Your financial health is an important consideration for your future. As you age and stop working, you’ll want to ensure you can continue living comfortably — this is where your retirement plan comes in.

Understanding the differences between an IRA and a 401(k) can help you make smarter decisions for your future. Both options offer valuable ways to grow your money, and they each have distinct features catering to different needs. Here’s what you need to know about each to make the choice that aligns with your plans.

What is an IRA?

An Individual Retirement Account (IRA) is a personal savings plan designed to help you grow your retirement nest egg with some tax advantages.

Unlike employer-sponsored retirement plans, an IRA is set up and managed by you, giving you greater control over how your money is invested. With potential tax benefits and a range of investment options, IRAs are a popular choice for building retirement savings.

Types of IRAs

There are a few types of IRAs, each offering unique benefits:

Traditional IRA: Contributions may be tax-deductible, and your money grows tax-deferred. You’ll pay taxes when you withdraw the funds in retirement, and contributions can lower your taxable income in the years you contribute.

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals during retirement are tax-free. While there’s no upfront tax break, your savings can grow tax-free, and you won’t owe taxes on withdrawals.

SEP IRA and SIMPLE IRA: These are tailored for self-employed individuals and small business employees. They come with higher contribution limits and other benefits suited for these situations.

Benefits of an IRA

IRAs offer plenty of advantages for retirement planning:

Flexible investment options: Choose from stocks, bonds, ETFs, mutual funds, and more to build a portfolio that fits your goals and risk tolerance.

Tax advantages: Traditional IRAs can provide immediate tax deductions, while qualifying withdrawals from a Roth IRA are tax-free in retirement. Both options help maximize your savings growth over time.

Accessibility: IRAs are available to anyone with earned income, making them a great option for those without access to an employer-sponsored plan.

Limitations of an IRA

While IRAs are powerful tools, they do have some limitations:

Contribution limits: IRAs have annual contribution limits that are lower than what’s allowed for 401(k) plans.

Income restrictions: Roth IRAs have income limits, and high earners may not qualify. For traditional IRAs, your income can affect whether your contributions are tax-deductible.

Early withdrawal penalties: Taking money out before age 59½ can result in taxes and penalties, so IRAs aren’t ideal for short-term savings.

No loan options: Unlike 401(k)s, you can’t borrow against an IRA.

What is a 401(k)?

A 401(k) is a retirement savings plan offered by employers that allows you to save for the future with tax advantages. Contributions come directly from your paycheck, often pre-tax, which can lower your taxable income. Many employers offer to boost your savings by matching a portion of your contributions, which can make a significant impact in the long run.

The money grows tax-deferred, meaning you don’t pay taxes on it until you make withdrawals in retirement. With its easy setup and potential for employer matches, a 401(k) is a simple and effective way to build your retirement savings.

How a 401(k) works

With a 401(k), a percentage of your salary is automatically set aside and deposited into your retirement account. Contributions are typically made before taxes, though Roth 401(k)s are also available, which can help reduce your taxable income for the year.

Employers usually offer a limited list of investment options, like mutual funds focused on stocks, bonds, or money market funds. You choose investments based on your retirement goals and risk tolerance.

Over time, your contributions, any employer matches, and investment growth combine to create a powerful tool for your retirement savings.

Benefits of a 401(k)

Having a 401(k) offers many potential benefits:

Employer matching contributions: Many employers match a percentage of what you contribute, essentially giving you free money for retirement.

High contribution limits: For 2024, you can contribute up to $23,000, with an extra $7,500 allowed for those 50 or older. These limits are much higher than what IRAs offer, making it easier to save aggressively.

Ease of use: Automatic payroll deductions mean you don’t have to think about making contributions — it happens seamlessly.

Tax advantages: Tax implications are another benefit. All contributions are pre-tax, and your investments grow tax-deferred, helping your savings grow faster.

Limitations of a 401(k)

401(k)s do have some limitations to keep in mind:

Limited investment choices: Your options are restricted to the funds offered in your employer’s plan, which may not provide full customization.

Potential fees: Some 401(k) plans have higher fees, which can impact your overall returns over time.

Access restrictions: Withdrawing funds before age 59½ typically results in taxes and penalties. While some plans offer loans, they must be repaid with interest.

Comparing IRAs and 401(k)s

Both types of accounts come with tax advantages and growth opportunities, but they differ in how they work. Factors like contribution limits, investment options, and withdrawal rules play a big role in determining which option best fits your goals.

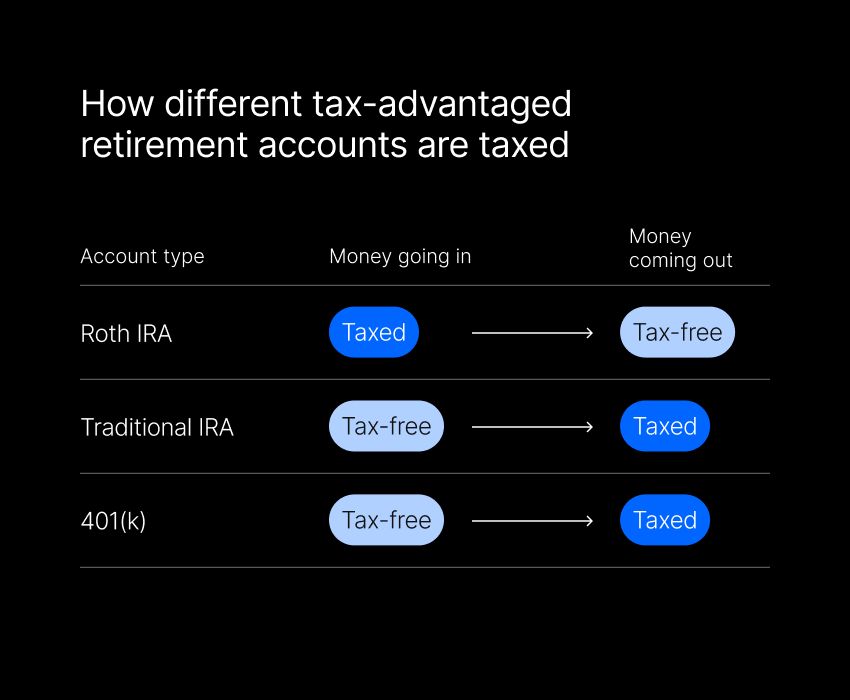

Tax advantages

Both IRAs and 401(k)s offer significant tax perks, but they work differently.

Traditional IRAs and 401(k)s: Contributions are pre-tax, lowering your taxable income today. The money grows tax-deferred, but you’ll pay taxes on withdrawals in retirement.

Roth IRAs: Contributions are made with after-tax dollars, but qualified withdrawals — including earnings — are tax-free.

The choice between these options often depends on your current tax bracket and what you expect it to be in retirement. If you think your taxes will be higher later, a Roth IRA’s tax-free withdrawals could be the better option.

Contribution limits

How much you can save is another key difference.

IRAs: In 2024, you can contribute up to $7,000 annually (or $8,000 if you’re 50 or older).

401(k)s: These accounts allow much higher contributions — up to $23,000 in 2024, with an extra $7,500 for those 50 or older.

A 401(k) is difficult to beat for anyone looking to save more aggressively. Its higher limits make it easier to set aside significant funds for your retirement.

Investment options

With an IRA, you have more control over how you invest. You can choose from individual stocks, bonds, ETFs, mutual funds, and more, tailoring your portfolio to your goals and investment risk tolerance.

A 401(k), by contrast, typically offers a smaller selection of funds your employer chooses. While this simplicity can be helpful, it may not provide the flexibility some investors seek.

Withdrawal rules

IRAs and 401(k)s impose penalties for early withdrawals (before age 59½), but the specifics vary.

Traditional IRAs offer more exceptions, like penalty-free withdrawals for first-time home purchases or certain education expenses.

401(k)s may allow loans or hardship withdrawals, but this depends on your employer’s plan and often comes with strict repayment terms.

Deciding between an IRA and a 401(k)

Choosing between an IRA and a 401(k) comes down to your financial goals, your employer's benefits, and how much control you want over your investments.

For many, the right answer isn’t one or the other — it’s both. A well-rounded retirement strategy often combines these accounts to take advantage of their unique strengths.

Assess your financial goals

Your financial goals are the foundation of this decision. Financial tools like Albert can make it easier to set clear goals, and track your progress to stay on track with your plans.

When you have your goals for the future in place, it’s easier to make a decision.

If contributing as much as possible is a priority, a 401(k) is a standout choice with higher contribution limits.

On the other hand, an IRA may be the better fit if having a wider range of investment options is more important. Think about your tax situation, the lifestyle you’re planning for in retirement, and how these accounts can help you get there.

If you're uncertain, you may also want to speak to an expert for financial planning.

Consider employer contributions

One of the biggest perks of a 401(k) is the potential for employer match. This is essentially free money added to your retirement savings.

If your employer offers a match, aim to contribute enough to get the full amount — it’s a no-brainer. Since IRAs don’t have matching benefits, this advantage can make a 401(k) the obvious choice for prioritizing contributions.

Evaluate flexibility and control

IRAs and 401(k)s differ in how much flexibility they offer.

With an IRA, you have full control over where your money goes: stocks, bonds, ETFs, mutual funds, and more, making it ideal for those who want a hands-on approach to investing.

A 401(k), on the other hand, keeps things simple. Contributions come straight out of your paycheck, and investment options are limited to those offered by your employer.

Your preference for convenience versus control can help guide your decision.

The benefits of a diversified retirement plan

Pairing an IRA with a 401(k) is a savvy way to build a stronger retirement strategy. With a 401(k), you can take advantage of employer contributions and higher annual contribution limits, while an IRA allows you to explore a wider range of investment options. Together, they offer a balanced approach to saving for retirement.

By diversifying across both accounts, you can also unlock valuable tax benefits. A 401(k) provides tax-deferred growth, while a Roth IRA can deliver tax-free income in retirement. This combination can help you manage your tax burden now and in the future.

Using both accounts will allow you to capitalize on the unique strengths of each, creating a more flexible and secure retirement portfolio tailored to your goals. This strategy helps you make the most of the tools available to set yourself up for a confident financial future.

An all-in-one financial app like Albert can also make managing multiple financial accounts easier by providing a clear overview of your contributions and growth over time so you can stay on top of your financial plan.

Making the right choice for your retirement

Deciding between an IRA and a 401(k) is a critical step in building your ideal retirement strategy. Both accounts offer unique benefits, and the best choice depends on your financial situation and long-term goals. Factors like contribution limits, investment options, tax benefits, and employer matching can guide your decision.

In many cases, combining both accounts is a smart way to maximize savings and flexibility. For example, you can take full advantage of an employer match in your 401(k) while using an IRA to access more diverse investment options. This balanced approach can strengthen your overall retirement plan and help you feel more prepared for the future.

By understanding how an IRA and a 401(k) work, you can make informed decisions that pave the way for a secure and comfortable retirement.

⚡️ Ready to start planning with our team of finance experts? Create an Albert account today and start your 30-day trial.