Managing your money doesn’t have to be overwhelming. Using a few simple budgeting rules and tools like a budgeting app to track your spending can help you gain clarity and control over your spending. These actions can help you feel more confident and secure in your financial well-being.

What are budgeting rules?

Budgeting rules are simple guidelines that help you manage your money. They show you how to divide your income between expenses like bills, savings, and personal spending. By following a budgeting rule that suits you, you can make better decisions with your money.

There are many different budgeting rules and methods out there. Some popular ones you may have heard of include:

The 50/30/20 rule

The 70/20/10 rule

The zero-based budgeting method

While each has a different approach, they all focus on helping you prioritize what matters most. These rules can help you plan ahead, avoid overspending, and ensure you’re saving for your future.

The 50/30/20 rule explained

The 50/30/20 rule is one of the most popular budgeting methods because it’s simple and flexible. It divides your monthly after-tax income into three key areas: needs, wants, and savings. This makes it a great option no matter where you are in your financial journey.

How to allocate your income

The rule is straightforward: 50% of your after-tax income should go toward needs, 30% toward wants, and 20% toward savings.

Needs: These are the essentials — things like housing, utilities, groceries, transportation, insurance, and healthcare. The goal is to make sure your basic living expenses are covered without stretching your budget too thin. If you find that you’re spending too much in any of these areas, it may be time to try to make some changes to your spending.

Wants: This category covers the non-essentials — things that make life more enjoyable but aren’t needed to survive. Eating out, weekend activities, hobbies, travel, and personal care all fall into this category. While these things are nice to have, they should be managed carefully to keep your budget balanced. It’s easy to blur the lines between needs and wants, so think carefully about what matters most to you.

Savings and debt repayment: The final 20% of your income should be used to save for the future and pay down debt. This can help you build long-term financial security. You should aim to put money into an emergency fund or a savings account for retirement and pay off any outstanding debts. You can also allocate funds to a down payment or an upcoming vacation.

Benefits of the 50/30/20 rule

The simplicity of the 50/30/20 rule makes it easy to follow and helps you ensure your budget is balanced.

You group your expenses into needs, wants, and savings to make managing your finances clearer and more manageable. This rule also encourages smarter spending habits so you can feel more secure about being prepared for the future.

What’s also great about this rule is its flexibility. It adapts to your financial situation and goals – whether you're saving for retirement, paying off your credit card debt, or just trying to live comfortably. The clear structure helps keep you on track, and it’s simple enough to adjust as your income or priorities change.

Using an app like Albert to help you categorize your expenses can make this rule even easier to follow. You’ll be able to track whether or not your spending is aligning with the 50/30/20 split and make adjustments if necessary.

By focusing on what’s most important to you — covering your needs, spending money to enjoy life, and saving for the future — the 50/30/20 rule helps you make your money work for you and your lifestyle. Over time, it can help you minimize your financial stress and build security.

Common mistakes to avoid

It’s difficult to avoid ever making a mistake when it comes to our finances. But being aware of common pitfalls can help you keep your spending on track:

Confusing needs and wants: One of the biggest mistakes people make is mixing up their needs and wants. If you start classifying non-essentials as needs, you could end up overspending and creating a financial imbalance. Be honest with yourself when categorizing your expenses.

Not adjusting your budget: As your income or expenses change, it’s important to update your budget. Regularly reviewing it will help you make sure that it matches your current situation and financial goals.

Skipping savings: Another mistake is neglecting your savings and debt repayment. It’s important to consistently allocate that 20% to your future. If you skip this step, you risk jeopardizing your long-term financial health.

Ignoring your emergency fund: It's important to have a cushion for unexpected expenses. Unplanned medical bills or car repairs could force you into debt without an emergency fund. Building and maintaining an emergency fund should be a top priority to keep your finances stable.

Other popular budgeting rules

If the 50/30/20 rule doesn’t quite fit your style, there are plenty of other budgeting approaches that might suit your needs and goals better. Here’s a look at some other popular choices:

The 70/20/10 rule

The 70/20/10 rule is another simple way to divide your income.

This rule allocates 70% of your income to spending, 20% to savings, and 10% to charitable contributions or debt repayment. It’s a great option for those who want a flexible yet balanced approach to budgeting while also prioritizing generosity.

70% for spending: This covers everything from fixed expenses and essentials to the fun stuff, giving you room to enjoy day-to-day life while covering the basics.

20% for savings: Putting aside 20% helps you build a safety net and save for future goals.

10% for giving or debt: This part goes toward charity or paying down debt, adding social responsibility to your budgeting plan.

This rule is ideal if you’re looking for something flexible but balanced. It keeps you covered financially, allows for some generosity, and helps you manage your money mindfully.

Zero-based budgeting method

Zero-based budgeting is for anyone who likes to have a more detailed handle on their money. With this method, you assign every dollar of income to a specific category — housing, groceries, savings, entertainment — until there’s “zero” left over. It’s a great choice if you want to feel in control of every dollar and make intentional decisions about where your money goes.

This approach also keeps you accountable, helping to prevent impulse spending. Just keep in mind that it takes some upfront planning and regular tracking to ensure your budget stays aligned with your goals.

This rule is especially helpful if your income fluctuates or you’re saving for something big, like paying off debt or a vacation. It allows you to stay flexible and adjust as life changes.

Envelope budgeting method

The envelope system is a straightforward, hands-on way to monitor your spending.

Here’s how it works: you put cash from your paycheck in physical envelopes, each marked for specific categories like groceries, entertainment, or transportation. When the envelope is empty, you have to pause spending in that category until the next budget cycle.

This method encourages discipline and helps you think carefully about each purchase. While it’s very effective for some, it might need a few tweaks to work with online shopping or automatic debit payments.

Some people have digitized the envelope system by using budgeting apps that let you track spending in each “envelope” electronically. This modern approach preserves the system’s benefits while accommodating modern payment methods.

How to choose the right budgeting rule for you

Picking the right budgeting rule is all about finding what fits your goals, spending habits, and lifestyle. Each rule has its perks, so finding the one that’ll work best for you financially and where you’d like to go is important.

Assess your financial goals

Start by considering your goals — both short-term and long-term. Are you saving for a big vacation, a new home, or trying to build an emergency fund? Your priorities will point you in the right direction.

If your focus is onbuilding savings or paying down debt, a method like the 50/30/20 or 70/20/10 rule, which prioritizes saving, could be just the thing.

But zero-based budgeting might be a better fit if you like to track every dollar.

Knowing what’s most important to you will help you choose a budgeting rule that supports those goals.

Evaluate your spending habits

Take a look at your spending style. Do you tend to overspend in certain areas or find it tough to separate your needs from your wants? Understanding your spending patterns can help you pick a rule to keep you on track.

For instance, if you often mix up your “needs” and “wants,” the 50/30/20 rule gives you clear guidelines to follow.

If you prefer a simpler, more hands-on approach, the envelope budgeting method might be more your style.

And if you need detailed control, zero-based budgeting could be perfect. Recognizing your habits will lead you to a rule that supports mindful spending.

Adjust for life changes

Life changes — like a new job, moving, or expanding your family — can quickly shake up your financial picture. That’s why it’s smart to choose a budgeting method that can adapt as your life evolves.

Look for a rule that’s flexible enough to shift with your needs and change as you change. Zero-based budgeting, for example, can be easily adjusted when circumstances change. The key is checking in on your budget regularly and adjusting as needed. This way, you’re always working toward your goals, no matter what life throws at you.

Tools and resources for effective budgeting

Using the right tools and resources can relieve some of the stress of budgeting, helping you manage your money without all the guesswork. Here are a few resources that can make planning, tracking, and reaching your financial goals much smoother.

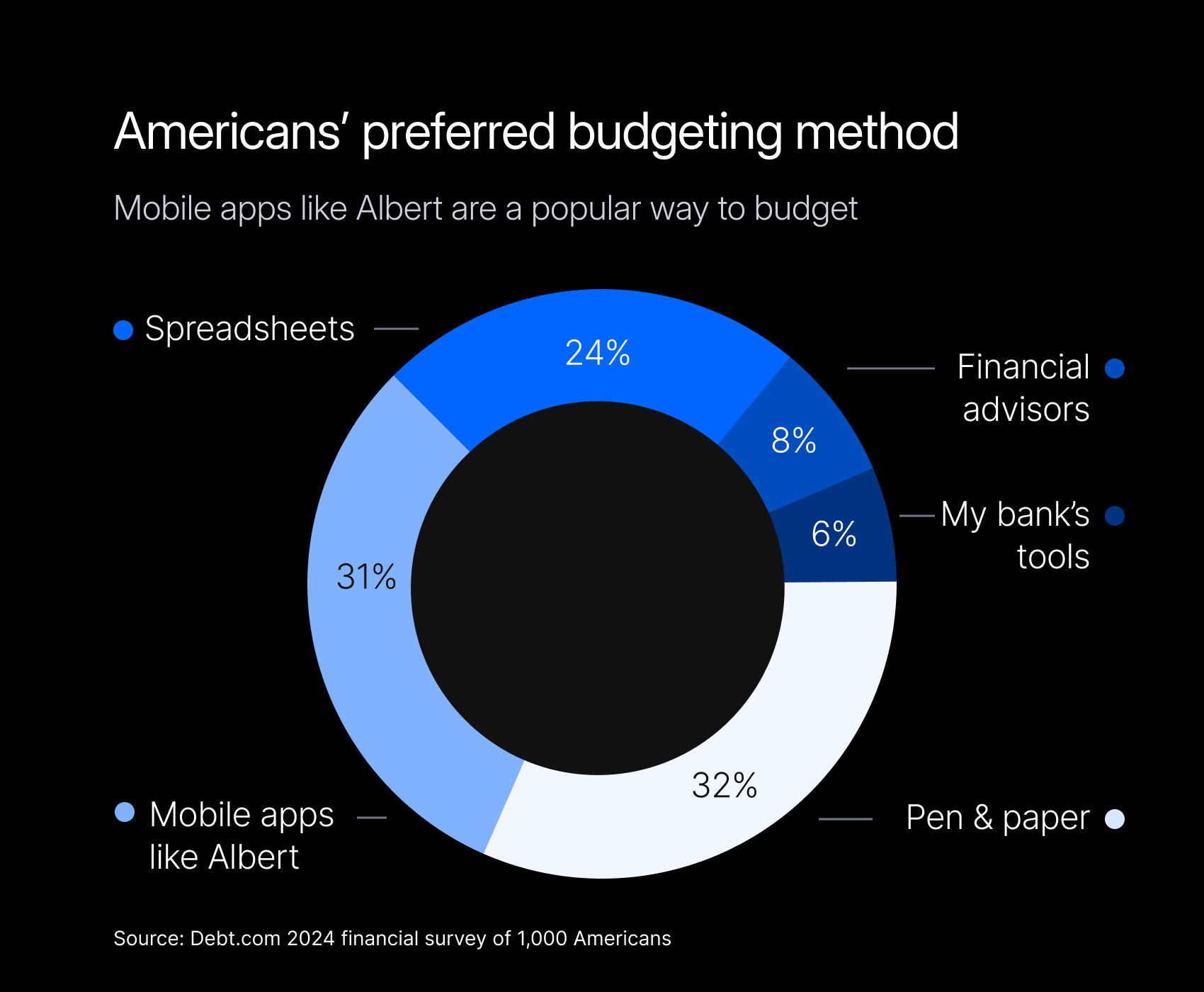

Budgeting apps and software

Budgeting apps are a convenient way to keep tabs on your spending, set financial goals, and stay organized. Many apps will let you categorize your expenses and even track your spending automatically. You’ll have a clear picture of where your money is going, which can help you make better choices.

Some apps, like Albert, offer everything from budgeting features to tailored financial advice, giving you extra confidence as you work toward your goals. Using tools like these makes it easier to manage your finances and keep everything on track.

Financial planning workshops

Financial planning workshops are a great way to learn more about budgeting, saving, and investing. These sessions, usually led by experts, cover topics like how to save, invest, and create a solid financial plan, giving you the skills and confidence you need to take charge of your money.

Workshops can boost your financial know-how, whether you’re new to budgeting or looking to refine your approach. Many community centers and organizations offer free or affordable workshops on retirement planning, debt management, and the basics of budgeting so you can find practical advice without overspending.

Online budget calculators

Online budget calculators are a quick way to get a clear view of your income and expenses. You can easily plug in your numbers; the calculator will break down your budget. This makes it easy to see where you want to make adjustments.

These calculators are usually customizable, so you can tweak categories and amounts to fit your unique situation. They’re simple to use, offer helpful insights, and keep you on track as you work toward your financial goals.

Finding sustainable success with budgeting rules

Following a budgeting rule is a great way to manage your finances. Whether you choose the straightforward 50/30/20 rule, the hands-on approach of the envelope method, or the precision of zero-based budgeting, it’s all about finding what works best for your goals and lifestyle.

When you choose the right budgeting rule and stay consistent, you can build a stronger financial foundation and feel more at ease about your future.

⚡️ Need a little extra help? Check out Albert’s budgeting features for personalized advice and insights to keep you on track.