Managing debt can feel overwhelming, but you can take control and work toward a debt-free future with practical steps and financial tools. Here’s how to assess your financial situation and create a clear plan to tackle your debt.

Understanding your debt situation

Before effectively paying off your debt, you need to understand exactly what you owe. A clear picture of your financial obligations helps you prioritize repayments and make informed decisions.

Assessing your total debt

Gather all your financial statements, including credit cards, personal loans, and other obligations. List out the details for each:

Outstanding balance

Minimum monthly payment

Interest rate

This process will give you a comprehensive overview of your debt and help you identify any patterns or strategies you could follow. For example, focusing on high-interest debts first could save you money, while targeting smaller debts first may offer quick wins to build momentum.

Budgeting apps or tools that track and organize your debts can help streamline this step. With everything in one place, you’ll have a clear guideline for setting goals and creating a repayment plan that works for you.

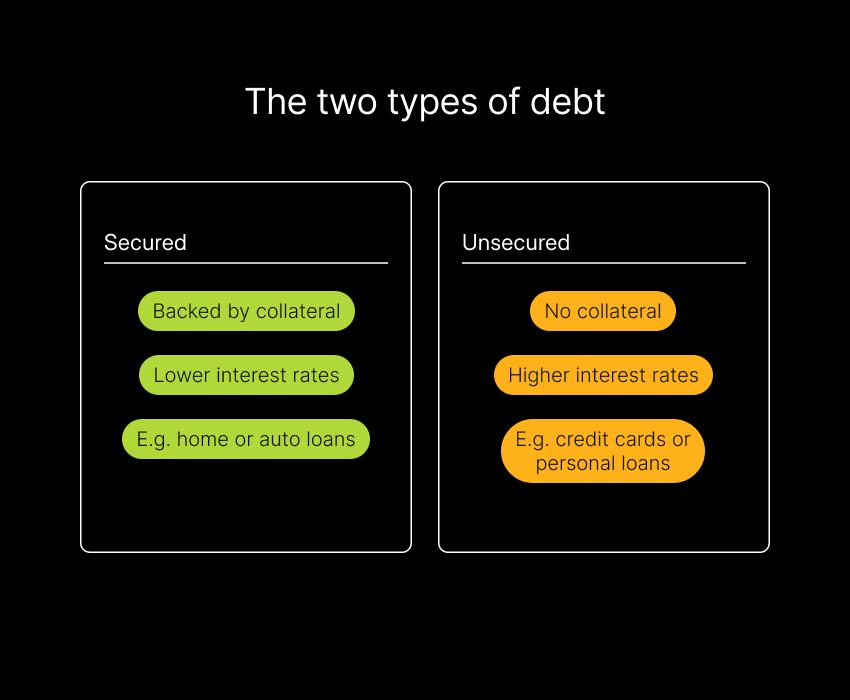

Understanding the different types of debt

Understanding the nature of your debts can guide how you prioritize them. There are two primary types of debt:

Secured debts, like mortgages or auto loans, are backed by collateral. These often have lower interest rates but carry the risk of losing the collateral if you fall behind.

Unsecured debts, such as credit cards or personal loans, lack collateral but usually come with higher interest rates.

Distinguishing between these types and high-interest versus low-interest obligations will allow you to create a repayment strategy tailored to your situation.

Evaluating interest rates and terms

Interest rates play a huge role in how quickly your debts can grow. That’s why paying attention to them is important for your repayment plan.

High-interest debts, like credit card debt, can snowball if left unchecked. Prioritize these obligations to minimize the interest you accumulate. If possible, explore refinancing options or consolidating debts for better terms — this can lower your interest rates and simplify your monthly payments.

Some financial apps can help you understand which of your debts cost you the most and where to focus your efforts. Stay mindful of any penalties for early repayment, but don’t hesitate to take advantage of opportunities to save.

How to create a debt repayment plan

Having a structured plan is essential for making progress on your debt repayment. A clear guide will keep you focused, motivated, and aware of your accomplishments so you can celebrate milestones. Here’s how to set financial goals, build a budget, and choose a strategy that works for you.

Set clear financial goals

Start by defining what you want to achieve. Do you want to pay off all credit card debt within a year or eliminate student loans in five years? Setting specific, realistic goals will give you direction and purpose.

Financial apps can be incredibly helpful here. They give you a platform to set, track, and monitor your goals. Features like visual progress charts and reminders can help keep you engaged and motivated.

It is also important to break larger goals into smaller, actionable steps. Achieving smaller milestones — like paying off one credit card or reaching a savings benchmark — can keep your motivation high and encourage you to keep going.

Budget for debt repayment

A realistic budget plays an important role in any successful repayment plan. Start by calculating your monthly income and subtracting essential expenses like housing, utilities, and groceries. The remaining funds can be allocated to debt payments and savings.

If you don’t have much to contribute to debt or savings, look for areas where you can cut back. This might mean reducing discretionary spending like dining out, canceling unused subscriptions, or switching to more cost-effective service providers. Small adjustments across multiple areas could free up money to direct towards debt.

Prioritize carefully

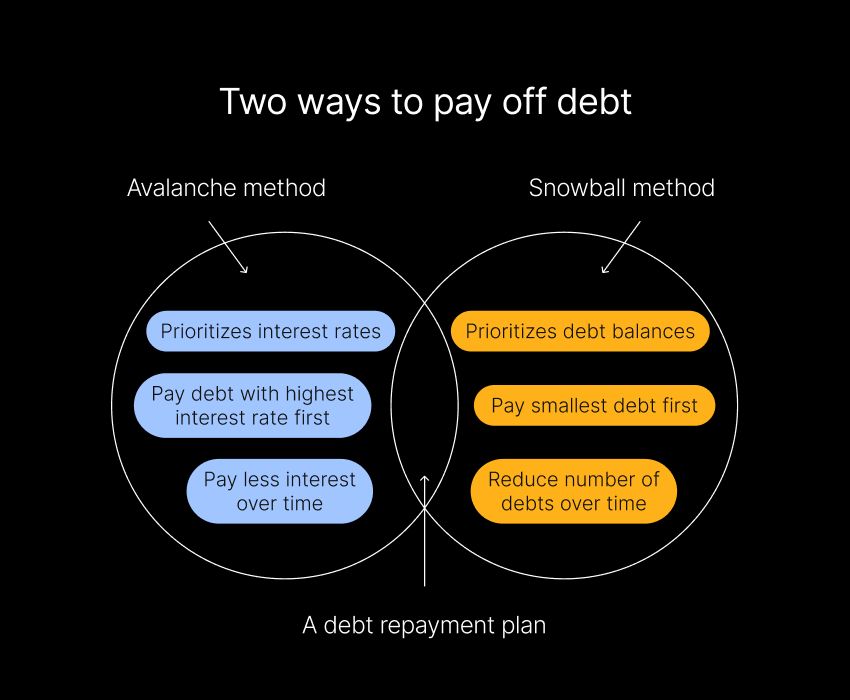

Selecting the right debt repayment strategy is key to staying on track. Two effective methods are the snowball and avalanche approaches:

Snowball method: Pay off your smallest debts first to achieve quick wins. These victories can boost motivation and build momentum. As you clear smaller debts, you roll their monthly payments into the next, larger debt, creating a snowball effect.

Avalanche method: First, focus on debts with the highest interest rates. This approach minimizes the total amount of interest you’ll pay over time. Once the highest-interest debt is eliminated, move on to the next highest.

Both strategies have their advantages. The snowball method offers psychological rewards, while the avalanche method is often more cost-effective. Many financial tools can simulate these strategies, showing potential timelines and outcomes to help you choose the approach that aligns with your goals.

Strategies to pay off debt faster

Paying off your debt faster can reduce the total interest you pay and help you achieve financial freedom sooner. Here’s how you can speed up the debt repayment process:

Increasing your income

Boosting your income gives you more funds to allocate toward your debt. If possible, consider taking on a side hustle, freelancing, or monetizing a hobby. Even temporary income boosts can impact your debt repayment plan.

Look for opportunities that fit your skills and lifestyle, such as gig work, selling handmade items, or offering local services. Redirecting these additional earnings directly toward debt repayment will speed up your progress.

Reducing unnecessary expenses

Cutting back on non-essential spending can free up extra money for debt repayment. Review your budget and pinpoint areas to trim costs.

Cancel subscriptions you rarely use

Reduce dining out and focus on meal planning at home

Find cost-effective entertainment alternatives, like free events, streaming services, or your local library

Automatic spending trackers offered by apps like Albert can help you identify patterns and reveal where to cut back. Being mindful of your spending in multiple areas can make a big impact on your overall repayment strategy.

Making extra payments

Whenever possible, pay more than the minimum payment each month. Extra payments directly reduce your principal balance, which lowers the interest you’ll owe in the long run.

Align payments with your paydays for consistency

Add even small amounts to your monthly payment — it all adds up over time

Use a budgeting app that makes scheduling additional payments easy and seamless

Remember that every extra dollar applied to your debt brings you closer to financial freedom. Combining increased income, reduced expenses, and extra payments can accelerate your progress and build a more secure financial future.

Tools and resources for debt repayment

The right tools and resources can make debt repayment more manageable by offering structure, clarity, and support — take advantage of them as much as possible.

Debt consolidation options

Debt consolidation allows you to combine multiple debts into a single loan with one monthly payment, often at a lower interest rate. This simplifies your finances and can reduce the total amount of interest you pay.

Before committing to this, research and compare consolidation loan options to find terms that work best for you.

Some financial platforms offer loan calculators or connect you with lenders, helping you assess whether this approach aligns with your financial goals. Be mindful of any fees or changes to your repayment timeline.

While debt consolidation isn’t suitable for everyone, it can be a powerful strategy if used correctly.

Balance transfers

For credit card debt, transferring balances to a card with a lower interest rate — or one offering a 0% promotional rate — could save you money. This strategy reduces the amount of interest accruing, allowing you to focus on paying down the principal amount.

Before initiating a balance transfer, check for any transfer fees and make sure you can pay off the balance before the promotional period ends. Otherwise, you may face higher interest charges. Use a budgeting app to track your progress and stay on top of deadlines to avoid surprises or penalties.

Also, make sure to review the terms and conditions carefully so you can make an informed decision and maximize your savings.

Seeking credit counseling

Professional credit counselors can offer you personalized guidance to help you regain control of your debt. They can assist with creating a tailored repayment plan, negotiate with creditors, and provide tips for better money management.

Nonprofit organizations often provide free or low-cost counseling services, making expert advice accessible to many. Credit counselors can also introduce you to options you might not have considered, offering insight and encouragement throughout your journey.

Staying motivated and avoiding new debt

Staying motivated is essential for reaching your debt repayment goals. Once you’ve reached your goals, avoiding new debt will help lead you to financial freedom.

Building an emergency fund

An emergency fund is essential for covering unexpected expenses and reducing the need to rely on credit cards or loans in a crisis. As a safety net, try to save three to six months’ worth of living expenses.

To make saving easier, consider setting aside small amounts regularly. Even small contributions add up over time, providing security and helping you avoid taking on additional debt.

Rewarding milestones

Celebrating your achievements on your debt repayment journey will help keep you motivated and make the process more rewarding. Break your larger goals into smaller, manageable milestones, and treat yourself when you reach them.

Remember, your rewards don’t need to be costly. Allowing yourself simple pleasures like a favorite meal, a takeout coffee, or a small splurge can make a big difference in keeping the momentum.

Visual progress trackers or apps can also help by making your milestones tangible, reinforcing your sense of accomplishment and commitment to your financial goals.

Avoiding credit traps

Stay vigilant against financial products, such as high-interest loans or credit cards with hidden fees, that could set you back. Always read the terms and conditions carefully before you accept any new offers, even if they’re tempting.

Take advantage of financial tools that monitor your credit score or flag potentially risky offers. This can help you be more aware and make informed decisions. Staying cautious and informed ensures that you don’t fall into new debt while working hard to eliminate your existing obligations.

Achieving financial freedom and living debt-free

Paying off debt can be challenging, but it’s achievable with the right plan. By understanding your debt situation, setting up a clear repayment plan, and using smart strategies to speed up the process, you’ll be on the path to financial freedom.

Tools like budgeting apps and professional advice can also make the journey easier. Keep yourself motivated and avoid new debt to ensure your hard work results in lasting change.

Remember, becoming debt-free is a step-by-step process that takes patience and persistence. With the right plan and mindset, you’ll reach your financial goals and enjoy the peace of mind that comes with financial stability.

⚡️ Sign up with Albert today to start getting your finances on track.