Homeownership is a meaningful milestone, offering stability and a space to make one's own. However, achieving such an ambitious financial goal can be challenging.

You can start saving for your dream home with the right plan and by following a few practical steps.

Understanding your savings goal

When thinking about how to save for a house, you first need to determine how much you’ll need. A clear savings target will help you stay focused and be prepared, factoring in the home’s price and the additional costs involved in the buying process.

Determine the right amount to save

Research home prices in your desired area to establish a realistic baseline. Aiming for a 20% down payment is often recommended, as it can reduce monthly mortgage payments and help you avoid private mortgage insurance (PMI).

For example, a $300,000 home would require $60,000 for a 20% down payment. If this feels out of reach, explore loan options with lower down payment requirements, such as 3% or 5%, while noting that these may involve higher interest rates or fees.

A home affordability calculator can help you understand how much house you can afford based on your income, debts, and financial situation. Don’t forget to include closing costs, which usually range from 3% to 6% of the home’s price — $9,000 to $18,000 on a $300,000 home. By accounting for these expenses upfront, you’ll have a comprehensive plan for your down payment savings.

Set a realistic timeline

Once you know your goal, outline a timeline that aligns with your budget. Review your income and expenses to determine how much you can save each month without overextending yourself.

For example, saving $1,000 monthly toward a $60,000 goal would take five years, or even less time if your funds are accruing interest. Breaking this into smaller milestones — such as monthly or quarterly targets — can make the process feel more achievable and keep you motivated.

Consider scheduling contributions to make the process easier. Scheduling regular transfers to a dedicated savings account ensures consistent progress without requiring manual effort. If your financial situation changes, adjust your timeline accordingly. Any unexpected bonuses, raises, or expense reductions can help you boost your down payment fund.

Consider additional costs

Your savings plan should include more than just the down payment. Closing costs, which range from 3% to 6% of the home price, are significant expenses to plan for. Moving costs, such as hiring movers or renting a truck, can also add up. Additionally, budgeting for home inspections is essential to avoid unexpected repairs later.

Setting aside funds for minor updates or fixes after purchase is also wise. Even if your new home is in good shape, unexpected maintenance costs can arise, so keeping an emergency fund specifically for these situations ensures you’re prepared.

Consider using separate accounts for your down payment, closing costs, and additional expenses to help you stay organized. This approach can help you track your progress toward each goal and ensures you’re fully prepared when it’s time to make your dream of homeownership a reality.

Creating a budget to maximize savings

Building a solid budget is essential for saving effectively toward your dream home. A clear plan helps you understand your spending, identify areas to cut back and redirect money toward your house fund.

Track your income and expenses

Start by listing all your sources of income, like your salary, bonuses, or side hustles.

Next, track your expenses, including fixed costs like rent, utilities, and loans, as well as variable costs like groceries, dining out, and entertainment.

Using a budgeting app like Albert can simplify this process by automatically categorizing your spending. With a clear breakdown, you can identify trends and areas where you might be overspending.

Tracking over a few months might reveal excessive spending on dining out or subscription services you no longer use. Once you know where your money is going, you can make the necessary changes.

Identify areas to cut back

Review your expenses and pinpoint areas where you can trim costs. Small adjustments can add up over time. For instance, preparing meals at home instead of dining out or skipping daily takeout coffees could help you save more each month.

Cancel any unused subscriptions or switch to cheaper alternatives for services like streaming where you can. Negotiate with service providers to lower bills for cable, internet, or phone plans — sometimes, a quick check can save you money. For essentials like groceries, use coupons, shop sales, and consider bulk buying.

Allocate funds specifically for house savings

Open a dedicated down payment savings account to keep your progress organized and separate from other financial goals. Commit to saving a fixed amount or percentage of your monthly income, and schedule regular contributions to reach your goal.

Consider using a high-yield savings account to earn more on your money while it sits. Over time, the extra interest can accumulate and help you reach your goal faster.

Exploring different savings accounts

The right savings account can help you maximize your money’s growth and align your savings plan with your financial goals. Whether you’re prioritizing higher returns or flexible access, understanding your options will help you make the right decision.

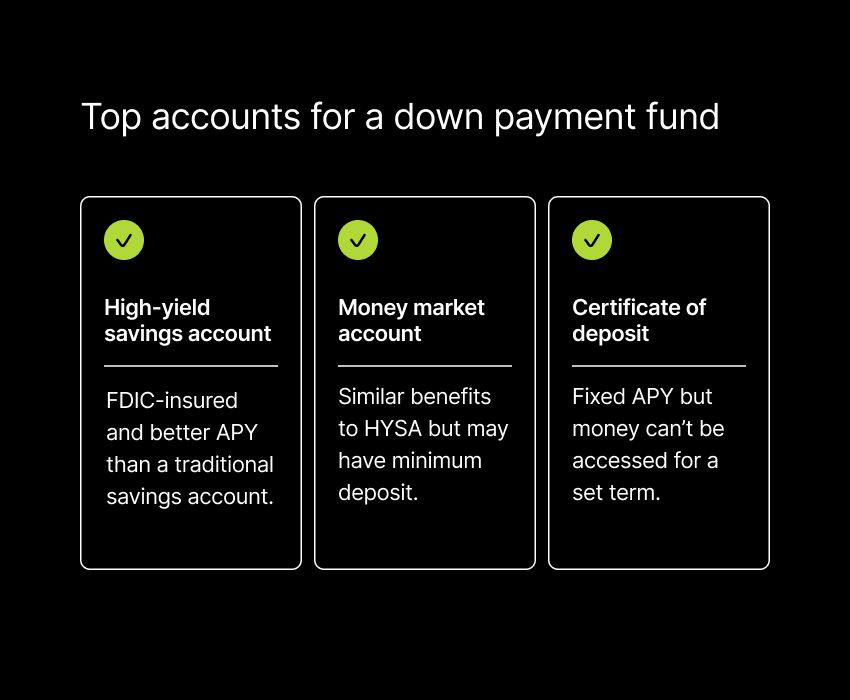

High-yield savings accounts

High-yield savings accounts offer better interest rates than traditional ones, meaning your money will grow faster. These accounts can offer competitive rates due to lower overhead costs.

When selecting a high-yield savings account, prioritize those with no monthly fees and a competitive interest rate. Always confirm that the bank is FDIC-insured to ensure your deposits are protected.

Opening a high-yield account specifically for your house savings can help keep your goal on track. The interest earned can add a noticeable boost to your fund, helping you reach your down payment faster. Plus, separating these savings from other funds makes it easier to focus on your goal.

Money market accounts

Money market accounts offer a mix of benefits, including higher interest rates than standard savings accounts and, often, added flexibility like check-writing privileges or debit card access. These features make it easier to access your funds when necessary.

Keep in mind that money market accounts may come with higher minimum balance requirements and limits on monthly transactions. Review the account terms carefully to ensure they fit your needs before you commit.

For those saving larger amounts and looking for easier access to their funds, a money market account strikes a balance between growth and flexibility.

Certificates of deposit (CDs)

Certificates of Deposit (CDs) allow you to lock in your savings for a set period of time in exchange for higher interest rates. Terms can range from a few months to several years, making CDs a strong option for goals with a clear timeline.

Because early withdrawals often come with penalties, it’s important to choose a term that matches your house savings timeline. If you’re certain you won’t need the funds until a specific date, CDs can steadily boost your savings.

For added flexibility, consider CD laddering — spreading your savings across CDs with staggered maturity dates. This strategy lets you access portions of your money periodically while taking advantage of higher interest rates.

Boosting your savings with additional income

Adding to your income can accelerate your progress toward your house fund. Whether through side gigs, selling unused items, or carefully chosen investments, even small efforts can make a big impact.

Side jobs and freelancing opportunities

Taking on a side hustle or freelancing is a great way to earn extra money. Look for opportunities that match your skills or hobbies — whether that’s tutoring, graphic design, writing, or offering handyman services.

Platforms like Upwork or TaskRabbit can make it easier to find gigs and connect with potential clients, and even a few hours of freelance work each week can build up over time. Transfer these earnings directly into your house savings account to stay on track.

Sell unwanted items

Decluttering your home can turn unused items into extra savings. Look for things in good condition that you no longer want or use, such as clothes, electronics, furniture, or collectibles.

Use platforms like eBay, Facebook Marketplace, or Poshmark to list and sell your items online, using clear photos and detailed descriptions to attract buyers. You could also host a garage sale for a quicker way to sell multiple items.

Invest with caution

Investing might help your savings grow faster if you're comfortable with risk. However, short-term goals like saving for a house call for low-risk options to protect your money.

Consider investments like high-yield savings accounts, CDs, or other conservative choices. Be mindful of your timeline and risk tolerance when choosing which approach is best.

While investing can increase your returns, avoiding high-risk strategies that might jeopardize your hard-earned savings is essential. Stick with something that offers steady, reliable growth to stay on track.

Taking advantage of first-time homebuyer programs

First-time homebuyer programs can make purchasing a home more affordable by offering perks like down payment assistance, reduced interest rates, or tax benefits. Exploring these options can lighten your financial load and help you achieve your homeownership goals sooner.

Federal assistance programs

The federal government offers several programs designed to help first-time buyers:

FHA loans: Backed by the Federal Housing Administration, these loans have lower down payment requirements (as little as 3.5%) and flexible credit qualifications, making them ideal for first-time buyers.

USDA loans: These loans are available for homes in eligible rural areas and often require no down payment. They’re a great option if you’re open to living outside major cities.

VA loans: Tailored for active-duty service members, veterans, and eligible surviving spouses, VA loans feature competitive rates and typically don’t require a down payment or private mortgage insurance (PMI).

Each program has its own requirements and benefits. A mortgage professional can help you determine which options align with your financial situation and housing goals.

State and local programs

State and local governments often have their own initiatives to support first-time buyers. These might include:

Grants to help with down payments or closing costs.

Low-interest loans with favorable repayment terms.

Special programs for certain professions, such as teachers or first responders, or for families with lower incomes.

To find programs in your area, check your state housing authority’s website or talk to a local real estate agent. These professionals can provide insight into available resources and guide you through the application process.

Remember that some programs may require you to meet income thresholds or complete a homebuyer education course. While these steps may take time, the benefits — like reduced upfront costs — can make homeownership more attainable.

Staying motivated and on track

Saving for a house is a big commitment, and staying motivated is important to reach your goal. Here are some strategies to help keep you focused and make the journey more manageable.

Set milestones and celebrate your progress

Breaking your goal into smaller, achievable milestones can make the process less overwhelming.

For example, aim to reach a certain amount each month or hit a quarterly target. When you reach a milestone, celebrate the achievement. The reward doesn’t have to be expensive — a favorite meal or a relaxing day off can be enough to keep you inspired.

Visual tools like a progress tracker or a budgeting app like Albert can also help. Managing your budget and monitoring your progress in real time can be motivating and reinforce your dedication to the goal.

Involve family and friends for support

Sharing your goal with trusted friends and family can give you extra encouragement and accountability. They might have helpful advice, share their experiences, or simply cheer you on when needed.

If you know someone with similar financial goals, consider teaming up with them. Having an accountability partner can provide motivation and the opportunity to share tips and celebrate wins together. When someone else is on the same journey as you, it can make saving feel less solitary.

When you are socializing, be open about your goal. Let friends know you’re saving for a house so they understand if you’re being more mindful of your spending. Some might even join you in budget-friendly outings, making it easier to stick to your plan without missing out on enjoyment.

Achieving your homeownership goals

Saving for a house takes planning, commitment, and patience — but the effort pays off. Setting a clear goal, being realistic, and taking a calculated approach can lay a solid foundation for homeownership.

Stay focused and recognize your progress along the way. With determination and smart strategies, you can navigate the challenges and look forward to the day you step into your new home.

⚡️ Start planning your homeownership journey today with our team of finance experts — try Albert today and take control of your money.