In personal finance, "frugal" and "cheap" are often used interchangeably, but they reflect different approaches to spending.

Being frugal means considering the cost and value of a purchase. This involves making thoughtful choices to get the most out of your money, even if it means spending more upfront for something that will last longer or provide better quality. The frugal approach doesn’t overspend unnecessarily but prioritizes long-term benefits over immediate savings.

On the other hand, being “cheap” focuses solely on spending as little money as possible, often at the expense of quality or durability. While this might save money in the short term, it can lead to frustration, dissatisfaction, and higher costs in the future when cheap items need replacing sooner.

For someone who has the means to spend a little more but struggles with focusing on dollar value at the moment, shifting the mindset from “What’s cheapest now?” to “What will give me the best value over time?” can make a huge difference.

Understanding the difference between these two attitudes is key to making smarter financial decisions that benefit you in the long run.

What does it mean to be frugal?

Frugality is all about making smart, intentional choices with your money. It’s not about cutting back for the sake of deprivation but about aligning your spending with your personal goals and values.

Being frugal means evaluating every purchase to ensure it brings value and contributes to your long-term financial well-being. This mindset can help you save, plan for the future, and still enjoy life without stress or guilt.

Frugal living encourages more sustainable habits, like reducing waste and prioritizing quality over quantity. Instead of chasing trends or impulsively buying, frugal individuals invest in things that will truly improve their lives, whether that’s experiences, long-lasting items, or financial security.

Characteristics of frugal people

Frugal individuals are deliberate with their money. They plan their budgets carefully, focusing on essentials and leaving room for occasional splurges that bring true joy. They also often rely on budgeting tools like Albert to track their expenses, research purchases to ensure they get the best value, and avoid falling for fleeting trends.

Sustainability is another key part of frugal living. Frugal people tend to minimize their waste, reuse items, and cook at home more often. They seek out discounts, buy second-hand when it makes sense, and always focus on making their money go further without sacrificing quality.

Benefits of being frugal

The perks of frugality go beyond just saving money. Over time, this mindset and way of living can help you build an emergency fund, invest in your future, and reduce your financial stress. Smart tools can help you automate the process, track your spending, and motivate you to hit your goals faster.

Frugality can also lead to more mindful spending, which helps develop a more satisfying and meaningful lifestyle. Evaluating what makes you happy can help you reduce impulsive buys and unnecessary clutter.

Plus, it’s better for the environment, as it encourages resourcefulness and reduces waste. Overall, frugality empowers you to take control of your finances, ensuring your choices support a secure, enjoyable future.

What does it mean to be cheap?

On the contrary, being “cheap” often means focusing exclusively on saving money in the moment without considering how well a product will hold up or whether it offers good value. This mindset prioritizes the lowest price tag, sometimes at the cost of quality or long-term satisfaction.

For people who can afford to spend a little more for something that lasts longer or works better, being “cheap” can lead to missed opportunities for smarter spending.

Choosing the least expensive option might seem like a win at the time, but it can result in frustration if the item wears out quickly or doesn’t meet your needs.

Traits of being cheap

People with a “cheap” mindset may avoid spending money unless necessary. This often means buying lower-quality items that need replacing sooner or skipping essential costs like preventative healthcare or car maintenance.

Over time, these choices can add up financially and in terms of convenience or quality of life.

Additionally, being overly focused on saving money can even strain your relationships. For example, skipping out on social events or prioritizing personal savings over shared experiences might leave others feeling undervalued.

Downsides of being cheap

While it might seem like a good way to save, being cheap can often cost more in the long run. Constantly replacing low-quality items or addressing avoidable issues — like neglected maintenance — can lead to larger expenses over time.

Focusing only on price can also detract from your overall happiness. Denying yourself small pleasures or cutting corners on items that matter can create stress and dissatisfaction. Sometimes, investing a little more upfront can result in greater satisfaction and fewer headaches down the road.

Shifting from a “cheap” mindset to a more balanced approach involves looking beyond the immediate dollar amount.

Instead of asking, “What’s the cheapest option?” try asking, “What gives me the best value for my money?” Learning to see spending as an investment in quality or long-term savings can make a big difference — not just financially but also in how you experience life.

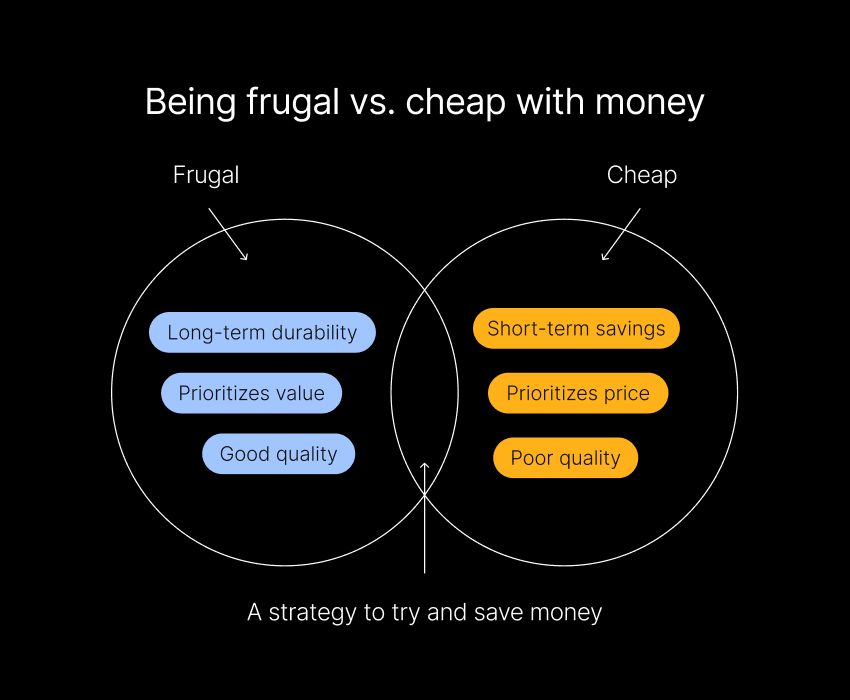

Frugal vs. cheap: Key differences

There's a fine line between being frugal and being cheap, but knowing that line can help you make better financial decisions. While both attitudes aim to save money, they reflect different approaches to spending and have distinct outcomes.

Quality vs. cost

Frugal spending prioritizes value. For example, choosing a slightly more expensive appliance that lasts for years can save you money — and hassle — compared to regularly replacing a cheaper, less reliable option.

Frugality doesn’t mean always spending more; it’s about being thoughtful and weighing the long-term benefits of your choices.

On the other hand, focusing purely on the price tag can lead to frustration. Cheap products or services might save a few dollars initially but often require more frequent replacements or repairs. For someone who can afford a higher-quality option, this mindset might hold them back from making smarter financial decisions.

Long-term vs. short-term thinking

The key distinction between frugality and cheapness lies in your perspective. Frugal individuals think about the bigger picture — they make decisions today that will pay off in the long run.

Whether investing in a durable product, contributing to an emergency fund, or prioritizing well-being, this mindset supports financial stability and personal fulfillment.

Being cheap often focuses on immediate savings. For instance, skipping routine car maintenance to save money now could lead to costly repairs down the line. This short-term thinking can create more stress and expenses in the future, making it harder to build financial security.

How to be frugal without being cheap

Striking the right balance between saving money and enjoying life comes down to smart decision-making. Being frugal means optimizing your resources and focusing on value, not just cutting costs.

With the right mindset and tools, you can practice frugality without veering into cheapness, ensuring you meet your goals without sacrificing quality or enjoyment.

Prioritize value over price

Frugality is all about prioritizing value over price. There’s more to consider than just the cheapest option — you also need to weigh factors like quality, durability, and how well a purchase fits your needs. For example, investing in a high-quality piece of furniture might cost more upfront but saves you money in the long run by lasting longer than a cheaper alternative.

This value-driven mindset extends beyond products to experiences and personal growth as well. Spending money on courses to boost your career or hobbies that bring you happiness can be a wise investment if you can afford them.

When you think about the bigger picture, you can align your spending with what truly matters to you. Focusing on long-term value and short-term savings can make for a more balanced and rewarding financial journey.

Smart shopping tips

Being a smart shopper can help you save money while still maintaining quality. Start by planning your purchases to avoid impulsive decisions. Then, when you shop, compare prices, read reviews, and look for sales, discounts, or coupons to stretch your budget further. These simple habits can affect how far your money goes.

You can also use financial tools like a budget planning app to make this even easier. Use an app to track your spending, set limits, and identify areas where you can cut back. Automating expense categorization and reviewing your bills and subscriptions regularly can also help you avoid unnecessary expenses.

Real-life examples of frugal vs. cheap

Understanding the difference between being frugal and being cheap comes down to how you approach everyday situations. Your choices reveal whether you’re focusing on long-term value or short-term savings — and that difference can shape your finances, relationships, and overall quality of life.

Everyday situations

You can see these differences play out in daily life. At the grocery store, a frugal person might use coupons, buy in bulk, and choose generic brands when the quality matches, all while prioritizing healthy, satisfying food.

A cheap person might grab the lowest-cost items without considering nutrition, flavor, or long-term value. Frugality ensures smarter spending without sacrificing quality or satisfaction.

When it comes to leisure, a frugal individual seeks out low-cost entertainment like community events or streaming discounts, finding affordable ways to enjoy life. A cheap person might avoid spending entirely, missing out on experiences that enrich their lives.

Financial decision-making

The contrast between frugality and cheapness becomes even more apparent in major financial decisions.

Consider home maintenance: a frugal person would invest in necessary repairs to avoid bigger expenses down the road. A cheap person typically avoids maintenance and repairs, only to face costlier issues later.

Or think about investing. Frugal individuals will do their research, use tools, or seek expert advice to make informed financial decisions that build wealth. Cheap individuals may avoid investing altogether, choosing immediate accessibility to their funds over long-term growth.

Frugality is about finding balance and prioritizing value, long-term benefits, and personal goals. Cheapness, by contrast, often sacrifices quality and relationships for short-term savings.

Choosing the right path for your financial future

Understanding the difference between being frugal and being cheap is essential for making smart financial decisions.

Frugality is about aligning your spending with your values and goals, focusing on long-term benefits, and finding a balance between saving and enjoying life. Tools like budgeting apps, expense tracking, and investment trackers make it easier to stay accountable and confidently make decisions.

Being cheap, by contrast, often prioritizes short-term savings over long-term value. This mindset can lead to missed opportunities, strained relationships, and higher costs in the long run.

Take control of your finances today and start building a smarter, more sustainable future with Albert. Whether you're just starting or looking to refine your financial approach, Albert’s easy-to-use budgeting and financial tools can help you confidently reach your goals.

⚡️ Try Albert today with a 30-day trial.