Creating a budget can initially feel overwhelming, but it’s a crucial step toward achieving true financial wellness. Your budget is a guideline to help you understand more about your money — where it’s going and how to take better control of it.

When you track your income and expenses with a budget, you can make smart choices that align with your financial goals.

With Albert’s budgeting features, the whole process becomes simple and automatic. You can easily categorize your monthly expenses and monitor your spending habits. When you use simple and approachable budgeting methods, you can sidestep financial stress and feel more confident in your money choices.

⚡️ Try Albert today and get a 30-day trial plus 50% off for 2 months

A solid budget simply helps you to live within your means while also saving for the future, giving you peace of mind and some much-needed security.

Understanding the importance of budgeting

Budgeting is the backbone of good financial management. But it doesn’t have to be complicated — it’s just about making conscious choices about where your money goes.

Budgeting is taking the reins on your finances — it gives you more control, reduces stress, and helps you make more informed decisions. With a budget in place, you can prioritize your spending based on what really matters to you and your goals.

Budgeting includes a few key features: tracking income, categorizing expenses, setting spending limits, and regularly reviewing your financial situation.

Understanding each of these elements is important to create a budget that fits your lifestyle and objectives. As you get more comfortable with budgeting, you’ll find it’s a flexible process that adapts to your changing financial circumstances — making it a valuable skill for life.

The importance of tracking income

Tracking income is the first step in your budgeting journey, and it’s a vital one. It means keeping a record of all the money coming into your household, whether it’s your salary, freelance work, rental income, or even government assistance. Knowing exactly how much money you have helps you make smart decisions about how to spend and save money each month.

Using digital budgeting features can really simplify this process. There are apps and websites that can categorize and update your earnings for you, reducing the possibility of making a mistake and giving you real-time insights into your finances. Plus, understanding your income patterns can help you spot fluctuations so you can plan ahead for those months when your earnings dip.

Tracking your income not only helps you assess your financial stability but also guides you to make proactive decisions that align with your long-term goals. If you notice that your expenses are consistently outpacing your income, it could be time to look into ways to increase your earnings or cut back on spending.

Categorizing expenses for better management

Once you have a solid grasp of your income, the next step is to categorize your expenses. This means breaking down your spending into groups like housing, utilities, groceries, transportation, entertainment, and savings. This will help you see where your money is going and identify any areas where you could be overspending.

To make sure you categorize effectively, take a look at your recent bank statements and receipts. Look for spending patterns and group similar expenses together. This helps you create a realistic budget and makes it easier to spot unnecessary spending that you may want to trim.

Categorizing your expenses also allows you to set spending limits for each category. When you assign a specific amount to each area, you can make sure your spending aligns with your financial priorities.

For example, if saving for a vacation is high on your list, you’ll want to start allocating more funds to your savings category and cut back on things like dining out. This is an intentional approach that will help you stay focused on your financial goals while still enjoying the things that matter most to you.

Steps to create a budget

Creating a budget is the first step to proper financial management, and it can be simplified into a few key steps.

By taking the time to assess your income, list your expenses, and categorize them into needs and wants, you can build yourself a clear financial plan. This process also involves setting financial goals and adjusting your spending habits, leading to a balanced and sustainable approach to managing your finances.

Assess your income

First things first – income. Before anything else, you need to think about all the money that flows into your household, everything from your regular paycheck to freelance gigs, rental payments, or even government benefits.

This will give you a clear picture of where you stand financially.

Gather your income sources: Regular paycheck, freelance work, rental payments, and government benefits.

Use digital budgeting tools: These can help track and categorize your earnings automatically, reducing errors.

Understand your income patterns: Knowing when your income fluctuates helps you plan for tighter months.

By taking a good, hard look at your total income each month, you’ll be able to make informed decisions about spending and saving, making sure you’re living within your means and moving slowly but surely toward your financial goals.

List your expenses

Next up is listing your expenses. This part of creating a budget is all about figuring out how you’re spending your hard-earned cash. Start by identifying everything from fixed expenses, like rent or mortgage payments, to variable costs, such as groceries and entertainment.

Identify your expenses: Fixed expenses (rent, mortgage) vs. variable costs (groceries, entertainment).

Gather bank statements and receipts: This gives you a comprehensive view of your spending habits.

Categorize your expenses: Sort them into fixed and variable expenses to see where you can cut back.

Once you have a comprehensive list, compare your expenses against your income. Your income minus expenses equals your available cash flow, which shows how much you have left to save, invest, or spend on other goals.

If you find that you’re spending more than you’re bringing in, it might be time to think about reducing some costs or finding ways to boost your income.

Categorize expenses into needs and wants

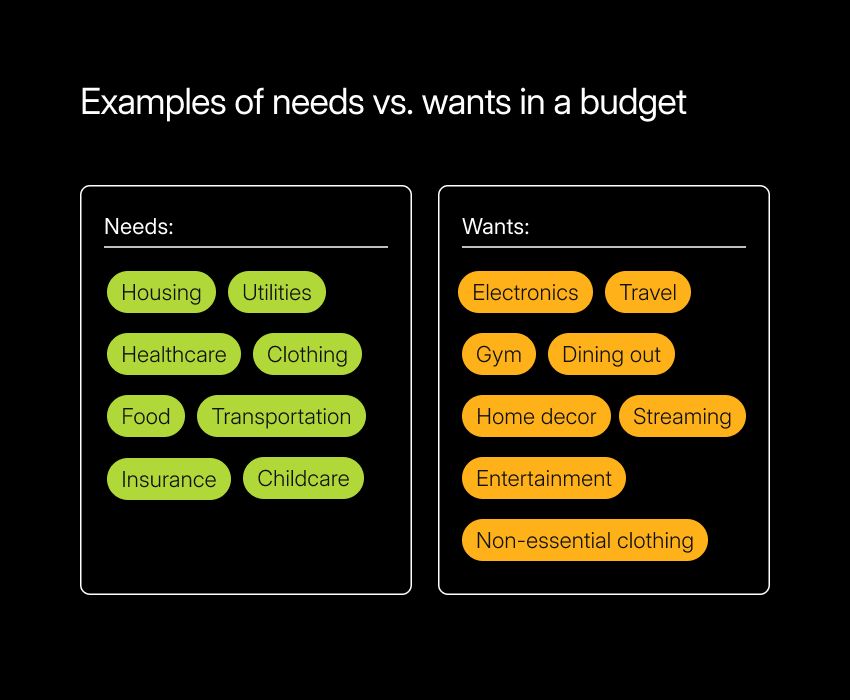

When you know what you’re spending and where you need to break it down further by categorizing your expenses into needs and wants. Needs are those essentials – like housing, utilities, groceries, and transportation – while wants are the fun stuff, like dining out and investing in your hobbies.

Distinguish between needs and wants: Identify which expenses are essential for daily living and which are discretionary.

Review your expense list: Separate your must-haves from the nice-to-haves.

Prioritize your spending: This helps allocate your income wisely and focus on what truly matters.

Understanding the difference between needs and wants helps you allocate your income in a way that supports your goals while still allowing room for fun.

Set financial goals

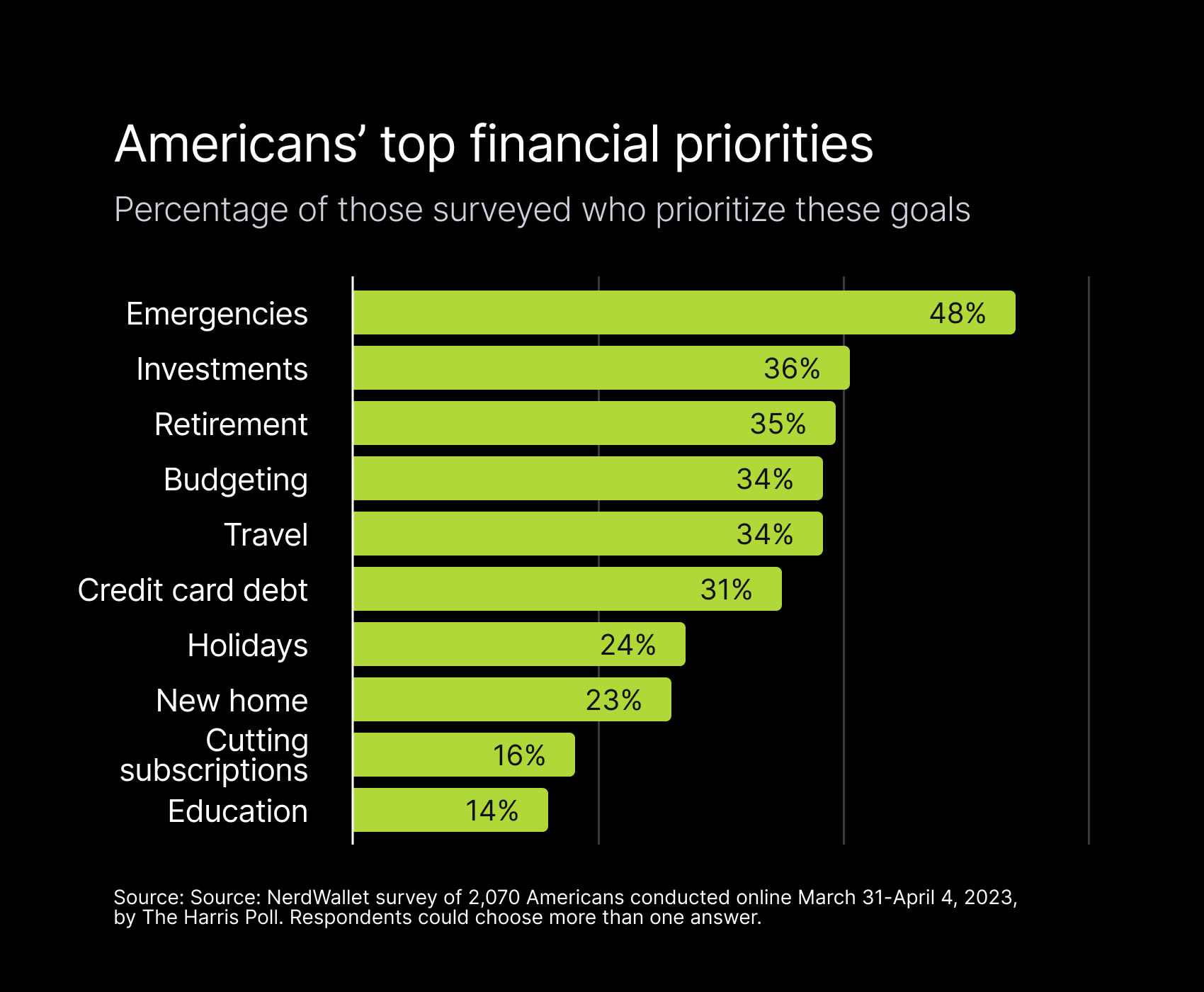

Next, you’ll want to get intentional about your financial goals.

These goals are what give your budgeting efforts direction and purpose. Think about both your short-term goals (like saving for a new phone) and long-term aspirations (such as buying a home or planning for retirement).

Use the SMART criteria: Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound.

Get specific with your goals: Instead of saying, “I want to save more,” try “I want to save $5,000 for a vacation by next summer.”

Break down your goals: Smaller, manageable steps make them feel more achievable and keep you motivated.

Setting clear targets will help you stay focused on reaching your goals, but making them realistic and manageable will keep you on track day-to-day.

For example, if you want to build an emergency fund, using a pay-yourself-first budget plan helps you prioritize your savings before making room for non-essentials.

Adjust your spending habits

When you create a budget, you’re likely to notice all the areas where you could adjust your spending. This is normal— it’s just about evaluating how you spend your money and making some tweaks that will help you in the future.

Review your categorized expenses: Identify areas where you can trim back.

Reduce discretionary spending: Consider cutting back or adopting a cash budget, which helps limit overspending by setting realistic spending limits to discretionary categories like dining out or entertainment.

Look for savings on fixed expenses: Can you negotiate lower utility bills or find a more affordable living situation?

Remember, budgeting isn’t a one-and-done task; it’s an ongoing and flexible process. Review your budget regularly to make sure it stays relevant and effective.

Tools and resources for budgeting

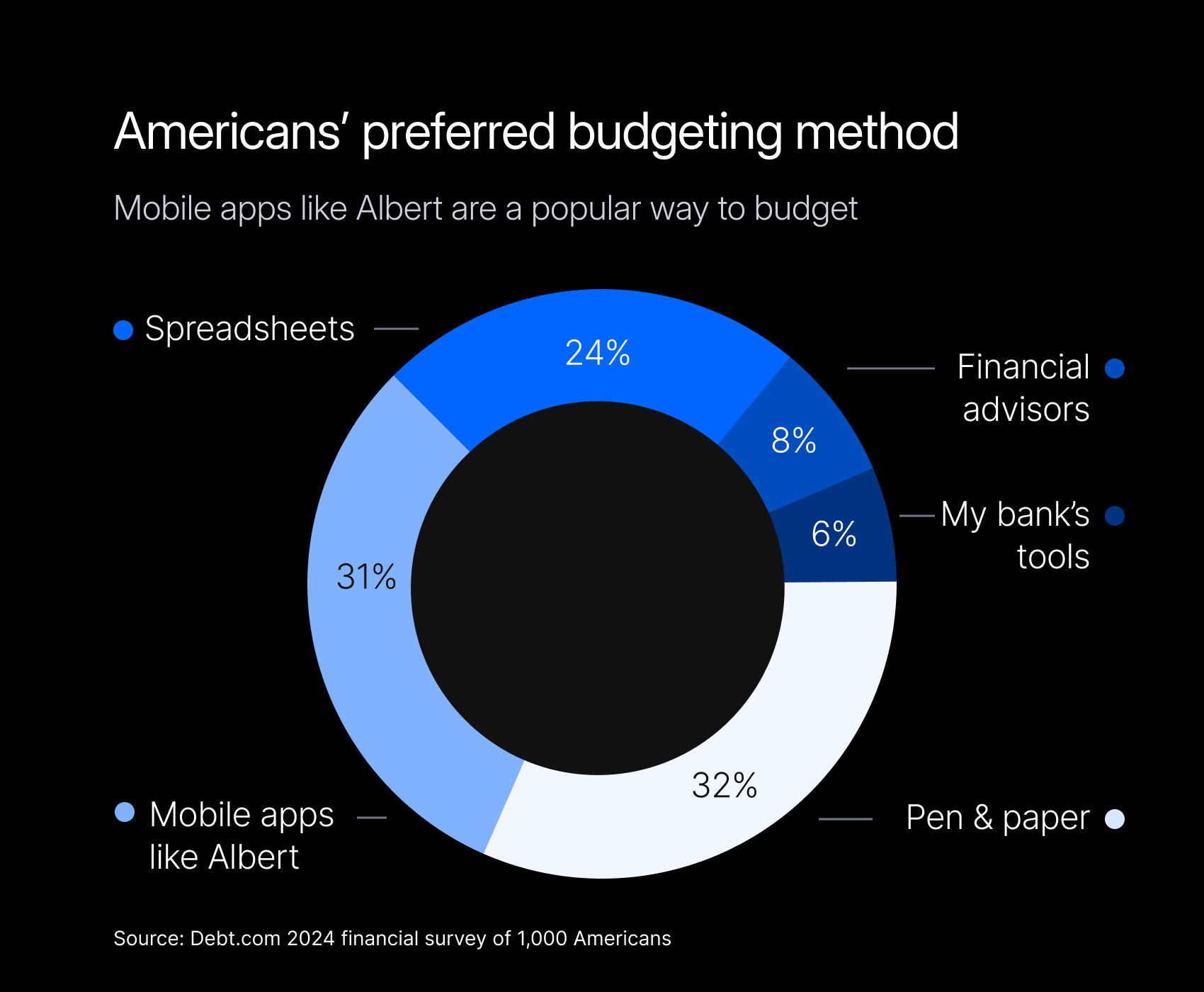

When it comes to budgeting, having the right tools and resources can really make a difference. They can simplify the process and help you manage your finances more effectively.

Whether you prefer using budgeting apps and software for their convenience or a good old-fashioned budget worksheet for a hands-on approach, these resources can help you to take control of your budget and make smarter spending and saving decisions.

Budgeting apps and software

Budgeting apps and software are your own personal finance assistants. They can simplify the budgeting process with features that do the heavy lifting for you. Here’s what you can expect from these kinds of digital tools:

Automatic transaction tracking: Forget about manually entering every single expense. These apps connect to your bank accounts and automatically track your transactions for you.

Expense categorization: They categorize your spending into neat and organized groups, making it super easy to see where your money is going.

Real-time budget updates: You’ll get instant insights into your financial health. With real-time data, you can make informed decisions about your spending and saving habits.

Albert is a budgeting app that helps you get a clear overview of your finances. Tapping into the power and convenience of budgeting apps will help you streamline your efforts and gain greater control over your finances. These tools make it much easier to make proactive decisions and feel more confident about money.

Using a budget worksheet

If you prefer a more hands-on approach, using a budget worksheet can be a great way to stay organized. Here’s why this traditional method is still effective:

Structured framework: A budget worksheet gives you a clear framework for organizing your income and expenses, helping you create a comprehensive financial plan.

Deeper understanding: By manually entering your financial info, you can better understand your spending habits and pinpoint areas where you might need to improve.

To create your budget worksheet, start by listing your income sources and all your expenses—both fixed and variable.

Then, categorize those expenses into needs and wants, allocating specific amounts to each.

This way, you’ll get a solid idea of where your money is going and can make any necessary adjustments to meet your financial goals.

What’s great about budget worksheets is that they’re completely customizable. Whether you prefer a digital spreadsheet or a printed template, these worksheets allow you to tailor your budgeting plan to fit your unique situation. It’s a tangible way to track your financial progress and make informed decisions about spending and saving.

It’s a straightforward and hands-on approach that will keep you engaged with your finances and on track.

Tips for sticking to your budget

Sticking to a budget takes some discipline and commitment, but it can be incredibly rewarding when you start seeing the results of your effort. Here are some easy tips to help you stay on track and keep your financial goals in sight.

Track your spending regularly

Keeping tabs on your transactions is non-negotiable. Regularly tracking your spending will help you get a clearer picture of your spending patterns, which in turn helps you decide where you may want to cut back or make changes.

Consider using budgeting apps or spreadsheets to monitor your expenses in real time. These tools make it easy to see where your money is going and can help you spot any discrepancies.

By tracking your spending consistently, you’ll stay aware of your progress, which helps you make proactive decisions to align your budget with your financial goals.

This habit builds accountability and helps you make sure your budget stays relevant, keeping you on track.

Review and adjust your budget monthly

Taking the time to review and adjust your budget each month is a must for keeping it effective. Life happens, and your financial situation could change, so it’s important to make revisions as needed.

At the end of each month, take a look at your actual spending compared to your budgeted amounts. If you see any discrepancies or areas where you’re consistently overspending, it’s time to make some adjustments.

At the same time, use this as a chance to celebrate your wins. If you’ve stuck to your budget, received a salary increase, or paid off a debt, use these moments to increase your savings contributions or set aside funds for a new financial goal.

Regularly reviewing and adjusting your budget is important if you want it to be a dynamic tool for managing your finances. Taking a proactive approach helps you maintain control over your financial situation and make the progress you want.

Involve the whole family in budgeting

Getting the whole family involved in budgeting can really boost accountability and motivation for everyone involved. When everyone understands the financial situation and participates in the budgeting process, it creates a sense of shared responsibility and teamwork.

Start by chatting with your family about why budgeting is important and how it benefits everyone. Encourage open conversations about financial goals and priorities, and invite everyone to contribute to the budgeting process.

Taking a collaborative approach puts everyone on the same page and ensures commitment to achieving your family’s financial objectives.

Common budgeting mistakes to avoid

We all make mistakes, but being able to recognize and avoid some of the most common budgeting pitfalls can make a huge difference in keeping your finances steady. Here are a few budgeting mistakes people often make — and how you can avoid them to keep your financial goals on track.

Overestimating income

One of the biggest budgeting missteps is overestimating your income. It’s easy to assume you’ll earn a bit more than you actually do, but this can lead to overspending and make it hard to meet your financial commitments.

To keep things realistic, consider all sources of income:

Your regular paycheck

Freelance work

Side gigs

It’s best not to count on extra hours or seasonal work unless they’re guaranteed.

Think about any potential fluctuations, too. If your income varies, it’s best to base your budget on a conservative estimate.

Not accounting for irregular expenses

Irregular expenses like annual fees, holiday gifts, or unexpected car repairs are easy to overlook, but they can really throw off your budget if you’re unprepared.

A simple solution? Set up sinking funds for these expenses. This means putting a little aside each month for things that don’t pop up regularly so you’re prepared when they do.

When you budget for irregular costs ahead of time, you’ll have funds ready when they come up without needing to dip into savings or use credit.

Forgetting to save for emergencies

Skipping an emergency fund is a big mistake that can jeopardize your financial security even when you feel like you’re smooth sailing. Without it, unexpected expenses like medical bills or sudden car repairs can derail your financial plans.

Make building an emergency fund a priority in your budget. Start small if you need to; even setting aside a bit each month adds up.

Aim to eventually save enough to cover three to six months of living expenses, giving you a solid safety net for unexpected job loss or other big expenses.

With an emergency fund in place, you’re protected from financial setbacks, and you can focus on reaching your long-term goals with peace of mind.

Taking control of your finances through budgeting

When you know how to make a budget that works for you, you're one step closer to financial peace of mind. By nailing down the basics, setting clear and realistic goals, creating a workable budget, and knowing how to avoid common pitfalls, you’re setting yourself up for long-term success.

Remember, budgeting isn’t a one-size-fits-all; it’s flexible and can adjust as your life and finances change.

With commitment and a little patience, you can make your budget work for you.

Want a head start? Albert makes budgeting easy with straightforward guidance and helpful features to keep you on track. It’s a tool designed to support you on this journey, providing everything you need to take on your goals confidently.

Ready to take control of your finances?

⚡️ Start using Albert today to simplify your budgeting process, track expenses, and achieve your financial goals with confidence.