When it comes to budgeting, there are plenty of methods out there to help you manage your money effectively. Whether you prefer spreadsheets, financial apps, or a simple envelope budgeting method, finding the right fit for you is key.

One popular and effective approach is the 60/30/10 budget: a simple but effective way to split your income into three essential categories: needs, wants, and savings. By using this structure, you can take control of your finances and work towards achieving your financial goals with confidence and less of a headache.

What is the 60/30/10 budget rule?

The 60/30/10 rule is an easy-to-follow strategy for managing your personal finances. It breaks your income down into three different categories:

60% for needs

30% for wants

10% for savings

This breakdown makes sure you cover your essential expenses but still allows some room for fun and future financial security. Its straightforward nature makes it a great choice for anyone who may find more complex budgeting methods overwhelming.

The beauty of the 60/30/10 budget is that it strikes a balance between what you need and what you want, giving you a solid framework for managing your money. Sticking to this plan helps you better understand your spending habits and make informed choices about how to allocate your income.

It’s especially useful for those who find themselves overspending, as it encourages a more disciplined approach to finances without completely restricting you. Plus, it’s easily adaptable. If your income or financial goals change, adjusting the 60/30/10 budget is very simple and quick to do. It's a flexible tool that supports your long-term financial planning.

Breakdown of the 60/30/10 budget

The 60/30/10 rule divides your income into three categories, each with its own purpose in your financial strategy. Understanding these categories is essential for effectively implementing this budget in your personal finances.

60% for needs

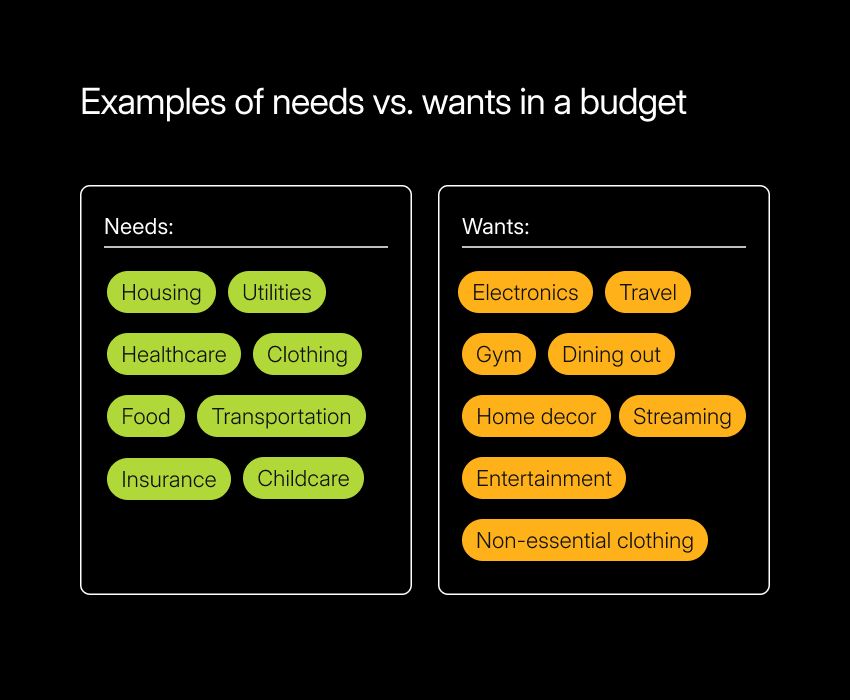

The largest portion of your income is dedicated to needs. This category covers essential expenses that keep your life running smoothly, such as:

Housing costs: Rent or mortgage payments

Utilities: Electricity, water, gas, and internet

Groceries: Food and household supplies

Transportation: Gas, public transport, or car payments

Healthcare: Insurance premiums and medical costs

Insurance: Car, home, and any other necessary coverage

By dedicating this significant portion to your needs, you ensure that your basics are covered first and foremost without putting your financial stability at risk.

It’s also a good idea to check in on these expenses regularly. Your needs can change due to lifestyle shifts or new financial situations. What’s considered a necessity can vary from person to person, so keeping track of what you absolutely need is crucial. This way, you can avoid any financial pitfalls and know that you’re taking care of your essentials.

30% for wants

You have to take care of yourself first, but you’re still allowed to have fun. The wants category gets 30% of your budget and is all about enjoying life a little. It includes those fun, discretionary expenses that aren’t necessary for survival but sure make things enjoyable. Think about things like:

Dining Out: Treating yourself to your favorite restaurant

Entertainment: Movies, concerts, or streaming subscriptions

Hobbies: Anything from crafting to gaming

Vacations: Getaways to recharge (you work hard)

Non-Essential Shopping: New clothes, gadgets, or whatever else you fancy

Setting aside this portion for wants allows you to treat yourself without guilt. Clever budgeting is all about balancing enjoyment with responsibility, so it's important that you make some room for fun in your budget so you can savor life’s little luxuries while still handling your financial obligations. This balance keeps your relationship with money healthy and encourages thoughtful spending.

10% for savings

The final 10% of your income is dedicated to savings, which is vital for securing your financial future. It’s where you’ll build:

An emergency fund: A safety net for unexpected expenses

Savings for future goals: Whether it’s a big trip or a down payment

Investments: To grow your wealth over time

By consistently setting aside a portion of your income for savings, you’re creating a buffer that can protect you when life throws curveballs your way.

Establishing a strong savings plan is essential for becoming more financially resilient. Whether you're putting money away for anemergency fund, your retirement, a major purchase, or just a rainy day, the 60/30/10 budget encourages you to take a proactive approach. Prioritizing savings now means you’re on the path to financial independence and security down the road.

How to implement the 60/30/10 budget

Implementing the 60/30/10 rule will require you to be intentional with your finances. But with a few simple steps, you can weave this budgeting method into your routine without much hassle so you can start making more and make informed financial decisions.

Calculating your income

Start by calculating your income — and make sure it’s accurate. Don’t overshoot what you expect to earn or forget to include any extras you may receive.

Take a moment to determine your total monthly earnings, including your salary, any freelance work, and other sources of income.

Knowing exactly how much you bring in each month sets a solid foundation for effectively distributing your funds across needs, wants, and savings. This clarity helps you manage your finances with confidence.

Allocating 60% to essentials

Once you’ve figured out your income, the next step is to allocate 60% of it to your essential needs: fundamental expenses like housing, utilities, groceries, transportation, and health insurance.

By dedicating this portion of your income to necessities, you ensure that your basic living requirements are met while keeping your lifestyle stable. Regularly reviewing these expenses can help you spot areas where you could adjust, ensuring you stay within the budgeted percentage without any unnecessary financial stress.

Designating 30% for wants

Next, you can consider the wants category, which accounts for 30% of your income. This is your space for personal enjoyment and leisure activities.

Think about expenses that enhance your life but aren’t essential for survival, like enjoying a meal out with friends, a streaming service subscription you enjoy, or investing in an artistic hobby.

By setting aside a specific amount for wants, you can indulge without feeling guilty and maintain a balanced budget.

Saving 10% for the future

After these expenses have been taken care of, it’s time to save.

Set aside 10% of your income for savings, focusing on building financial security. This could be for an emergency fund, retirement, or even investments. Prioritizing your savings means you’re prepared for unexpected expenses and future financial goals. By consistently saving, you create a cushion that supports your financial independence and long-term stability.

Benefits of the 60/30/10 budget

The 60/30/10 budget offers several key benefits that can enhance your financial management and overall well-being:

Simplicity: The budget is easy to understand and even easier to apply, making it accessible to anyone, no matter their financial background. With just three clear categories, you can focus on your financial goals without getting lost in complicated processes and details.

Financial discipline: By designating specific percentages for needs, wants, and savings, you’ll be spending more mindfully and prioritizing your financial goals. This structured approach can lead to smarter financial choices and sets you up for a stable financial future.

Long-term security: Saving is a big focus in this approach. By consistently setting aside 10% of your income, you’re building a financial cushion that can help you tackle unexpected expenses and plan for goals like savings and debt repayment. This will build financial independence and help you sleep at night.

Challenges and considerations

While the 60/30/10 rule offers great benefits for many different types of people, it’s not without its challenges. Being aware of these can help you decide on your budgeting process:

Categorizing expenses: Figuring out what qualifies as a need versus a want can be tricky. Some expenses may fall into gray areas, like a gym membership, which could be essential for someone who prioritizes their health but is just a luxury for another. It’s all about your personal financial priorities.

Adapting to income changes: Life is unpredictable, and changes like a new job or unexpected expenses can shake up your budget. While the 60/30/10 rule is flexible, you may need to reassess your financial goals and make adjustments to stay on track.

Balancing goals: This budgeting method highlights the importance of savings, but don’t forget about your short-term needs. Finding a healthy balance between short-term and long-term goals is key to maintaining overall financial well-being.

Is the 60/30/10 budget right for you?

Figuring out if the 60/30/10 budgeting strategy fits your needs means taking a closer look at your financial habits and goals. It’s a budgeting style that offers a streamlined and adaptable way to manage money, but it’s not for everyone.

Start by considering your income and expenses. If you find that a 60/30/10 split covers your essentials, allows room for some extras, and still lets you save, then this approach could work well. Its simplicity is part of the appeal, especially if you’re after a structured yet flexible way to meet your goals without a lot of hassle.

But if your financial situation requires a more customized approach, or if you prefer a style with more detailed tracking, another method might suit you better.

Making the most of your budget with the 60/30/10 rule

The 60/30/10 rule is a simple but powerful framework for managing your personal finances. By dividing your income into needs, wants, and savings, you can find a healthy balance and stay focused on your financial goals.

While every budgeting method has its challenges, awareness and proactive planning can make a massive difference. Taking a structured and consistent approach to spending and saving not only helps build financial stability but also lays a foundation for your future.

Using the 60/30/10 method alongside Albert’s budgeting and saving features will help you take full control of your financial wellness. Take advantage of the incredible resources available to you, adopt some simple budgeting principles, and do away with the stress that typically comes with thinking about your money.

⚡️ Learn how Albert can help you take charge of your finances and meet your personal goals.