Zero-based budgeting is a practical way to take control of your finances by giving every dollar a purpose. Instead of relying on habits or old spending patterns, this method starts fresh each month with a new budget.

The goal is simple: allocate your income intentionally to align with your financial priorities, whether that’s saving, paying off debt, or building an emergency fund.

Zero-based budgeting encourages mindful spending because it requires you to justify every expense. It’s not about restriction — it’s about achieving clarity and purpose in your spending. Each dollar works toward your goals, making this method a powerful tool for financial planning.

What is zero-based budgeting?

Zero-based budgeting is a straightforward way to take charge of your finances by giving every dollar a purpose.

Unlike traditional approaches that roll over your previous budget, the zero-based budgeting method starts fresh each month, which means that every dollar of income is intentionally allocated. This could be toward bills, savings, debt repayment, personal goals, or even enjoyment.

This budgeting approach encourages more mindful spending and helps you to prioritize what truly matters to you. Instead of just tracking expenses, zero-based budgeting aligns your spending with long-term financial goals.

Using a budgeting app like Albert can make zero-based budgeting even simpler. By automating expense tracking and categorization, you’ll get a clear picture of your spending habits, making it easier to stick to your plan and stay on track.

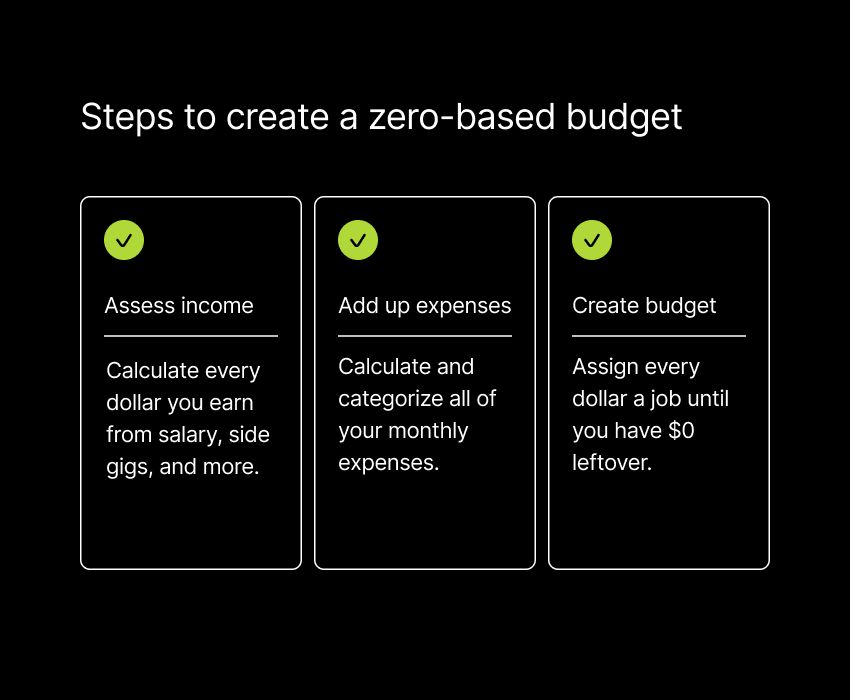

Steps to create a zero-based budget

Getting started with zero-based budgeting is easier than it sounds. By following these straightforward steps, you’ll take control of your finances, allocate every dollar intentionally, and work toward your financial goals with confidence.

List all sources of income

The budgeting process should always start with identifying every dollar you expect to earn during the month. This includes your salary, freelance income, side gigs, and any other earnings.

A complete picture of your income ensures an accurate foundation for your budget.

Tracking and recording your income will help minimize errors and give you a clear starting point. You could do this in a notebook or use an app to simplify the process.

Identify and categorize monthly expenses

Next, note your monthly expenses, including fixed, recurring expenses like rent and utilities, variable expenses like groceries and entertainment, and irregular costs like annual insurance payments.

Break down your spending into different expense categories so you can gain a better understanding of your habits. You can use past bank statements or expense tracking tools to ensure nothing is overlooked.

Clarifying your past spending can help you spot areas where you can cut back or reallocate funds to better align with your goals.

Assign every dollar a job

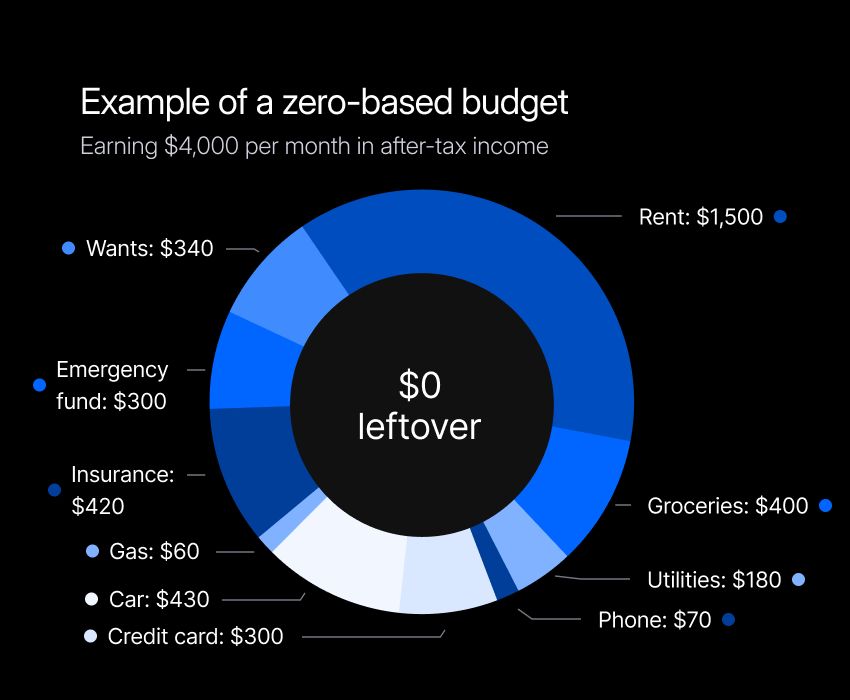

Once you’ve outlined your income and expenses, allocate every dollar in your budget until there’s no money left unassigned.

Start with essential costs — like housing and food — then allocate the rest of your funds toward savings, debt repayment, and discretionary spending.

By assigning each dollar a purpose, you can gain more control and ensure your spending supports both your immediate needs and future plans.

Benefits of zero-based budgeting

Zero-based budgeting can benefit you in various ways to set you up for long-term financial success.

By promoting a structured, intentional approach to managing your money, this method can help you align spending with your goals, sharpen your financial awareness, and increase your savings potential. Here's how:

Improved financial awareness

Zero-based budgeting encourages you to track and justify every dollar spent, making you more aware of your financial habits.

This heightened awareness helps identify unnecessary spending and reveals areas where you can reallocate funds toward more important goals.

Budgeting apps like Albert can give you real-time insights and easy-to-understand summaries to boost your financial awareness, making it even easier to track your progress. Albert also helps you track your cash flow and alerts you to upcoming bills so you can confidently manage your spending.

Better control over spending

Zero-based budgeting reduces the chance of impulse purchases or overspending by assigning every dollar a specific purpose.

A structured approach will give you a clear plan for your money, leading to better control over your finances. More control can reduce stress and boost confidence — a clear benefit of this method.

Increased savings potential

Another major benefit of zero-based budgeting is its ability to help you boost your long-term savings.

By allocating funds to savings goals at the start of each month, you prioritize saving rather than hoping there's money left over.

Challenges of zero-based budgeting

While zero-based budgeting can be an effective way to manage your money, it's not without its challenges. Being aware of these obstacles can help you develop strategies to make the process smoother and more sustainable.

Time-consuming process

One of the main challenges of zero-based budgeting is the time it takes to set up and maintain.

You need to carefully list all your income sources and categorize every expense, which can be tedious, especially when starting.

Luckily, using the right budgeting app can make this process easier by automating much of the tracking and categorizing. This will reduce the manual work involved, so you’ll spend less time on the setup and more time on the practical aspects of money management.

Requires consistent monitoring

Zero-based budgeting isn't a one-and-done activity — it requires ongoing attention and a monthly refresh to keep it working.

Your income and expenses may change, and you'll need to adjust your budget accordingly. This means regular budget check-ins are essential to staying on track.

Finding time for these check-ins can be tough for those with busy schedules. Setting up a routine, like reviewing your budget weekly or monthly, can help you stay on top of it.

Tips for successful zero-based budgeting

Zero-based budgeting will only benefit you if done right. Here are a few practical tips to help you stay on track and make the process smoother.

Use a budgeting app

Technology can simplify budgeting no matter what approach you choose. Budgeting apps like Albert automate the tracking process, categorize expenses, and give you real-time insights.

When you reduce the manual effort, budgeting becomes less of a chore. Taking advantage of technology can also help you keep things accurate and up-to-date since you won’t miss any transactions.

Involve family members in the process

When budgeting is a shared responsibility, it can be more effective. Bringing everyone in your household into the process ensures that each member is aligned on family financial goals and understands how money is allocated.

Open communication about your income, expenses, and priorities will also encourage transparency and commitment in your family. Regular check-ins will help keep everyone engaged and make it easier to adjust the plan when life changes. Working together regularly will ensure that everyone is on the same page.

Regularly review and adjust your budget

Financial situations aren’t static, so your budget shouldn’t be either. Regularly reviewing and adjusting your budget ensures it stays relevant as your circumstances change.

Whether you experience a shift in income, an unexpected expense, or new priorities, reviewing your budget at least once a month will help you stay on track.

Common mistakes to avoid with zero-based budgeting

Zero-based budgeting is a great tool, but a few common mistakes can make it less effective. Here’s how to avoid them:

Forgetting irregular expenses

Irregular expenses, like annual subscriptions, car maintenance, or medical bills, don’t occur every month, but they still need to be accounted for.

If you overlook them, you might face unexpected shortfalls when these costs arise.

To avoid this, list all irregular yearly expenses and divide them into monthly amounts. By setting aside money each month for these costs, you’ll be ready when they show up.

Not adjusting for lifestyle changes

Big life changes — like a new job, moving, or getting married — can affect your income and expenses. You need to update your budget for these shifts, otherwise you may deal with inaccuracies and derail your financial goals.

This is why it’s important to regularly review and adjust your budget to reflect your current situation. Always take the time to update your income and expenses to match your lifestyle changes so your budget doesn’t fall behind.

Is zero-based budgeting right for you?

Zero-based budgeting offers a practical and intentional approach to managing your finances. It requires active involvement and consistent monitoring, but the benefits — like improved financial awareness, better control over your spending, and increased savings potential — make it worthwhile for many.

This method works well for people who want to take control of their money and align their spending with their personal goals. While it can be a bit demanding, tools like Albert can simplify the process by automating tracking and providing insights to keep you on track.

Whether it’s right for you depends on your financial goals, habits, and how much time you’re willing to commit. If you’re ready to put in the effort, zero-based budgeting can offer a clear path to financial success. It promotes a better understanding of your finances and helps you stay focused on long-term goals.

⚡️ Looking for an easier way to budget? Try Albert today for automated tracking and insights.