Understanding the different types of budgets is key to managing your finances effectively and getting the most out of your money. Your financial budget is more than a list of expenses—it’s a tool to help you manage everyday spending, save for future goals, and take charge of your financial well-being.

Understanding the basics of budgeting

Budgeting is about planning where your money goes and balancing your income with expenses, savings, and investments. A simple plan can help you avoid living beyond your means, manage debt, and work toward goals like building an emergency fund, saving for retirement, or achieving financial stability.

To create a budget, you need to start by tracking your income and expenses.

List all your income sources, like your paycheck or side gigs, and then jot down your monthly expenses. Include fixed costs like rent, groceries, utilities, and non-essentials like dining out or entertainment.

The Albert all-in-one money app has budgeting, saving, and spending features that can simplify this process and help you understand your finances. Knowing where your money goes can reveal areas where you could cut back on or save money.

The importance of choosing the right budget

There are many different types of budgets you could work with, and choosing a budget style that matches your goals and lifestyle is important. Not every budget works for everyone — what’s right for one person might not fit another’s habits or needs. The key is to find an approach that aligns with your goals and keeps you motivated.

The right budget should make room for spending adjustments as your life changes, like a raise at work or new expenses. This flexibility ensures your financial plan grows with you, staying relevant as your finances change.

When you pick a budget system that resonates with you, you’re more likely to stick with it. It’s a personalized choice that can build your financial literacy, reduce stress, and help you stay on track to reach your goals. Implementing your chosen budget system into the right financial app can simplify things even further.

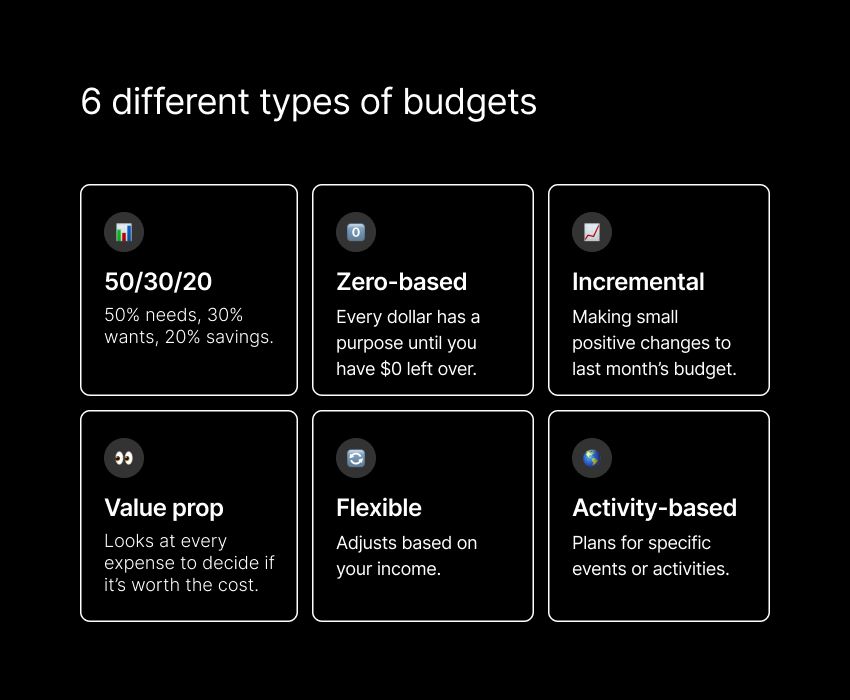

Different types of budgets

Budgeting isn’t one-size-fits-all. With a range of methods out there, you can choose the approach that best suits your lifestyle and financial goals. Here are some of the most popular ways to manage your money.

Zero-based budgeting

Zero-based budgeting involves giving every dollar a purpose. You allocate your income to different categories until you reach zero, meaning there’s a plan for each dollar — whether that plan is spending or saving.

This method keeps you focused on your priorities but requires careful tracking and self-discipline. While it can be time-intensive, zero-based budgeting is ideal if you want a clear understanding and more control over where your money goes.

Incremental budgeting

Incremental budgeting builds on the previous month’s budget, allowing you to make small tweaks based on new expenses or income changes.

For example, if you know you'll spend more on utilities during winter, you can increase that category slightly. Albert’s budgeting features make adjustments like this quick and simple.

This straightforward method saves you the hassle of starting from scratch each month. If your finances are steady, this can be a convenient way to stay on track without a regular extensive overhaul.

50/30/20 budgeting

The 50/30/20 budgeting rule breaks down your income into three main categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

This works well for those whose income may fluctuate month to month, as your spending plan is based on percentages of your income rather than fixed amounts.

This method is a great choice for anyone looking for a balanced, easy-to-follow approach. It helps create a well-rounded budget that’s both sustainable and flexible.

Activity-based budgeting

Activity-based budgeting focuses on planning for specific events or activities. Whether it’s a vacation, a wedding, or even large upcoming medical bills, this approach lets you plan ahead.

Setting aside funds for one-time or occasional costs helps you avoid surprises and stay in control when large, unexpected expenses arise.

Value proposition budgeting

Value proposition budgeting is about getting the most out of every dollar you earn. With this method, you assess each expense to see if it’s worth the cost. If something doesn’t add enough value, you may decide to cut it.

This approach will help you focus on spending your money on what matters most to you, allowing you to save more and enjoy the things that truly enhance your life.

Flexible budgeting

Flexible budgeting adjusts to fit your income, making it the perfect option if your earnings vary monthly.

Instead of setting fixed amounts, you allocate percentages to variable expenses, allowing your budget to grow or shrink based on your income. This flexibility helps you adapt to changes without losing sight of your financial goals.

60/30/10 budgeting

The 60/30/10 budgeting rule allocates 60% of your income to needs, 30% to wants, and 10% to savings or debt repayment.

This method is ideal for those prioritizing essentials while leaving room for enjoyment and future planning. By focusing on percentages, it offers flexibility for fluctuating incomes.

The 60/30/10 rule is perfect for anyone seeking a practical, straightforward way to manage their money, ensuring necessities are covered while balancing personal goals and lifestyle.

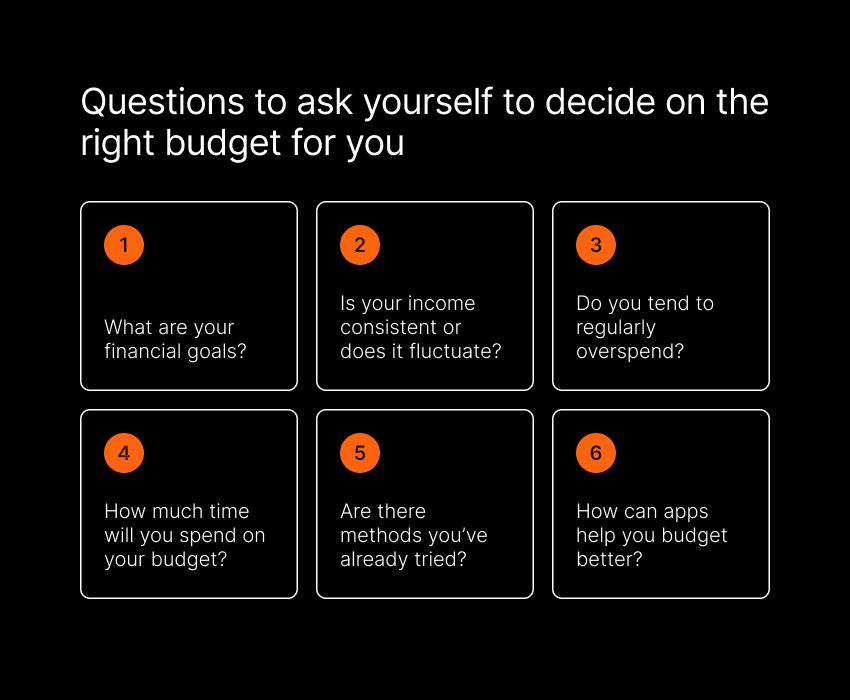

How to choose the best budget for you

Choosing the right budget depends on your goals, income, and spending habits. The key is finding a method that fits your lifestyle and feels easy to stick with. Here are some simple steps to help you figure out which budget works best for you.

1. Define your financial goals

Start by thinking about what you want to achieve. Are you focused on paying off debt, building an emergency fund, or saving for a large purchase? Setting financial goals will help you choose a budget that focuses on what matters most to you.

2. Consider your income

A fixed budget (like zero-based budgeting) might be your best bet if you have a steady income. But if your income fluctuates each month, you might want a flexible budget that adjusts based on how much you make.

3. Think about your spending habits

Do you tend to overspend? A detailed budget that tracks every dollar could help you stay on track. A percentage-based approach like the 50/30/20 rule could be a better fit if you prefer something simpler.

4. Reflect on the time you have

Different budgets take different amounts of time to manage. Some methods need daily tracking and adjustments, while others are more hands-off. Choose a budget that matches how much time you’re willing to spend on it.

5. Be open to experimenting

It's okay to try different budgeting methods until you find what works for you. You could even mix and match approaches to create a personalized system that fits your needs. As your situation changes, stay open to adjusting your budget.

6. Use technology to simplify the budgeting process

Budgeting apps like Albert can make tracking your spending, categorizing expenses, and getting personalized insights easier. Using tech can save you time and make budgeting less of a chore.

Ultimately, the best budget is the one you can stick with long term. Find the method that fits your financial goals and lifestyle, and don’t be afraid to adjust it as life changes.

Tips for successful budgeting

Creating a budget is just the first step. Sticking to it takes a solid plan and smart strategies. Here are some simple tips to keep you on track:

Set realistic goals: To stay motivated, start with achievable financial goals. Break large goals into smaller, manageable steps to make progress feel more attainable.

Track your expenses regularly: Staying on top of your spending is key. Set up automated tracking with an app to make it easier to check in without doing all the work yourself.

Use budgeting features: Apps like Albert make budgeting easier by tracking and categorizing your spending. Many of these apps will even alert you if you’re getting close to your spending limits so you can make adjustments in real time.

Be flexible: Your financial situation can change over time, so allow room for your budget to evolve. Life happens — your budget should be able to keep up.

Avoid impulse purchases: Give yourself some time before buying something on a whim. Try the 24-hour rule and wait a day before purchasing anything non-essential. It’ll help you make more mindful decisions.

Review and adjust: Make sure your budget is still working for you. Check in regularly and tweak it as needed to keep things aligned with your goals.

Celebrate milestones: Recognizing small wins along the way can help keep you motivated. Celebrate your progress — it’ll help you stay on course.

Finding your ideal budgeting method

There are many budgeting methods, but choosing the right one doesn’t need to be overwhelming. The key is to decide what fits your financial situation, goals, and lifestyle.

Budgeting is personal — what works for one person might not work for another, so it may take some trial and error to find the method that suits you best.

The most important thing is to stay consistent and committed, no matter your chosen method. Whether you go for a detailed approach, like zero-based budgeting, or prefer something more flexible, the goal is to take control of your finances and work toward a less stressful future.

Apps like Albert can make the entire budgeting process easier. Helping you track spending, monitor bills, and spot savings opportunities — all in one place. With the right method and tools, managing your money can be more straightforward and less stressful.