Creating a budget and sticking to it isn’t complicated – it’s all about awareness, planning, and discipline, and the steps are seriously simple.

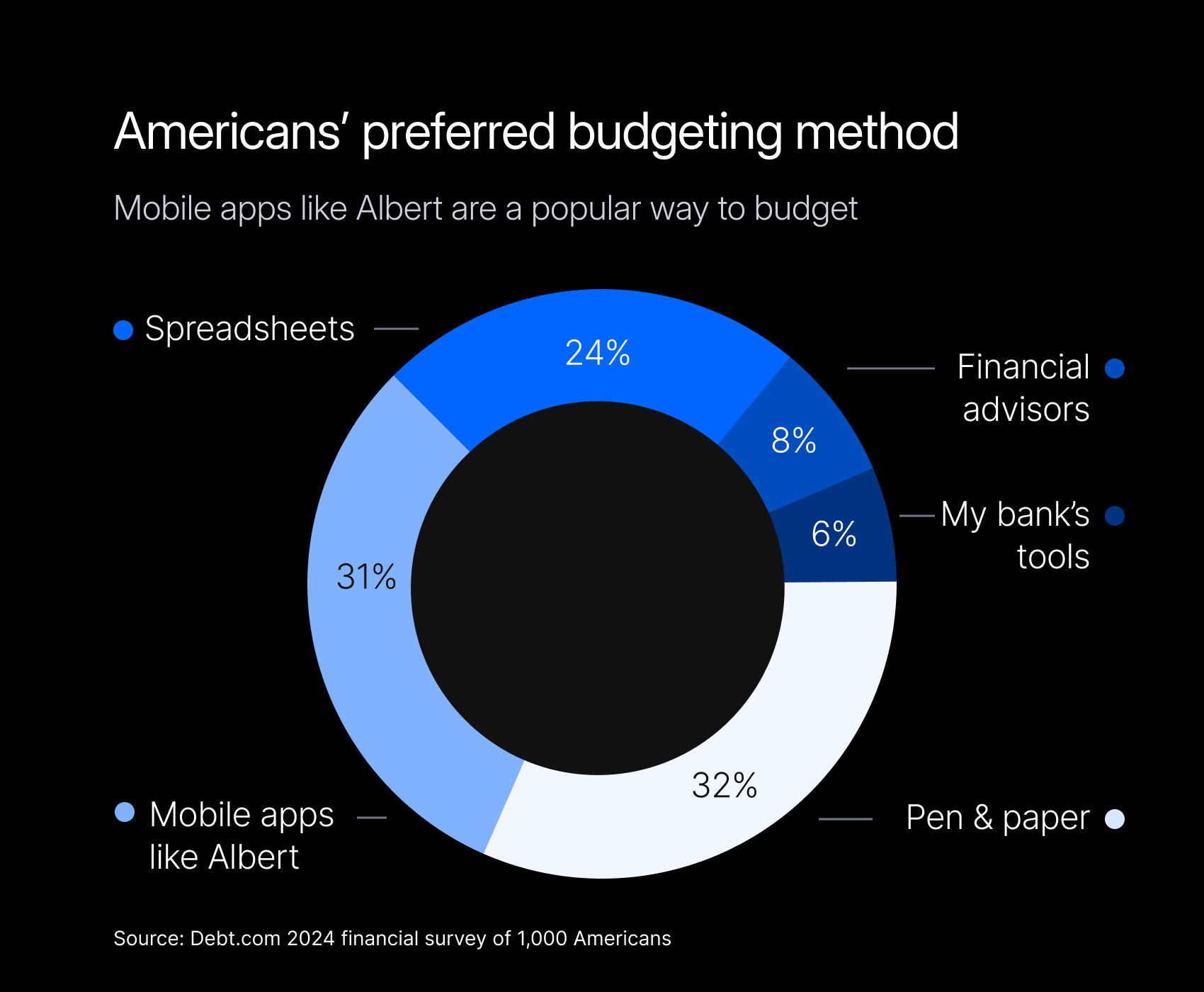

It starts with listing your income and expenses and categorizing them into "needs" and "wants" to see where you could cut back. Tools like budgeting apps or simple spreadsheets can help you get a clear picture and adjust as needed.

Once you’ve created a budget, regularly check in on your spending to catch any overspending early, and set realistic limits to stay prepared for any unexpected expenses that may pop up.

Remember, budgeting isn’t about restricting yourself—it’s about making mindful choices that support your financial goals and future security. Here’s a deeper look into what makes budgeting simple and sustainable.

Understanding your budget

A budget is more than just numbers; it’s a reflection of your financial priorities and even your personal values. By creating a budget, you’re allocating your resources to ensure essentials are covered and paving the way for future goals like homeownership or retirement.

A well-structured budget clarifies where your money goes, making it easier to manage day-to-day expenses and handle unexpected costs without debt.

What is a budget?

A budget is a plan for your money that outlines how much you earn and where it’s going. Think of it as a guide to help you understand your financial situation and make more informed financial decisions. A good budget not only guides your spending and saving habits but also ensures you’re prepared for your future needs.

By tracking both income and expenses, you can manage your finances more effectively, live within your means, and set aside funds for things that matter to you – like building an emergency fund, saving for a major purchase, or investing. The best and most sustainable budgets are realistic and tailored to your needs. Life happens, and your budget needs to be able to adapt to any financial changes, expected or not.

Why budgets are important

Budgets are designed to boost your financial health and security. They give you more control over your money by helping you prioritize your spending. Aim to cover your essentials first, and then set aside some money for savings and fun, non-essential spending.

With a clear picture of your income and expenses, a budget reduces the temptation to overspend and helps you avoid falling into debt. Plus, a budget helps you to plan for future expenses and build a financial cushion for emergencies, giving you peace of mind and reducing financial stress.

Whether you're trying to handle debt payments, save for an upcoming vacation, or prepare so you can retire comfortably, you can use a budget as a structured plan with milestones to make your goals achievable.

Tracking your spending

Creating a spending plan and then forgetting about it for the rest of the month probably isn’t going to be helpful. This is where tracking comes in.

Tracking your spending is what will make your budget effective, by showing you where your money really goes and whether or not your spending aligns with your goals and values.

By keeping a detailed record of your bills and other expenses, you’ll be able to understand your own financial habits better and make some decisions about where and how you could improve.

With so many ways to track spending – from apps that do the work for you to simple logs that you keep yourself – it’s easier than ever to stay on top of your budget.

Using budgeting apps

Apps are a great way to stay organized without much extra effort. Budgeting apps like Albert track your spending automatically, organize transactions by category, and send helpful alerts if something unusual pops up.

Most budgeting apps allow you to link your accounts, so you can get a real-time view of your finances and easily see where your money goes each month. You’ll see dynamic graphs and charts to visualize your spending and help you pinpoint areas where you may need to adjust.

You can even be reminded (with timely notifications) about upcoming bills, helping you avoid late fees and penalties. Having an app like this on your phone makes managing money easier, allowing you to stay focused on your bigger financial goals.

Keeping a spending log

If you prefer a more hands-on approach, keeping a spending log might be right for you. This method is as simple as it sounds: you manually record every purchase you make.

You can use a notebook or a spreadsheet, whichever feels most convenient. There are both digital templates and printable ones you can find online to make this easier, or you can customize your tracking according to your own needs. Hold onto your receipts or use your bank statements to update your log regularly.

While this approach takes some discipline, it also keeps you engaged with your financial health and forces you to be more mindful about your spending. You can use your tracking to dig deeper into your financial habits and spot any trends you’re not happy with.

Setting realistic goals

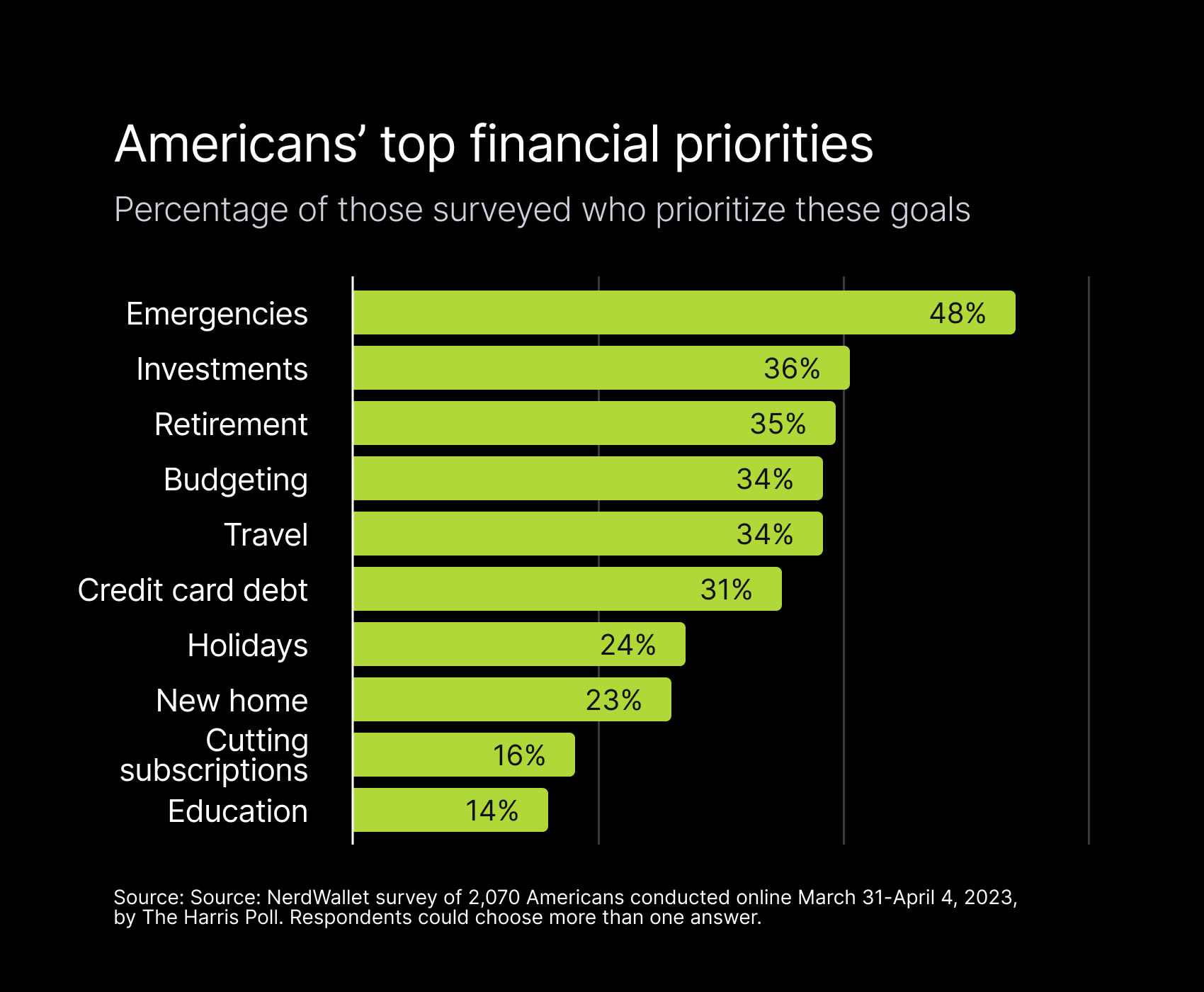

Setting realistic financial goals is the key to making your budget work for you. Having clear goals will give you direction and motivate you to keep going and stick to your budget.

You need to identify what you’re working towards by setting some short-term and long-term goals.

Short-term goals could be:

Saving for a vacation

Paying off a credit card

Cutting back on unnecessary shopping

Long-term goals may include:

Buying a house

Building up a retirement fund

Launching your own business

Once you have your goals, it helps to prioritize them based on what’s most urgent or important. This prioritization will guide your monthly budgeting choices and help you make the best use of your money.

To keep things manageable, break your bigger goals into smaller, realistic steps to keep you motivated.

Prioritizing expenses

Prioritizing your expenses is essential for sticking to your budget. A helpful first step is to separate your expenses into needs and wants.

Needs are the essentials – things like housing, groceries, and transportation.

Wants, on the other hand, are the nice-to-haves, like dining out or entertainment.

By covering your needs first, you make sure your essentials are taken care of and that you don’t need to worry about paying your bills. Then, you can look at how much is left for wants or for saving towards your goals. This helps you stay on top of your budget and allows you some wiggle room to adjust if needed.

Remember, if you have more than one goal at a time, you may need to prioritize one over the other depending on urgency or your own wants and needs. The upside of structuring your budget this way is that it’s flexible.

Saving for emergencies

Saving for emergencies is a critical part of financial planning, acting as a safety net for life’s unexpected expenses. Since you never know what could happen, you should try to focus on building an emergency fund before saving for other goals.

It’s recommended across the board to have an emergency fund that could cover three to six months of living costs. This cushion can help you afford unexpected costs, like medical bills or a job loss, with less stress.

Start by setting a specific savings goal and make a plan for how you’ll reach it. For example, you can decide to set aside a certain dollar amount or percentage of your salary every month, and you can automate these savings with a direct transfer to stay consistent. Once you’ve built up this fund, you’ll be better able to focus on other financial goals with less worry.

Adjusting your budget

Life happens. Things change – they could go wrong, or they could go right. You may face unexpected medical bills, or you could get a salary increase. Make sure that you adjust your budget to reflect any of these kinds of changes.

Regularly checking in on your budget helps you spot any overspending and adjust as needed. This flexibility keeps your budget in sync with your goals and ensures it stays effective.

When you need to review your budget, start by looking at your current financial situation: Are there any new expenses or changes in income? Identify any areas where costs have crept up or where you could save a bit. Shifting funds around as needed, whether for essentials or savings, can help you stay financially stable without stress. If you’re proactive, you can stay in control of your finances and make adjustments whenever necessary, with less stress.

Identifying unnecessary expenses

One of the best ways to keep your budget in balance is by identifying unnecessary expenses. Take some time to go through your spending habits and sort out what you actually need from the things you simply want.

Some common areas of overspending include:

Dining out and takeout

Subscriptions

Impulsive clothing shopping

By reviewing these areas, you may spot some easy opportunities to save. For example, cutting down on takeout or streaming services can free up money for your savings or even for paying down debt. Be more mindful of these extras so you can make smart decisions about where to cut back and create a budget that supports your goals.

Making necessary changes

Making adjustments to your budget doesn’t have to be overwhelming. Once you’ve found some areas for improvement, you can make practical changes to your spending.

This could mean cutting back on non-essential expenses or finding more affordable options for the things you need. For instance, try shopping around to see if you can get your insurance for a lower rate.

You could also consider ways to bring in a bit more income, such as picking up a side hustle or selling old items you no longer need.

Small adjustments can make a big difference over time, and being proactive will help you make sure that your budget always reflects your present financial situation and goals.

Staying accountable

Setting goals and creating a budget that supports them is all good and well, but you still need to act on your plans. Staying accountable is a key piece of this puzzle.

When you hold yourself responsible for your financial choices, you’re much more likely to stick to your budget and reach your goals.

There are many ways to keep yourself on track, such as:

Sharing your budget with a partner or friend

Doing weekly budget check-ins

Removing the temptation to overspend (unsubscribe from promotional newsletters)

Rewarding yourself for reaching milestones

Building consistency and discipline will help you stay financially stable over time. By staying accountable, you can make decisions that support your goals while avoiding the pitfalls of overspending.

Sharing your budget with a partner

Sharing your budget with a partner or trusted friend can be a great way to stay accountable. By opening up about your financial goals and budget, you get a built-in support system to encourage you to stay on track.

It helps if your accountability partner shares their financial journey with you as well. This kind of partnership makes room for open conversations about any financial challenges or changes that may come up for either of you so you can work through them together. You’ll both be involved in the process, whether it’s deciding how to save or where to cut back, making it easier to stay disciplined.

Plus, sharing your budget brings transparency to your financial goals, helping you both stay focused and committed.

Reviewing your budget regularly

Whether or not you decide to find a financial accountability partner, it’s still essential that you review your own budget on a regular basis.

By taking the time to review your financial plan, you’ll be able to spot any inconsistencies or areas where you’ve veered off track so you can make adjustments.

Set aside some time each month to go over your total income, spending, and savings, making sure everything lines up with your goals. This is also a good time to account for any recent changes in income or expenses.

More regular (such as weekly) check-ins will help you stay on top of your present financial situation and help you make sure your spending is on track for the month.

Staying on track with your budget, sustainably

Sticking to a budget and avoiding overspending takes a mix of discipline, awareness, and dedication to your financial goals. When you take the time to understand your budget, track your spending habits, set realistic goals, and make the necessary adjustments, you’ll find yourself on the path to financial stability and peace of mind.

Keep in mind that budgeting isn’t a one-time task; it’s an ongoing project that needs regular check-ins and tweaks along the way. But if you stay proactive and adaptable, you’ll be well-equipped to meet your financial objectives without any hassle.

If you're looking for more tips on budgeting and financial planning, explore Albert’s full range of features to find the perfect solution for your needs. It could be just what you need to streamline your budgeting process.

⚡️Make budgeting easier with Albert. Start today and take control of your financial future!