Financial security is all about having stability and confidence in managing day-to-day expenses, saving for future goals, and handling unexpected costs without added stress.

While everyone’s financial journey looks different, building strong habits is an important first step. This typically involves creating a budget that works for you, saving consistently, and making informed choices with your money. Here’s everything you need to know about financial security and what it might mean for you.

What is financial security?

Being financially secure means having enough money to cover your living expenses, manage emergencies, and work toward future goals without constantly stressing about money. It means creating a stable foundation where unexpected costs won’t derail your life and where you feel confident managing your finances.

At its core, financial security is about understanding your unique financial situation and making thoughtful choices. It involves balancing your income, expenses, savings, and investments to support your current lifestyle and future ambitions. Financial stability and security aren't about being wealthy — they’re about having control over your money and knowing you’re prepared for the unexpected.

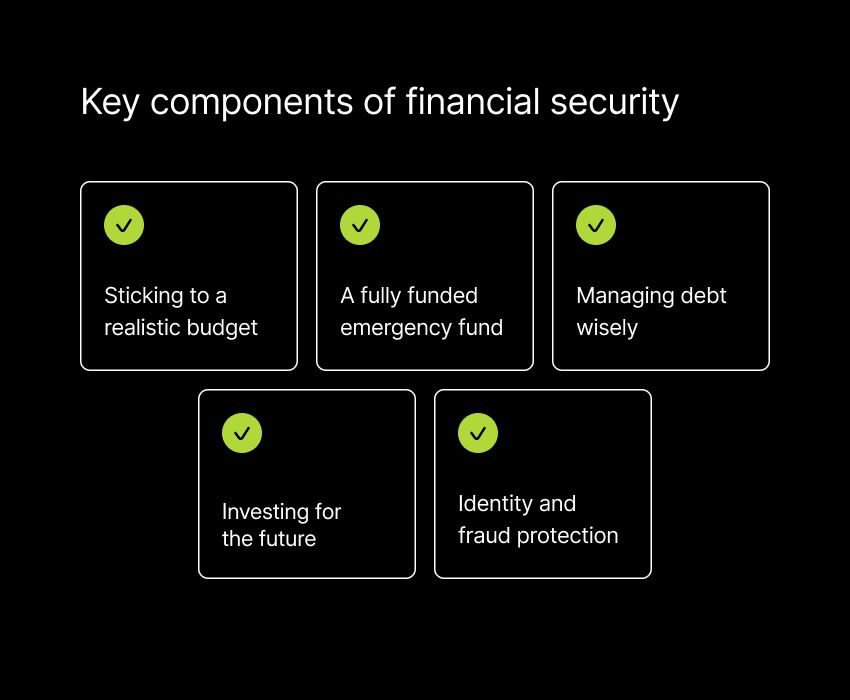

Building financial security also means protecting yourself from risks like identity theft or fraud. Services that monitor your accounts and provide real-time alerts can add an extra layer of protection, helping you safeguard your financial foundation.

If you’re looking to achieve financial security, it starts with education. Understanding budgeting, how interest rates work, investment options and the importance of credit scores empowers you to make smart financial decisions.

Why financial security matters

Financial security is essential because it can improve your overall quality of life. When your finances are under control, you can reduce money-related stress, avoid unnecessary debt, and focus on achieving your goals. It gives you the freedom to handle emergencies without jeopardizing your future plans and helps you manage daily expenses with a clear head.

Even minor unexpected expenses can create significant challenges and lead to poor decision-making without financial security. When you’re financially secure, you’re less likely to make impulsive choices based on immediate needs. Instead, you can focus on long-term planning, whether buying a home, launching a business, or saving for retirement.

Ultimately, financial security impacts more than your bank account. It can enhance your overall well-being and help you build a foundation supporting your goals.

Steps to achieve financial security

Achieving financial security takes thoughtful planning and consistent effort. Here are practical steps to help you build a stable financial foundation:

Build a budget that works

A realistic budget is a cornerstone of financial security. It helps you track income and expenses so you can live within your means.

To create your budget, list all your income sources and itemize expenses like rent, groceries, utilities, and discretionary spending.

Separate your expenses into “needs” and “wants” to prioritize essentials and pinpoint areas where you can cut back. A budgeting app like Albert can simplify this process by tracking your spending patterns and offering you insights into how you manage your money.

Do your best to keep your budget flexible and review it regularly to adjust for significant life changes or shifting priorities. A well-maintained budget isn’t about restricting yourself; it’s about taking control of your money and ensuring every dollar aligns with your financial goals.

Create an emergency fund

An emergency fund — your financial safety net — can cover unexpected costs like medical bills or car repairs without derailing your goals.

Experts recommend saving three to six months’ worth of essential expenses, but starting small is still a good idea because every little bit adds up. Alongside your emergency fund, you should also consider your retirement savings and other ways you can plan for the future.

Manage debt wisely

Debt, especially high-interest debt like credit cards, can make it more challenging to achieve financial security.

To manage your debt, start by listing them all out, noting the interest rates and minimum payments. Focus on paying off high-interest debts first while keeping up with the minimum payments on others.

Consider consolidating your debt or negotiating lower interest rates if possible. Use budgeting tools to track your payments and stay on schedule. By handling your debt strategically, you may be able to free up money to allocate toward savings and investments, contributing to a more stable financial future.

Invest for the future

Investing can be a powerful tool for growing your wealth and achieving long-term goals. When you start investing, try to diversify your investments across stocks, bonds, and other assets to balance risk and return. Start as early as possible — even small amounts with compound interest can grow significantly over time.

Take advantage of platforms that offer professionally managed portfolios or guided investment tools. You can use these and other resources to educate yourself on different investment strategies and ask for professional advice if you need to. Once you’re set up, regularly review and adjust your portfolio to ensure it always aligns with your goals and market trends.

Remember, successful investing is typically a long-term effort. You can build wealth and secure your financial future by staying patient, diligent, and informed.

Common mistakes to avoid on the path to financial security

It’s good to be aware of some of the more common financial mistakes people tend to make. Steering clear of these will help you build long-term stability. Here’s what to watch out for and how to stay on track:

Neglecting a budget: Skipping the budgeting step is one of the most frequent pitfalls. Without a clear view of your income and expenses, overspending becomes easy, often leading to debt and financial stress. A solid budget helps ensure that you control where your money goes.

Skipping an emergency fund: Failing to save for emergencies can leave you vulnerable to unexpected expenses like medical bills or car repairs. Without a financial cushion, these surprises can push you into high-interest debt. To avoid this, regularly set aside even small amounts to build a safety net over time so you can cover emergencies.

Ignoring high-interest debt: Allowing high-interest debt to linger can be costly. The longer it accumulates, the harder it is to pay off. Focus on paying off high-interest debt first, as this can reduce the total you owe and free up some of your financial resources for saving and investing.

Investing without knowledge: Diving into investments without understanding your options can lead to unnecessary risks. Take some time to learn about different investment products and strategies. Using tools or platforms that offer guidance can help you make smarter, more informed decisions.

Overlooking financial security measures: Neglecting to protect your finances increases your exposure to identity theft and fraud. Make sure you’re using account monitoring and identity protection services to safeguard your money and personal information. Being proactive is key here — don’t wait for something to go wrong.

How to maintain long-term financial security

Achieving financial security is an important milestone, but keeping it requires continuous engagement and flexibility. Here’s how to stay on track and adapt:

Regularly review your financial plan

Revisit your financial plan regularly to make sure it always aligns with your goals and life circumstances.

Events like getting married, having children, or changing jobs can significantly impact your finances. Adjusting your budget, savings, investments, and insurance needs will help you stay prepared and protected.

Tracking your progress can also help you keep your motivation levels high. Celebrate your milestones to reinforce the positive habits you’re building and maintain your momentum.

Regular check-ins will keep your plans effective and relevant.

Adapt to life’s changes

Flexibility is essential for long-term financial security. Life is unpredictable — whether it’s a job transition, relocation, or economic shift, being ready to adjust ensures resilience.

Build adaptability into your financial plan by diversifying your investments, reassessing your budget regularly, and strengthening your emergency fund as you need to.

Do your best to stay informed about financial trends, and don’t hesitate to look for advice if you face major decisions or challenges. Albert’s finance experts can offer personalized budgeting advice and answer any money questions you may have to help you on your journey.

It can be stressful when things change but try to embrace it as an opportunity to refine your strategies. When you’re proactive and open to evolution, you can strengthen your financial position and navigate uncertainties more easily.

Long-term security isn’t just about the numbers; it’s about being engaged and responsive to life’s shifts.

Your journey to financial security

Financial security isn’t a one-time achievement — it’s an ongoing journey that starts with understanding how important it is to take care of your financial well-being.

By creating a solid plan and staying disciplined, you can start to build a strong financial foundation for a stable, fulfilling future.

Remember, financial security isn’t just about growing your wealth; it can lead to peace of mind and improved confidence in your ability to handle life’s ups and downs. With the right approach and commitment, financial security is within reach, bringing opportunity, stability, and freedom into your life.

⚡️Take control of your financial future — download Albert and start building your security today.