Short-term loans can help you access cash fast to cover unexpected expenses or bridge the gap between paychecks without long-term commitments. However, the type of loan you pick makes a significant difference.

Not all short-term loans are the same. Factors like the loan amount you’re eligible to receive, repayment period, and fees can all vary. A trustworthy lender will make the terms clear upfront, so you know exactly what you're agreeing to before borrowing. Understanding these terms and the interest rates and repayment options is essential to avoid unnecessary costs and financial strain.

Comparing your options will help you find a loan that fits your budget and repayment ability — making it a financial tool, not a setback.

What are short-term loans?

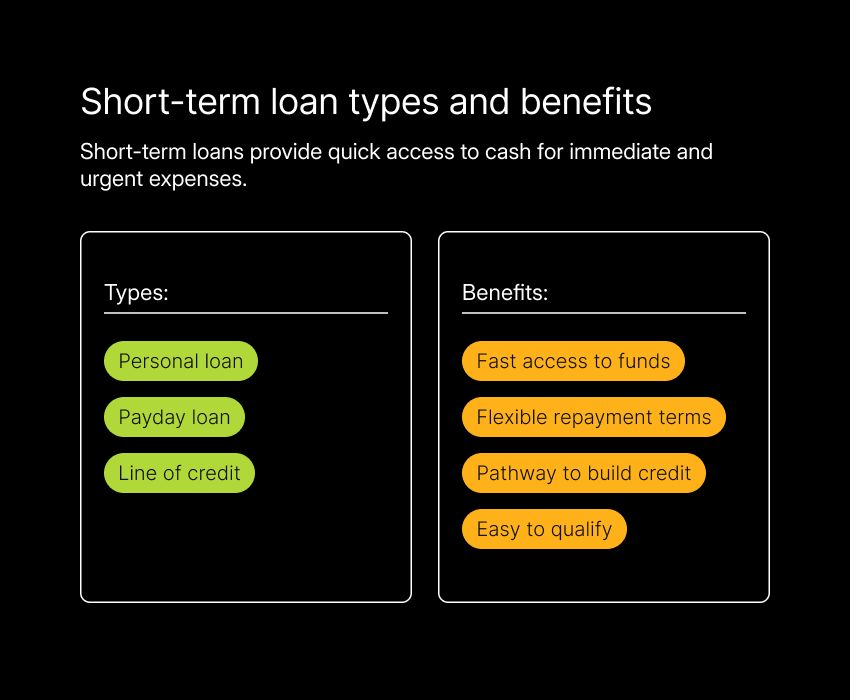

Short-term loans provide quick access to cash for immediate and urgent expenses, typically repaid within a year. They’re designed for situations where you need a small amount of money fast — whether it’s for medical bills, car repairs, or other urgent costs that can’t wait until your next paycheck.

These loans will all look slightly different in terms of interest rates, fees, and repayment terms. Some have fixed costs, while others charge interest based on the borrowed amount and loan duration. Understanding the finer details is important to help you choose the best option for your financial situation and needs.

Short-term loans come in different forms. Each type has its own benefits and considerations. The best short-term loans offer flexibility and speed with minimal approval requirements. Unlike long-term loans that often involve credit checks and collateral, short-term loans are typically easier to qualify for — even if your credit isn’t perfect.

Types of short-term loans

Short-term loans come in various forms, each designed to meet different financial needs. Knowing what’s available helps you choose the best loan for your situation. Here’s a breakdown of the most common types of short-term loans and what they have to offer.

Personal loans

Personal loans are versatile and can be used for anything you need — from home improvements to medical expenses or debt consolidation. These loans usually have fixed interest rates and repayment terms ranging from a few months to a couple of years, so you’ll know exactly what your payments will be.

Some personal loans require a credit check, but many lenders offer options for those with less-than-perfect credit. The application process is typically simple, and you can access the funds you’re granted quickly. Personal loans can be a good option if you need to borrow a larger sum of money, as they offer more flexibility than some other short-term options.

Payday loans

Payday loans are short-term loans designed to cover urgent expenses that you’re unable to handle until your next paycheck. They’re typically easy to get, with minimal documentation required and no credit check. This accessibility makes payday loans an option when you need fast cash.

While payday loans can help when used responsibly, it’s important to be clear about the terms and ensure you can repay on time to avoid extra charges. Some payday lenders offer fair terms with transparent fees, making them a good choice for immediate financial needs when you’re in a pinch.

Line of credit

A line of credit is a flexible borrowing option that allows individuals to access funds up to a set limit, similar to a credit card. Borrowers can withdraw money as needed and only pay interest on the amount used rather than the full credit limit.

Lines of credit can be secured (backed by collateral, like a home or savings) or unsecured (based on creditworthiness). They are useful for managing cash flow, covering unexpected expenses, or funding ongoing projects. Since interest rates can vary, it's important to use a line of credit responsibly to avoid high costs over time.

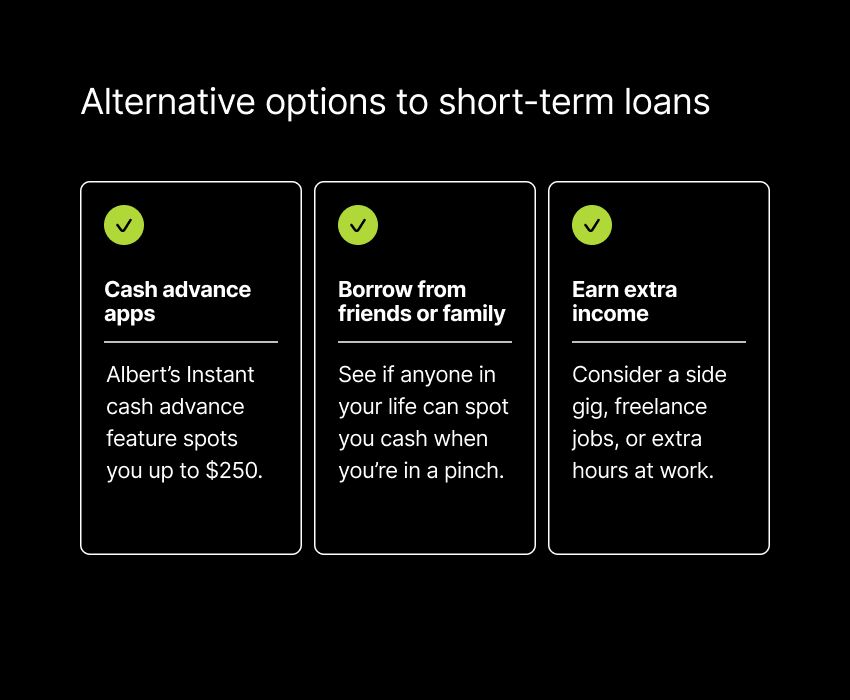

Alternatives to short-term loans

Cash advances

Cash advances provide quick access to funds without the hassles typically associated with a traditional loan. They’re fast and easy to access without the need for extensive applications — often done in just a few clicks on an app.

While a credit card cash advance does typically involve additional fees and interest, there are simpler, more affordable options. Albert’s Instant Advance, for example, offers cash advances up to $250 with no credit check, no interest, and no late fees. This makes it a good option when you need fast access to funds.

Since there’s no interest or late fees, paying back the advance on time keeps things simple and transparent. This option works well for those who need quick, straightforward financial relief without the added burden of high interest or complex terms.

Borrowing from friends or family

Borrowing from friends or family can be a flexible and cost-effective alternative to traditional loans, often with little to no interest and more manageable repayment terms. Since there’s no formal lender involved, it can provide quick financial relief without the high fees or credit checks associated with short-term loans

It’s important to communicate clearly about repayment expectations to avoid misunderstandings that could strain relationships. A written agreement outlining the loan amount, repayment schedule, and any interest (if applicable) can help keep both parties on the same page.

Earning extra income

Earning extra income through side gigs or freelance work can be a practical way to address financial needs without taking on debt.

Opportunities like gig economy jobs (e.g., ridesharing, food delivery), online freelancing (e.g., writing, graphic design), or selling items you no longer need can quickly boost your cash flow. Even small efforts, such as tutoring, babysitting, or pet sitting, can make a difference in covering unexpected expenses or building a financial cushion.

By leveraging your skills and resources, earning additional income can provide greater financial flexibility and reduce reliance on short-term loans.

Benefits of short-term loans

Short-term loans offer several advantages, making them a practical solution for immediate financial needs.

Fast access to funds: Many short-term loans have quicker approval processes, helping you cover your urgent expenses without delays.

Flexible repayment terms: These loans are designed to be repaid quickly, allowing you to clear your debt without long-term financial commitments.

Easier eligibility requirements: Unlike traditional loans, many short-term options don’t require a credit check.

Potential credit improvement: Making on-time payments can strengthen your credit history, increasing future borrowing opportunities.

Understanding these benefits can help you decide if a short-term loan is the right choice for your financial situation.

How to choose the right loan

Choosing the right short-term loan involves more than just picking the first option that comes your way. It's important to carefully assess your personal situation and compare various loan offers to ensure you find the best fit for your needs.

Consider your financial needs

The first step is understanding exactly how much money you need and why. Be clear about the specific amount you want to borrow and the purpose behind it. This clarity will help you select a loan that aligns with your financial goals without overburdening you with unnecessary debt.

For example, as an alternative, if you only need a small amount to cover an urgent expense, a cash advance from Albert Instant Advance can offer you up to $250 quickly, if you qualify, without a credit check, which may be ideal for short-term financial needs.

Assess your ability to repay

Next, think about your ability to repay the loan on time. Take stock of your income, current financial obligations, and budget to make sure that you can comfortably meet the loan’s repayment terms.

Being realistic about what you can afford is the key to avoiding future financial strain as far as possible. This approach will also help you maintain a balanced budget, giving you peace of mind while managing your debt.

Compare interest rates and fees

Interest rates and fees can vary significantly from lender to lender and impact the total cost of borrowing. This is why comparing different loan options and evaluating their terms is important before deciding.

Compare multiple lenders and look for loans with clear, upfront fee structures, avoiding any that seem to have hidden charges. These can drive up the cost unexpectedly and cause unnecessary financial strain.

Review repayment terms

Before committing to a loan, take some time to review the loan terms carefully. Pay attention to the length of the repayment period, the flexibility of the payment schedule, and any penalties for paying off the loan early or late.

Loans with flexible repayment options can make it easier to manage your finances and reduce your risk of falling behind on payments. The more flexible the terms, the more manageable the loan will be in the long run.

Tips for your short-term loan application

Applying for a short-term loan is much more straightforward if you prepare in advance. Here are a few tips to improve your chances of approval and find a loan that aligns with your needs.

Check your credit score

Before you apply, take a look at your credit score. If it’s lower than you’d like, take steps to improve it.

For example, try to start paying down existing debts and fixing any errors you notice on your credit report. Using budgeting tools that monitor your credit can give you a clear picture of your financial health and help you stay on track.

Even if your score isn’t perfect, knowing where you stand will give you more confidence and allow you to target lenders that fit your credit profile.

Gather the necessary documents

Being prepared with the right paperwork can make your application process faster and easier.

Lenders typically ask for proof of income, ID, and banking info. Having everything ready will help you complete your application quickly, accurately, and with less stress.

Evaluate lender reputations

Not all lenders are created equal, so it’s important to do your research. Look into the lender’s terms, customer service, and transparency. It’s a good idea to read reviews and ask for recommendations so you can get a sense of their reliability.

Always choose a lender with a reputation for honesty and reliability to make sure you’re getting the best loan for your needs while protecting yourself at the same time.

Making the most of short-term loans, responsibly

Short-term loans can be a useful tool when you use them correctly. By understanding what they are, how they work, and selecting the right option, you can address your urgent financial needs in a way that makes sense for you.

The key is to be thoughtful about your financial situation, do your research, and manage the loan responsibly.

Platforms like Albert make managing your finances even easier. With features like Instant Advance, which offers cash advances of up to $250, budgeting features, and credit monitoring, Albert can help you make informed decisions. The goal is to find an option that fits your financial plan and gives you the support you need without adding unnecessary pressure.

When you lean on the right tools and resources, you can confidently navigate short-term loans. Staying informed ensures you choose the right loan that aligns with your needs and improves your financial health.

⚡️We’ll spot you $25 - $250 — try Albert Instant cash advance today!