Teaching your kids about money is key to helping them become financially responsible adults. Starting early makes it easier for them to grasp core concepts like saving, spending, and sharing, laying a strong foundation for their future.

It’s not just knowing the value of a dollar — it’s about understanding how money works in everyday life, from budgeting to making smarter financial choices.

As a parent, you play a crucial role in guiding your children through these lessons. Clear, straightforward guidance sets the stage for your children to grow up feeling confident in managing their finances.

The goal is to teach them how to make wise financial decisions so that when the time comes, they can handle their money with ease and a solid understanding.

Why it's important to teach kids about money

Teaching your kids about money will help prepare them for a successful financial future. When they understand how money works, they’ll be better equipped to make smart decisions as they get older.

Financial literacy will help them navigate saving, spending, and investing — empowering them to become financially responsible adults and do a better job navigating any potential money troubles down the road.

Financial education builds independence and confidence in people of all ages. Your kids will be able to learn the value of hard work and the rewards it brings. They’ll start to see that money doesn’t just appear; it’s earned through effort. This understanding motivates them to set goals and work toward them. It also helps them realize the importance of saving for the future instead of spending impulsively.

Teaching money management also sharpens math skills and critical thinking. When your kids handle money, they’ll practice counting, adding, and subtracting. They’ll also learn to make informed and well-thought-out choices based on their budget and needs. This real-world application of math strengthens their academic abilities and improves their problem-solving skills.

The financial habits your kids develop early on will likely stick with them for life. You help them build healthy attitudes toward finances by teaching them good money habits. They’ll be less likely to fall into debt and more likely to grow wealth over time, which contributes to their overall well-being and security.

When to start teaching kids about money

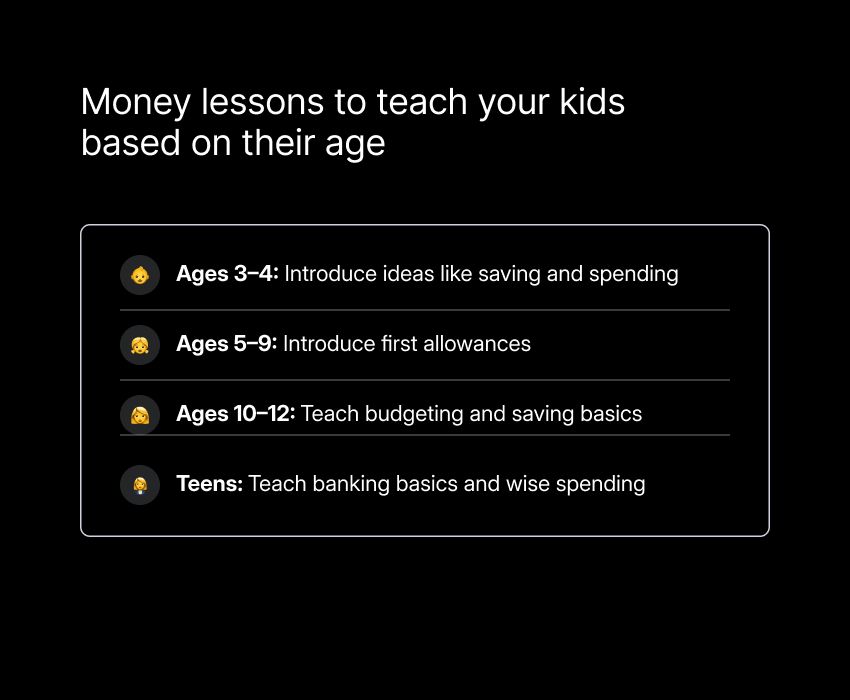

It’s never too early (or too late) to start teaching your kids about money. The sooner you begin, the better. Kids as young as three or four can start understanding basic financial concepts. At this age, they’re often curious and eager to learn, making it the perfect time to introduce simple ideas like saving and spending. This early exposure will set the foundation for more advanced lessons as they get older.

Starting early helps your kids naturally understand the role money plays in everyday life. They’ll notice transactions at stores and may ask questions about how buying things works. Explaining these experiences in simple terms can satisfy their curiosity and set the stage for future lessons.

Once your kids reach elementary school, they’ll be ready for more complex concepts. Earning money through chores or saving for something they want becomes more relevant. This is a great time to introduce allowances, giving them hands-on experience with managing their own funds.

While it’s never too late, waiting too long to teach your kids about money can lead to missed opportunities. Habits formed early can shape their financial future, and your guidance can make a big difference. By starting the conversation early, you can help prevent negative behaviors like impulsive spending or misunderstanding the value of money.

There are plenty of helpful tools that can make these lessons easier for your kids to understand. User-friendly resources let you show them how to save, budget, and even invest in a way that clicks with their young minds.

Technology can also make the process interactive and engaging, making money management something they enjoy learning about.

Simple ways to introduce money concepts to young kids

Teaching your kids about money doesn’t have to be complicated. You can make it fun and meaningful by using simple, everyday activities. These small changes in your routine can help your kids understand money in a way that sticks with them.

Using everyday activities to teach money basics

Everyday tasks offer great opportunities to teach your kids about money:

Grocery shopping: Give your child a small amount to spend on a snack. Help them make choices within their budget. This will teach them about cost and value.

Household budgeting: Involve your kids in creating a family budget. Explain how money is allocated for needs like food, utilities, and entertainment. This can help them understand financial priorities.

Saving an allowance: Show your kids how to add their allowance to a jar or piggy bank. Seeing their savings grow makes the idea of saving tangible and fun.

Shopping trips: Talk about needs versus wants when making purchases. This will help them understand the importance of smart spending.

Using digital tools: Show your older kids how to track spending with an app like Albert. This bridges the gap between physical money and digital finance, making budgeting easier to grasp.

Charitable giving: Teach your kids about generosity by choosing a cause together and setting aside money to donate. This can demonstrate to them that money isn’t just for personal use but can also help others.

These everyday activities can make financial concepts more relatable, and by weaving them into your daily life, you’ll be helping your kids build lasting, healthy money habits.

Incorporating play and games

Playtime is a great way to reinforce money lessons as well:

Board games: Games like Monopoly can teach kids about earning, spending, and investing in a fun, low-pressure environment.

Pretend play: Set up a pretend store or restaurant at home. Your kids can role-play financial transactions, practice counting money, making change, and understanding pricing.

Educational apps: Interactive apps that reward saving or smart spending can help reinforce good habits and engage your kids in learning about money.

Homemade games: Create a savings challenge chart or a budgeting puzzle. Personalizing these games based on your child's interests can keep them engaged and motivated.

Celebrate achievements: Whether winning a game or reaching a savings goal, celebrating your child’s progress may encourage them to continue practicing positive money habits.

By making financial education fun, you can help your kids develop a positive attitude toward money while teaching them valuable skills they’ll use in real life.

Strategies for teaching money management to preteens

As your kids enter their preteen years, they're ready for more advanced lessons in money management.

This is the perfect time to teach them skills like budgeting, saving for goals, and distinguishing between wants and needs. These lessons will equip them with practical tools they'll use throughout their lives.

The role of allowance in learning

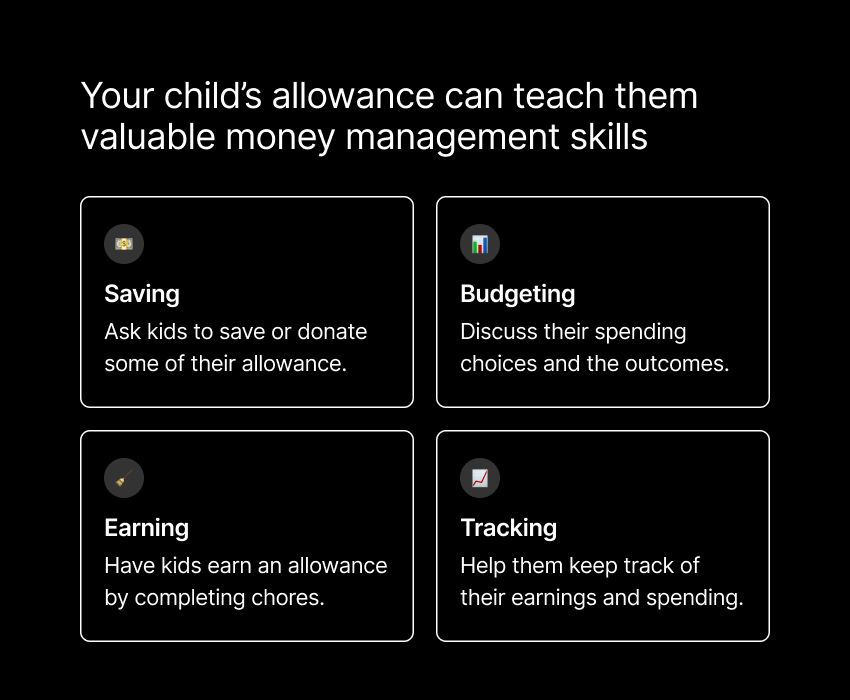

An allowance is a great way to introduce your kids to money management. By giving them a regular amount, you help them take responsibility for managing their own funds.

This hands-on experience can teach them how important it is to budget, save, and make thoughtful spending decisions.

Set guidelines: Make sure a portion of the allowance is saved or donated. This encourages good financial habits and makes them think about their choices.

Discuss their choices: Talk through their spending decisions and the outcomes. Use these discussions as teaching moments to reinforce the lessons.

Introduce earning money: Have them earn money through chores or small jobs. This shows them how work leads to income, helping them understand the relationship between effort and reward.

Use tracking tools: Help them track their spending and savings. Digital tools that monitor progress toward financial goals can keep them engaged and give them a visual understanding of money management.

These strategies can help you teach your preteens to take control of their finances while you provide guidance along the way.

Encouraging saving and goal setting

Teaching your kids to set financial goals gives them direction and discipline. Whether it's saving for a new gadget or a special trip, having a goal motivates them to manage their money carefully.

Create a savings plan: Help them break down their goal into smaller, manageable steps. This makes saving feel more achievable.

Track progress visually: Use progress trackers to keep them motivated. Seeing how close they are to their goal makes the process more exciting.

Celebrate milestones: Acknowledge their achievements as they reach savings goals. Positive reinforcement will make the journey enjoyable.

Introduce basic investment concepts: You can also explain how money can grow over time through investment. This simple concept could spark an interest in long-term financial planning.

By providing support, resources, and open conversations, you’ll be able to help your preteens develop confidence in managing their money. These skills will set the foundation for future financial independence and responsibility.

Financial lessons for teenagers

As your kids approach adulthood, financial education becomes more important than ever. With new responsibilities like part-time jobs and preparing for college, it’s crucial that they understand the basics of banking, budgeting for teens, and wise spending.

These skills will equip them for the challenges ahead and help them build a strong financial foundation.

Understanding banking and budgeting

Introducing your teenagers to banking is an essential step. Opening a bank account in their name will give them hands-on experience in managing their money. They’ll learn how to:

Deposit earnings

Monitor balances

Understand interest rates

Budgeting also becomes more complex at this stage. Your teenagers may have income from part-time jobs or allowances and expenses like transportation, entertainment, and savings goals. Teaching them to create and stick to a budget can help build responsibility and planning skills.

When your teen turns 18, a budgeting app like Albert can help them categorize expenses and provide budget insights, making tracking their finances easier. These tools fit well with a teen’s tech-oriented lifestyle and can help them stay on top of their spending.

This is also a great time to start discussing adult financial responsibilities, like taxes and insurance. Providing clear resources and guidance will help to demystify these topics and reduce any worries or uncertainty they may feel about them.

The importance of earning and spending wisely

Learning to earn money firsthand is invaluable. Encourage your teenagers to pursue part-time jobs or entrepreneurial projects. These experiences will teach them the value of hard work and provide practical knowledge about managing income and expenses.

As they gain more independence, your teenagers will face decisions about spending. Show them how to:

Compare prices

Recognize quality

Consider long-term value

Discuss the difference between needs and wants to help them make informed choices. Analyzing spending habits through digital tools can also help them understand where their money goes and make adjustments.

It may also be beneficial to introduce basic investing concepts. Start by explaining things like stocks, bonds, and compound interest. These ideas can spark interest in growing wealth and help them see the bigger picture of long-term financial planning.

By guiding your teenagers through real-world financial situations, you’ll prepare them for responsible money management as they transition into adulthood. Encourage open discussions and provide support as they make financial decisions. This will help them build a healthy relationship with money and set them up for financial success in the future.

Teaching kids about credit and debt

Credit and debt can be tricky topics, but it’s important to introduce them to your kids before they reach adulthood. Understanding these concepts early on helps them avoid financial pitfalls and prepares them to manage borrowing and repayment responsibly.

Explaining credit cards and loans

Credit cards and loans are common tools that come with responsibilities. Teaching your kids how credit works — including interest rates and repayment terms — can help give them a clear and balanced understanding of the process. They’ll learn that while credit can be useful, it comes with risks if not managed carefully.

Use real-life examples: Walk through scenarios like buying something with cash versus using credit. This will help your kids see how interest can add up and increase the total cost of an item over time.

Introduce the concept of a credit score: Explain how financial habits, like making payments on time and borrowing responsibly, impact their credit score. This way, you’ll teach them how trust is built with lenders and why good financial habits matter.

Discussing the impact of debt

Understanding debt’s impact is key to helping your kids avoid financial trouble. Teach them about the consequences of debt, like how interest can pile up and cause stress, so they know when and how to borrow responsibly.

Use relatable examples: Talk about things like student loans, car loans, or credit card debt to show real-world consequences. Highlight the importance of timely repayment and avoiding unnecessary debt.

Teach debt management strategies: Show your kids how to manage debt by creating repayment plans or consolidating loans. These strategies can empower them to take control if they face debt later in life.

Tools like Albert that track finances can help illustrate how debt affects overall financial health. Show them how debt can impact their budgets and savings goals so they learn how important it is to manage it wisely.

Having open conversations about credit and debt will help build trust and understanding. By clearly breaking these topics for them, you’ll prepare your kids to handle credit and debt confidently and responsibly in the future.

Using technology to teach money skills

Technology offers plenty of innovative ways to teach your kids about money. Learning becomes interactive and relevant to today’s financial world with digital tools.

Incorporating apps and online resources will help to engage your kids and clarify their understanding.

Educational apps and online tools

There are many apps designed to teach financial literacy. These tools make learning about money fun and interactive through games and simulations. Your kids get real-time feedback and can learn at their own pace.

Goal-setting and tracking: Many platforms will let your kids set goals, track progress, and explore different financial concepts in a safe digital environment. This can give them practical experience managing money, preparing them for real-world financial decisions.

Visual learning: Online tutorials and videos can make complicated topics easier to understand with visual explanations. These resources can keep your kids engaged and help them grasp concepts more easily.

Parental controls and monitoring features will allow you to guide the learning process and ensure the content is age-appropriate. You’ll be able to support your kids as they navigate their financial education.

Safe online banking practices

As your kids get more familiar with digital finance, it’s important to teach them about online safety as well. They need to know how to protect their personal information and recognize potential scams.

Set guidelines for online activities: Teach your kids the importance of using secure passwords, avoiding suspicious links, and monitoring their accounts regularly. Teach them about identity theft and how to be cautious about sharing personal information.

Use trusted platforms: Choose apps prioritizing security so your kids can confidently learn about online banking and money management.

By combining technology with financial education, you’ll help your kids build essential skills for managing money in the digital age. This prepares them for a world where digital finance is the norm and helps them stay safe while navigating it.

Encouraging financial responsibility as a family

Financial education is often more effective when the whole family gets involved. When everyone is on the same page, you can create a supportive environment that encourages positive money habits in everyone.

Open communication and shared goals make the process more collaborative and meaningful for everyone.

Setting family financial goals

Setting goals together as a family helps build unity and accountability. Whether saving for a vacation, a new appliance, or a community project, working toward a common objective teaches teamwork and commitment.

Involving your kids in the planning and tracking of these goals can give them a sense of ownership. They’ll learn how individual contributions add up and the importance of collective effort. It’s also great practice for setting budgets and sticking to them.

Using tools with goal-setting features can help visualize the goals, allocate funds, and track milestones together. It makes the process more engaging and keeps everyone on the same page.

Talking through financial decisions will also allow your kids a chance to understand the reasoning behind your choices. This will teach them about prioritizing and making sacrifices to reach something meaningful.

Celebrating success as a family can reinforce the value of working together and give everyone a boost of confidence in managing money.

Leading by example

As a parent, you set the tone for your kids’ financial habits. Young people often tend to mirror what they see at home, so it’s important to lead by example.

Modeling wise spending, saving, and budgeting can help instill those habits in your kids. Be open about your financial decisions and share the reasoning behind them to build trust and encourage them to ask questions and engage in the process.

Using budgeting and saving tools in your daily routine can reinforce the importance of responsibly managing money. These small actions will show your kids that financial health is something to prioritize.

Avoiding negative financial habits, like impulsive spending or unnecessary debt, can also send a powerful message. This will teach your kids to be mindful and responsible with their own money in the future.

Preparing your kids for a financially secure future

Teaching your kids about money is one of the best investments you can make in their future. By equipping them with the knowledge and tools to manage finances, you’re setting them up for financial security and independence.

Use tools that make finance easy to understand to make the learning process more engaging and practical. Apps and platforms like Albert, with user-friendly features for budgeting, spend tracking , and even investing, can help you teach your kids in a hands-on way. While kids won’t be able to use Albert until they’re 18, the Albert Family plan is a great resource to show them budgeting basics and let them see how their parents manage their money wisely.

Embracing technology and making financial education a priority as a family lays a strong foundation that will pay off in the long run.

⚡️ Sign up for Albert today with a 30-day trial to kickstart your family’s journey to financial confidence.