Setting financial goals is one of the first steps to taking control of your money and building a more stable future. When you set clear goals, you can build a guide to follow to achieve them.

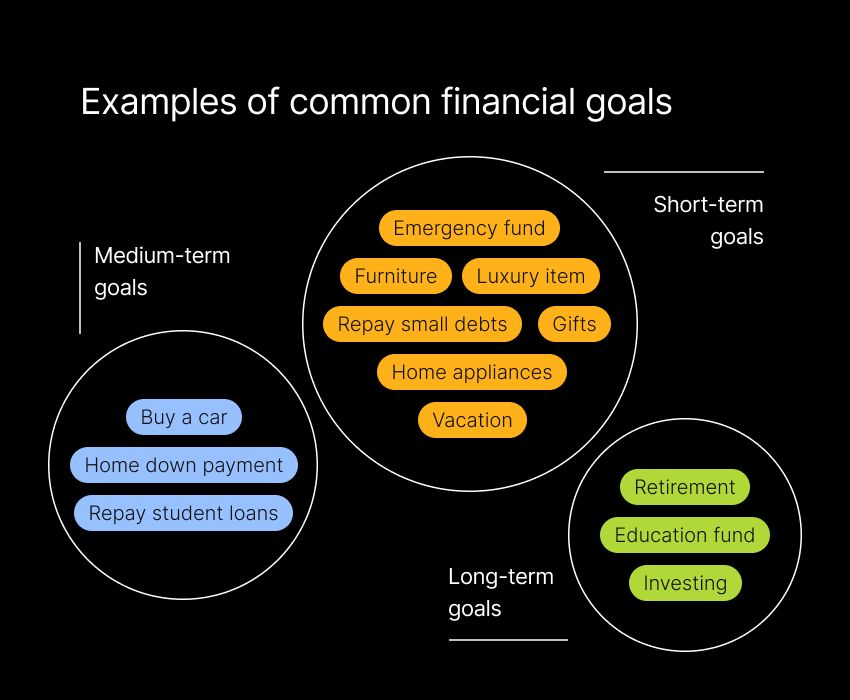

You can set long, medium, or short-term goals for your finances — or a combination of all three. You could set many different goals depending on your values and the things you want to achieve in your life.

With some thought and thorough planning, you can start working toward the financial goals that matter most to you.

Understanding financial goals

Financial goals are specific and measurable targets that help you manage your money and spend in a way that makes sense.

Goals can range from paying off debt to building wealth through investments. Regardless of what your goals are, having them in place helps you focus on what’s important and make decisions that move you closer to where you want to be financially.

Setting goals will give your financial life direction and help you make smarter decisions about saving, spending, and investing. This gives you a plan for successful money management.

Here’s a breakdown of the different types of financial goals:

Short-term goals: Saving for a new appliance, paying off a small credit card balance, or building an emergency fund

Medium-term goals: Buying a car, funding education, or saving for a home down payment

Long-term goals: Planning for retirement or building long-term wealth through investing

Setting goals will help you prioritize your spending, save more effectively, and work toward long-term stability. When you know exactly what you're aiming for, it’s easier to make smart choices that align with your objectives.

Having goals can also keep you on track. They help you avoid impulse spending and focus on what really matters. Without clear goals, it’s easy to lose direction and make financial decisions that derail your progress.

Finally, goals motivate you to save and invest. Having something concrete to work toward keeps you disciplined and focused. Plus, you can track your progress, adjust your strategy when necessary, and build confidence as you work toward achieving your goals.

Here are some financial goals examples to get you started:

Examples of short-term financial goals

Short-term financial goals are the objectives you can ideally achieve within a year. These play an important role in building a solid financial foundation and often involve small but meaningful steps toward greater stability.

Building an emergency fund

An emergency fund is money you set aside for unexpected expenses like medical bills, car repairs, or a sudden job loss. Having this fund means you won't need to rely as much on credit cards or loans when life throws you a curveball. A good rule of thumb is to aim for three to six months of living expenses in your emergency fund.

To start, set a clear savings target and contribute to it regularly. Setting up automatic transfers from your checking account to a separate savings account makes saving easy without thinking about it.

Keep the fund in a separate account to ensure it’s available when needed while avoiding the temptation to dip into it for non-emergencies. You can also track your progress to help keep you motivated as you reach each milestone.

Paying off credit card debt

Credit card debt can pile up quickly, thanks to the high interest rates. Paying it off can help reduce stress and free up your money for other goals. A good way to start is by setting a specific target, like paying off $2,000 in credit card debt within six months.

To start making progress, create a budget to track your expenses and figure out where you can cut back to put more money toward your debt. Paying a little extra when you can will help speed up the process.

Clearing your credit card debt also has the bonus of improving your credit score, giving you more financial flexibility in the future. Plus, the money you would’ve spent on interest can go toward future savings or investments to boost your financial health.

Saving for a vacation

If you’re thinking about going on a trip, planning ahead can make it a lot easier to afford. To budget for a vacation, you’ll need to determine how much the trip will cost and start setting aside money regularly to reach your goal when you’re ready to travel.

To stay on track, consider setting up a dedicated vacation savings account and tracking your spending. This will help you see where you can cut back and contribute more to your travel budget.

By planning and saving ahead, you can enjoy your vacation with less financial stress. It’s a win-win: you get to enjoy your trip and the satisfaction of knowing you worked toward it with discipline and smart planning.

Examples of medium-term financial goals

Medium-term financial goals usually take one to five years to achieve. They’re a step up from short-term goals in terms of planning and commitment, but they’re essential for progressing toward your bigger financial dreams.

Since mid-term financial goals often involve larger sums of money, they may require some adjustments in your spending habits. But by breaking them down into smaller, manageable steps, you can make steady progress toward achieving them.

Saving for a new car

Buying a new car can be a big expense, and saving for it in advance helps avoid taking on a large loan or paying high interest rates. Start by calculating how much you need and setting a realistic timeline to reach that goal.

You may want to create a separate savings account just for your car fund and set up automatic transfers to streamline the process. Contributing regularly will help you stay on track and reach your goal on time.

When choosing a car, keep your budget in mind. Stick to a sensible price range and consider long-term costs, like fuel efficiency and maintenance. This way, you can help ensure you’re making a smart financial choice and keeping your goal realistic.

Paying down student loans

Student loans can be a massive burden, but paying them off faster can save you a lot on interest. Setting a monthly goal to pay a little extra can make a difference over time.

Start by reviewing your budget to see where you can free up extra cash for loan payments. You can also look at refinancing your loan to secure a lower interest rate and reduce the overall cost.

Having your student loans paid off will give you more financial freedom down the road. Once they’re paid off, you can focus more on other important goals like buying a home or investing for your future.

Building a home down payment fund

For many people, owning a home is a big life milestone. Saving for a down payment is a crucial step toward homeownership, and it usually involves putting aside around 20% of the home’s purchase price. However, this can vary depending on the type of loan.

Set a clear goal for how much you need to save and by when, and then break that down into monthly or weekly savings targets.

To make homeownership more affordable, consider first-time homebuyer programs or loans with lower down payment requirements. Also, remember to check in on your savings plan regularly and adjust it as needed based on changes in your finances or the housing market.

Examples of long-term financial goals

Long-term financial goals are those that take more than five years to achieve. They are essential for securing one's financial future and often involve significant planning and investment.

Reaching your long-term financial goals takes commitment and, often, smart investment strategies to grow your wealth over time. The key is to start as early as possible (though it’s never too late) and stay consistent: two major factors in successfully hitting these big milestones.

Planning for retirement

Retirement planning is an important savings goal that ensures you have enough money to live comfortably when you’re no longer working. The first step in this case is to estimate how much money you think you’ll need, then contribute regularly to retirement accounts like a 401(k) or an IRA.

For long-term goals like these, the earlier you start, the better. This is because compound interest can work in your favor over a longer period of time. Investing consistently and diversifying across stocks, bonds, and other assets can help your money grow while managing risk.

Reviewing your retirement plan regularly is important, especially when life changes, like a new job or salary increase. Adjusting your contributions to match your income can help you keep your plan on track. And if you’re unsure where to start, don’t hesitate to reach out for professional advice to help you maximize your growth potential.

Saving for your children's education

With education costs rising each year, it’s a good idea to start saving early for your kids' college expenses. Setting up dedicated savings accounts like a 529 plan can offer tax benefits and help your money work for you by growing over time.

Even small contributions made regularly can add up significantly by the time your child is ready for college.

Once your children graduate from high school, you can also explore scholarships and grants to help make higher education more affordable. However, planning ahead means you’re less likely to be blindsided by tuition bills, and your child will have more options for their future.

Investing for long-term wealth

Investing is how you can grow your money over time by earning returns. When you set a goal to invest a specific amount each month (even a small amount), you can build significant wealth in the long run.

Understanding your risk tolerance and long-term financial goals will help you make decisions about investing. Diversifying your investments across different types of assets can reduce risk while still positioning you for growth.

Regularly reviewing your investment portfolio is also important — this helps you stay aligned with changing market conditions and your evolving goals. The more you learn about investment options, the better equipped you’ll be to make smart choices that support your financial future and unique goals.

How to set financial goals

Setting financial goals is more than deciding what you want to achieve. It’s about taking a thoughtful, realistic approach to make sure those goals are attainable. The key steps to setting effective financial goals include assessing your current financial situation, using the SMART goal framework, and tracking your progress so you can adjust along the way.

Understand your financial situation

Knowing where you stand financially is important before setting any goals. This means examining your income, expenses, debts, and assets. Understanding your current financial situation will help you identify where you’re doing well and where there’s room for improvement so you can set sensible goals.

Budgeting tools like the Albert app can make this process much easier. They can give you a clear picture of your spending habits and highlight areas where you can cut back. This will make it easier to redirect any extra cash toward your goals instead of letting it slip through the cracks.

Knowing where you stand also helps you set realistic goals that fit within your income and obligations. This way, you’re helping set yourself up for success, not failure.

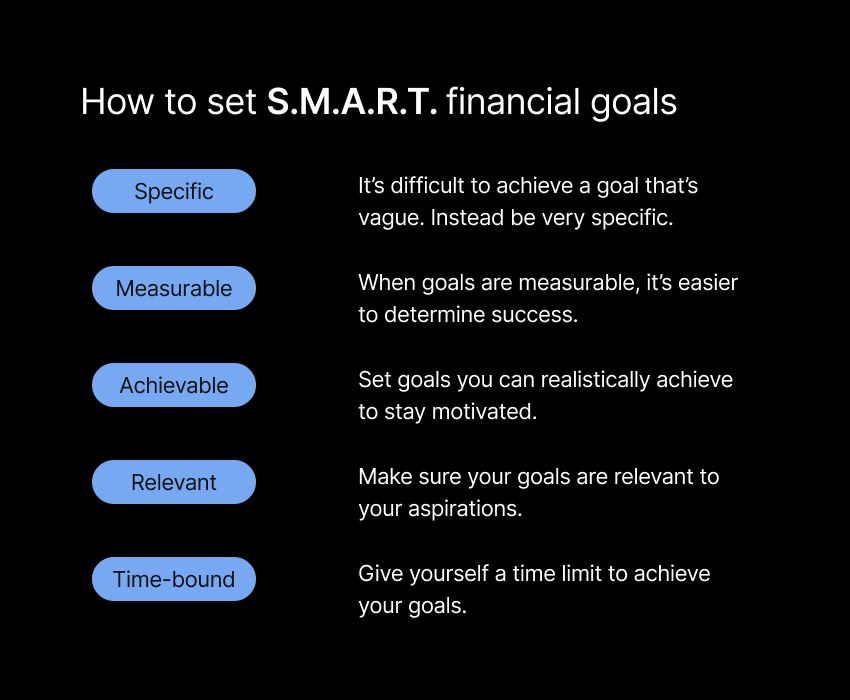

Set SMART financial goals

A great way to set clear, achievable goals is to use the SMART framework. SMART stands for goals that are:

Specific

Measurable

Achievable

Relevant

Time-bound

This approach helps you get focused and make sure your goals are practical.

For example, instead of saying, “I want to save money,” a SMART goal would be: “Save $5,000 for an emergency fund within 12 months.” It’s specific, measurable, and has a clear deadline.

Using SMART goals can help keep you motivated and on track. Write down your goals and revisit them regularly to keep them front of mind and reinforce your commitment. You can also use tools that track your progress so you stay accountable.

This type of goal setting also makes it easier to plan. You’ll know exactly what steps you need to take and can identify any potential obstacles in advance. If things aren’t going as planned, you can adjust your approach and keep moving forward.

Track your progress

Tracking your progress is important for staying on top of your goals. By regularly reviewing your savings, investments, and debt repayments, you can ensure that you’re headed in the right direction.

Plenty of apps and tools can help with this, offering real-time updates and notifications to keep you informed. These tools track your spending, show how your savings are growing, and give insight into your investments' performance.

If you find that you’re falling behind, you can try to make adjustments like increasing your savings contributions or cutting out some unnecessary expenses. And don’t forget to celebrate your wins along the way. Recognizing your achievements — even small ones — will keep you motivated and reinforce those positive financial habits.

Tips for achieving your financial goals

Reaching your financial goals takes discipline, consistency, and smart planning. With the right strategies in place, you can make steady progress toward those big objectives. Here are a few tips that will help you stay on track.

Create a budget that works for you

Your budget is a roadmap for managing your money. It shows how much you’re earning and where your money is going. It helps ensure you’re putting enough toward reaching your goals. You can gain more control over your finances by assigning specific amounts to different categories (like needs, wants, and savings).

One popular approach to budgeting is the 50/30/20 rule: allocating 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. But keep in mind that the best budget is the one that fits your lifestyle and financial priorities. Whether you use a simple envelope system or a more detailed approach, find what works for you.

You can use a budgeting app like Albert to make budgeting even easier. These apps can track your spending in real time, helping you spot where you may be overspending and identify areas where you can cut back. And as life changes, you can adjust your budget to stay on track.

Automate your savings

Automating your savings makes the whole process easier since you won’t need to remember to transfer your savings every week or month.

Set up automatic transfers from your checking account to a savings or investment account so you’re consistently contributing to your goals without having to think about it.

Stay motivated

Staying motivated is one of the biggest challenges when working toward financial goals, but there are simple ways to stay focused:

Set milestones along the way and celebrate when you hit them — big or small. Each victory helps you stay focused on the bigger picture.

Use visual reminders like charts, vision boards, or apps showing progress. Seeing how far you’ve come can motivate you to keep going.

Get support from friends, family, or online communities with similar goals. You don’t have to feel alone in your financial journey.

Remember why you’re doing this. Whether it’s financial freedom, a vacation, or a more secure future, keeping your “why” front and center can help you through tough times.

And when you feel stuck or uncertain, don’t hesitate to seek advice from financial experts. Sometimes, a little outside perspective can make all the difference.

Achieving financial stability through goal-setting

Setting and working toward financial goals is one of the most powerful ways to take control of your financial future. When you know what you want to achieve and put a plan in place to make it happen, your aspirations become a lot more attainable. With the right strategies, tools, and habits, you can stay on track and make progress toward your goals.

One of the best ways to stay focused is using tools that automate and simplify your financial tasks. From budgeting for financial goals to tracking your spending, these tools take the guesswork out of managing money. They allow you to focus on the bigger picture: achieving the financial security and freedom you seek.

⚡️ Take control of your money — try Albert today.