Sticking to your budget when shopping doesn't have to be difficult. When you consider what can help you meet your budget while shopping for important items, a little planning goes a long way. Simple habits like making a shopping list, comparing prices online, buying in bulk, and taking advantage of loyalty programs and promotions can all add up to making it easier for you to stick to a plan and spend mindfully.

With some organization, strategy, and using an app for budgeting, managing a budget without compromising on getting what you need will be absolutely feasible.

Understanding your budget

Creating a budget that works for you starts with knowing how much money you have and where it needs to go. By understanding your income and expenses, you can prioritize your needs and still allocate some money toward your wants without overspending. This approach will help you stabilize your finances and show you how to stay within your means.

Setting realistic spending limits

To avoid overspending, calculate your monthly income after taxes and list out your essential expenses. These would be things like rent, utilities, and groceries. What’s left over can be allocated to non-essential purchases, but be sure to set a spending limit so you have money leftover to go towards debt repayment and savings.

Example: If you earn $3,000 per month and your essential expenses add up to $2,200, you’ll have $800 left. You might allocate $300 of that for shopping and then save the remaining $500.

Albert’s automatic budgeting features make this even easier by helping you track all your expenses, monitor your bills, and set spending limits without the hassle.

Analyzing essential vs. non-essential purchases

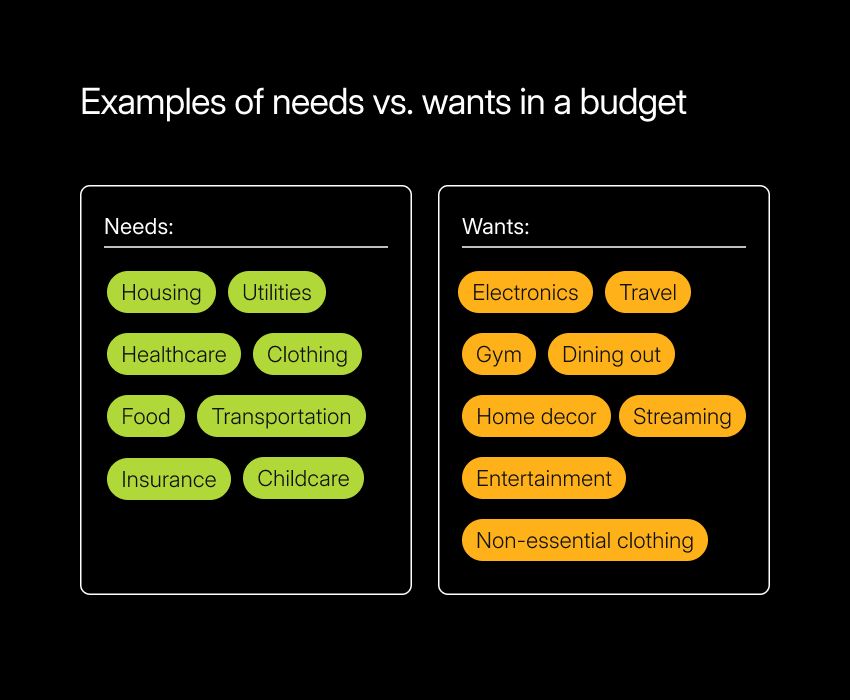

Distinguishing between your needs and wants is key to staying on budget. Every month, you’ll be spending money on essentials as well as things that are simply nice to have. Knowing the difference will help you track your spending habits more carefully.

Essentials include things like work clothes or household supplies. Non-essentials might be a new smartwatch or a new vase for your living room. Both of these kinds of expenses are okay, but focusing on what you need helps you make sure your money is going toward what matters most.

Take time to evaluate each item you’re thinking of buying and ask yourself if it’s truly necessary or just a nice-to-have. Albert’s simple budgeting feature categorizes your expenses for you, giving you a clear view of where your money is going so you can adjust your habits if needed in order to reach your financial goals.

Smart shopping strategies

Once you've set a realistic budget, the next step is to stick to it and shop wisely. Smart shopping is about more than just spending less; it’s about being mindful of what you buy and how you approach your spending. Smart shopping strategies can help you get everything you need without going over your budget, which is essential for financial stability in the long term.

Compare prices

Price comparison is one of the easiest ways to save money. Before making any purchase, check for the same item in different stores and see where you can get the best deal. With a quick web search, you can compare prices in just a few clicks. You might be able to find the same items at varying prices across stores because of sales or promotions.

Consider using price comparison websites or apps that can help you track down the best prices. Many stores offer price-matching policies, so don't hesitate to ask if a specific retailer will match a competitor's price if you show them proof of a lower price available. Some time spent on thorough research could lead to substantial savings.

Using coupons and discounts for substantial savings

Coupons and discounts are a great way to save. Many retailers offer digital coupons on their websites or apps, and signing up for newsletters can also get you access to exclusive deals.

Watch out for seasonal sales or clearance events where discounts are even steeper. This is an especially good idea when you’re planning for a large, unusual purchase. Some retailers offer loyalty programs that can also help you spend less by offering points or rewards that can translate into future savings. Make the most of these loyalty programs and any other opportunities you come across to cut costs without sacrificing what you need and want.

Buying in bulk when appropriate

Buying in bulk can be a great way to save money, especially for non-perishables. When you buy in larger quantities, you usually pay less per unit, which means your dollars are stretching further. This is an excellent way to save money on items you would have bought anyway.

It’s still important to ensure these items won’t go to waste. Check your storage space and consider how many of the items you’ll really use before you make a big bulk purchase.

Things like toiletries, cleaning supplies, and canned goods are usually good candidates for bulk buying, and you can take advantage of warehouse clubs and wholesalers for even better deals.

Planning your shopping trip

Good planning is key to sticking to a budget. Organizing your shopping trip ahead of time will help you avoid unnecessary purchases and get the most out of both your time and money. When you’re prepared, you can focus on what you actually need and avoid distractions that lead to overspending.

Creating a shopping list

A shopping list might sound like a basic solution, but it’s incredibly effective. It helps you stay focused on what you need and steer clear of impulse buys. Before you head to the store, write down everything you plan to purchase. If possible, group similar items together on your list to make the trip quicker and more efficient.

Having a list also saves you time since you won’t wander the aisles trying to remember what you need. Stick to the list, and if you’re tempted by something not on it, pause and think about whether it’s really necessary. This approach will help you stay on track with your budget.

Deciding the best time to shop

Timing is everything, and when you shop can matter almost as much as what you shop for. Shopping during sales events – like Black Friday, holiday promotions, or end-of-season sales – can lead to substantial savings. Some stores also offer discounts on specific days of the week, so it pays to do a little research.

Planning your trip around these deals can help you stretch your budget further. Plus, shopping early in the morning or during the week can help you avoid crowds, making it easier to focus on making better purchasing decisions. Being strategic about timing is an easy way to shop smarter.

Leveraging technology for saving money

Technology can be a game-changer when it comes to sticking to your budget. There are plenty of apps and tools designed to help you save money and stay organized. By using tech to your advantage, you can make smarter choices and keep a close eye on your spending.

Using shopping apps

Shopping apps are often great price comparison tools. They might help you find digital coupons or let you know when something you want has gone on sale so you can get the best deal. Many retailers offer exclusive deals through their apps that you won’t find anywhere else, so it’s worth downloading the ones where you find yourself spending regularly.

Cashback apps are another great tool that can help you save. These apps give you a percentage back on whatever you buy, and over time, those small rewards add up to something you can use for another purchase.

Tracking your spending

If you really want to stick to your budget, you need to keep an eye firmly on where your money is going each month. Expense tracker apps allow you to monitor your spending in real time so you can catch any issues right away. They’ll break down your purchases by category, highlight spending patterns, and let you know when you’re getting close to your budget limits.

Regularly reviewing your spending gives you the insight needed to adjust your habits if necessary. Albert's spending tracking feature gives you a clear picture of all your financial activity by bringing all your transactions together in one place, making it easier to make smart financial decisions and avoid overspending.

Avoiding common pitfalls

Even with the best planning, it’s easy to slip up and overspend. Recognizing and avoiding common pitfalls can help keep your budget on track. By staying mindful of these challenges, you can shop confidently and avoid unnecessary financial strain.

Steering clear of impulse buys

Impulse purchases can quickly throw your budget off kilter and leave you feeling stressed and strapped for cash. Impulse buys are those unplanned purchases made on a whim when something in a store grabs your attention. They’re hard to avoid altogether, but it’s possible with self-discipline and a plan.

The best way to avoid impulse buying is to stick to your shopping list and steer clear of sections or aisles that don’t relate to what you need. Additionally, avoid browsing online stores when there’s nothing specific you need – boredom shopping can easily lead to buying things you don’t really need.

If you’re an impulse shopper by nature, a simple trick is to wait 24 hours before buying anything that wasn’t planned. Take this time to think about whether you really need it or if it’s just a passing desire. Albert’s budgeting feature can also send you alerts when you’re nearing your spending limits, helping you stay focused.

Watching out for hidden costs

Hidden shopping costs, like taxes, fees, and shipping charges, can quickly inflate the final price of an item, especially when you’re shopping online. Always double-check the total cost before completing any purchase to make sure the cost fits into your budget — surprise fees and all.

It’s also a smart idea to read the fine print if there is any – familiarize yourself with any return policies or warranty terms that could lead to unexpected expenses later. Staying aware of hidden costs can save you significantly down the line.

Staying on track with your budget

Sticking to your budget while shopping will always be easier when you plan ahead and shop mindfully. Understand your financial position beforehand, make lists, and take advantage of helpful tools so you can make smarter decisions that align with your financial goals.

Albert offers features that simplify budgeting, saving money, and spending to support you every step of the way.

Consistency and mindful choices are key. Remember, every dollar saved adds up and contributes to your overall financial well-being. With the right approach, shopping can be stress-free and an opportunity to rack up savings instead of a costly mistake.

⚡️ Learn how Albert can help you take charge of your finances and meet your personal goals.