure it stays on track. Be proactive to keep your financial plan relevant, reduce stress, and avoid surprises throwing you off course.

Adjusting your budget over time

Remember, your budget isn’t a one-time document — it should evolve as your life changes. If income changes, new goals arise, or your lifestyle shifts, you may need to adjust your budget. Regularly reviewing and tweaking your plan will keep it aligned with your current reality.

Schedule regular check-ins with your partner that go beyond catching up on your weekly or monthly spending. Take the time to reassess your life and consider whether your budget still aligns with the way you’re living and the way you want to live.

Strengthening your relationship through budgeting

Budgeting for couples isn’t just about managing money; it’s about building a stronger partnership based on trust, transparency, and shared goals.

When you work together on your finances, you’re improving your financial situation and deepening your relationship. Open communication, mutual support, and help from the right budgeting tools will make the process easier and more enjoyable.

If you approach budgeting as a team effort, you and your partner can tackle the financial challenges that come your way and achieve your goals together.

⚡️ Albert: the budgeting app for couples — get started with a 30-day trial.