A cash budget, simply put, is a smart and essential financial system that helps you manage your money efficiently.

It shows the inflow and outflow of cash over the span of a month, helping you track where your money comes from and where it goes. This makes it easier to plan for your future expenses, creating a financial plan that gives you clarity on your money and helps you be proactive in your spending.

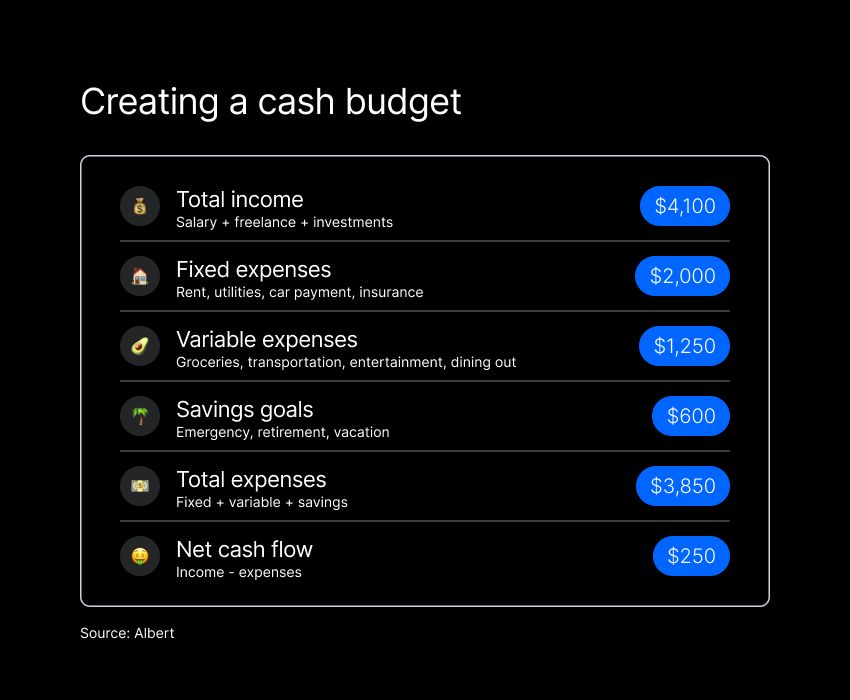

To create a cash budget, start by listing your expected income – like your salary or interest earnings – and subtracting your expenses, such as bills and other purchases. This easy process will help you stay aware of what’s happening with your money and take proactive steps to avoid any financial surprises.

While cash budgeting can be done with a simple notebook and pen, taking advantage of modern technology can streamline the process. The Albert all-in-one money app offers budgeting, saving, spending, and investing features that help simplify financial management.

⚡️ Try Albert today and get a 30-day trial plus 50% off for 2 months

What is a cash budget?

A cash budget is a straightforward plan that outlines your expected cash “inflows” and “outflows” for the month – what’s coming in and what’s coming out. Your plan is designed to help you manage your money more effectively by offering you a clear view of where your money comes from and where it’s going.

By creating a cash budget, you can plan for your future cash positions and ensure that you have enough funds to cover expenses and meet your money goals. To do so, you’ll need to list all your income sources, like your salary, investments, and any additional income you may have coming in, as well as all your expenses, including bills, groceries, and entertainment.

The main purpose of a cash budget is to offer a clear picture of your financial position. It helps you make better decisions about spending, saving, and investing. You’ll be able to spot areas where you can cut costs and find more room for savings, as well as avoid overdrafts, reduce debt, and set yourself up for long-term success.

When it comes to personal finance, using a cash budget is essential for staying financially stable. It keeps your spending in line with your income and prevents mishaps. By regularly updating your budget, you can adjust to any changes in your income or expenses to ensure your plans are still on the right track. Using Albert’s budgeting features can help you simplify this process, providing automated tracking and insights into spending.

Importance of a cash budget

Why does having a cash budget matter? Essentially, it’s a crucial step in taking charge of your personal finances.

It acts as a financial compass, guiding you toward responsible spending and saving habits. By understanding your cash inflows and outflows, you can make better decisions that will always support your financial goals. A cash budget also helps you anticipate shortfalls so you can adjust your spending before problems arise.

One of the biggest benefits of a cash budget is preventing overspending. Without a clear plan, it’s easy to spend more than you earn, which can quickly lead to debt. A cash budget helps you set realistic spending limits based on your actual income and build financial discipline. It can also help you spot unnecessary expenses, giving you the opportunity to cut back and save more.

On top of this, a cash budget helps with setting and reaching your financial goals. Whether you’re saving for a big upcoming purchase, planning a vacation, or setting money aside for an emergency, your cash budget will help ensure you’re allocating funds towards these objectives regularly.

It provides a realistic timeline and keeps your financial resources on track. Plus, it reduces financial stress by giving you full control over your money, minimizing surprises from any unexpected costs.

Managing a cash budget is even easier with automated tracking and personalized insights. Albert’s budgeting features will help you simplify the process, help you monitor expenses, and adjust your budget as needed.

Components of a cash budget

A well-structured cash budget brings together several key components to give you a comprehensive view of your finances. Making sure you understand each of these elements is essential if you want to create an accurate and effective budget.

Cash inflows

Cash inflows represent all the money coming into your bank account (or your pocket) during the budget period. This includes regular income like your salary or wages, as well as other earnings like interest, dividends, refunds, side hustle income, or even gifted cash. Your cash inflow forms the foundation of your budget.

Listing out all your potential income sources helps ensure that your budget reflects your true financial capacity. It’s important that you keep in mind when and how often your money is coming in, too. For example, freelancers or gig workers with irregular incomes need to plan a little more carefully to manage their cash flow effectively.

Cash outflows

Cash outflows cover all the payments, bills, and other expenses you anticipate during your budget period. This includes fixed expenses like rent or mortgage payments, utilities, and insurance premiums, along with variable costs like groceries, entertainment, and transportation. Making a list of all your anticipated expenses prevents oversights that could disrupt your spending plans.

Categorizing expenses helps you understand your spending habits and could even highlight areas where you can cut costs. For example, analyzing your spending on eating out or unnecessary subscriptions might reveal areas and opportunities to save money.

Net cash flow

Your net cash flow is the difference between total cash inflows and total cash outflows for the budget period and shows whether you have any extra cash available or are short for the month.

A positive net cash flow means you have extra money available, which can go toward savings, investments, or paying off debts. A negative net cash flow shows a shortfall and means you need to make an adjustment to your spending or perhaps find an additional source of income.

Calculating your net cash flow gives you a clear picture of your financial health for the month and helps you make informed decisions about how to handle either any surplus or deficit proactively.

Understanding the components of a cash budget—cash inflows, cash outflows, and net cash flow—is essential for effective financial management. These elements work together to provide a detailed view of one's financial situation, enabling proactive planning and smart money management.

Steps to create a cash budget

Creating a cash budget may seem overwhelming initially, but breaking it down into clear steps makes the process more manageable. A structured approach will help you develop a budget that reflects your financial situation and helps you achieve your goals.

Here are the steps to follow:

Identify cash sources: Start by listing all regular income from employment, including salary or wages after taxes. Don’t overlook any additional income streams like bonuses, freelance work, interest earnings, or side hustle income. Being thorough helps make sure that your cash budget gives you a complete picture of what you have available.

Determine cash expenditures: Next, list all your anticipated cash outflows. Start with fixed expenses like your rent, insurance premiums, and loan repayments. Then start estimating variable expenses like groceries, personal care, and gas. Remember to account for occasional expenses like car maintenance and gifts for friends and family.

Calculate net cash position: When you have a clear idea of your inflows and outflows, calculate your net cash position by subtracting total expenses from total income. This number will tell you whether you’re in a surplus or a deficit for the budget period and allow you to make a decision about how to handle it.

Don’t forget to keep your cash budget up-to-date and relevant. Life changes, unexpected expenses, or changes in your income can seriously impact your financial position and may require you to make adjustments. Taking full advantage of financial tools like Albert will make it a little easier to track your money continuously and receive personalized recommendations to help you adjust your budget as needed.

Benefits of using a cash budget

Using a cash budget offers several important benefits that can improve your financial well-being. It serves as a foundation for solid financial management, providing clarity and control over your personal finances. Here are some of the biggest benefits:

Improved financial awareness: A cash budget encourages you to closely examine your income and spending habits on a regular basis, leading to more mindful spending.

Debt management: Understanding cash flow helps you prioritize high-interest debts and allocate your funds more effectively, potentially saving money on interest payments.

Better saving potential: A clear view of your income and expenses could reveal more opportunities to save, whether for an emergency fund or specific financial goals.

Reduced financial stress: Knowing exactly where your money is going can offer you peace of mind and reduce that niggling feeling about your finances.

Super simple: Using technology, like an app that provides automated tracking, personalized insights, and user-friendly features makes managing a cash budget simple and accessible.

Common challenges in cash budgeting

While cash budgeting is always a valuable practice, it’s not foolproof. It’s normal to face challenges that can impact the accuracy of your budget, so recognizing and addressing these obstacles will help you stay on track.

Overestimating inflows

One common challenge is overestimating income. This happens when you predict a higher cash inflow than what actually occurs, leading to shortfalls in your budget.

Overly optimistic predictions can result in not having enough cash to cover your expenses, which can be tough to come back from.

To avoid this, make sure you take a more conservative approach when estimating your income, especially when it comes to irregular sources like freelance work or investments. Base your estimations on past income and consider potential fluctuations for a realistic guess.

Underestimating outflows

Underestimating expenses is another common issue. Small, irregular, or unexpected costs can be overlooked and throw your budget off completely.

Ignoring variable or unexpected expenses can disrupt your budget and put you under financial strain, so make sure you track all your expenses and review your previous spending patterns to make an informed calculation.

On top of spending mindfully, overestimating your expenses or including a buffer for unexpected costs will help you stick within your budgeted amounts.

Tips for effective cash budgeting

Getting the most out of your cash budget goes beyond just jotting down numbers. Here are some simple but practical tips to help you manage your money effectively and prioritize your financial future:

Set realistic goals: Start by defining clear and achievable financial goals. Whether you want to save for an upcoming vacation, build an emergency fund, or pay off your debt, having clear objectives gives you something to aim for and keeps you motivated.

Monitor regularly: Make it a habit to check in on your cash budget often. Regular reviews help you see how you’re doing and spot any issues early on in the month so you can make adjustments before things get out of hand.

Use technology: Take advantage of budgeting apps like Albert. These tools help you track your spending automatically and offer personalized insights on how you can improve. Using technology makes budgeting easier and less of a chore.

Prioritize savings: Treat your savings as a non-negotiable expense. Set aside a portion of your income every month for savings before you spend on anything else. This helps to avoid overspending and builds a financial cushion.

Be flexible: Life is unpredictable. Be willing and ready to adjust your budget when needed – whether it’s an unexpected expense or a change of income, being flexible will help you stay on track.

Seek support: Don't hesitate to reach out for help if you need it. Consult financial experts or tap into resources offered by financial apps. Getting advice from professionals will give you fresh ideas and strategies to improve your budgeting.

Take charge of your finances

A cash budget is a vital tool for taking charge of your finances. It provides clear guidance on your expected income and expenses, offering valuable information about your financial health.

By using a cash budget, you’ll learn financial discipline, reduce your stress, and start working toward your financial goals.

Embracing the benefits of modern-day technology can only improve your budgeting experience and reduce the effort it takes to manage your money. By using automated tracking tools like Albert and taking advantage of personalized insights, you can make it easier for yourself to start building a more secure financial future.

All in all, understanding and using a cash budget is a simple, proactive step towards navigating your financial journey with a little more confidence and a lot more knowledge.

⚡️ Create your free account with Albert today, and begin your financial journey.