When paying off debt, choosing the right strategy can make a huge difference. Two of the most popular approaches are the snowball method and the avalanche method. Each has its own strengths depending on your financial goals and personal preferences.

Both methods are effective, but finding the one that works best for you is key. Whether you need the motivation boost from the snowball method or the financial efficiency of the avalanche method, both paths can help lead you to debt freedom.

Understanding the basics of debt repayment

Breaking your debt down into clear, manageable steps can make it easier to handle. This is why different debt repayment strategies exist. The snowball and avalanche methods provide a structured way to reduce your balances and regain control over your finances.

Debt can come from many sources, like credit cards, student loans, medical bills, or personal loans. No matter the source of your debt, creating a plan to pay it off is essential. Not only will this help you reduce financial stress, but it’ll also improve your credit score and overall financial health.

Interest rates play a major role in how much you end up paying. The higher the interest rate, the more you’ll pay over time. That’s why understanding your interest rates and the total balance of your debts is crucial for selecting the right strategy.

Creating a realistic budget is an important first step when you want to pay off your debt. Try to allocate some of your income specifically for debt repayment to keep yourself on track. A budgeting app like Albert can make this easier by helping you track your spending, set up custom budgets, and automatically categorize transactions. You can tackle your debt more effectively when you have the right tools and strategies in place.

Finally, building strong financial habits like regularly reviewing your statements, setting spending limits, and cutting unne

cessary costs can help keep you focused and organized as you work toward becoming debt-free. With the right combination of budgeting and a solid repayment strategy, you can make steady progress toward financial freedom.

The snowball method

The snowball method is a straightforward debt repayment strategy that focuses on paying off debts from the smallest t

o the largest balance without considering interest rates.

The idea is to build momentum with quick wins early in the process, making it easier to stay on track.

How the snowball method works

To start, list your debts from smallest to largest balance. Keep making the minimum payments on all your debts to avoid late fees.

Then, direct any extra funds toward the smallest debt. Once that’s paid off, add the amount you were putting toward it to the minimum payment for the next smallest debt. This creates a snowball effect, with your payments growing as each debt is eliminated.

For example, say you have three debts: $500, $1,000, and $2,000. You’ll focus on paying off the $500 first. After it's gone, you take the amount you were paying on it and add it to the payment for the $1,000 debt. This speeds up the repayment process, helping you clear the second debt faster. Your momentum increases as each debt is paid off, which helps keep you motivated and on track.

The snowball method focuses on emotional motivation — small wins keep you engaged and committed to your goal.

This method works well for those who thrive on visible progress and need encouragement to stay consistent with their debt repayment.

Pros and cons

Like any strategy, the snowball method has its advantages and disadvantages. Here’s a breakdown of what to consider:

Pros:

Boosts motivation: Paying off smaller debts quickly can give you a sense of accomplishment and encourage you to keep going.

Simplifies focus: Since you’re working on one debt at a time, staying focused and organized is easier.

Reduces stress: Early wins can ease anxiety and keep you moving forward.

Cons

:

May increase interest costs: Since you’re not prioritizing higher-interest debt, you could end up paying more in the long run.

Potentially longer repayment period: Depending on the size of your debts, this method may take longer to pay off everything.

Not ideal for large debts: Large debts with high interest rates could cost more if they’re not tackled sooner.

The Avalanche Method

The debt avalanche method is a debt repayment strategy focusing on paying off debts with the highest interest rates first.

This approach helps you minimize the total interest paid over time, potentially saving you money and speeding up your path to becoming debt-free.

How the avalanche method works

To use the avalanche method, start by listing all your debts, from the highest interest rate to the lowest. Continue makin

g minimum payments on each debt to avoid penalties.

Then, direct any extra funds toward the debt with the highest interest rate. Once that debt is paid off, move on to the one with the next highest interest rate, and apply the same strategy.

For example, say you have three debts: one with an 18% interest rate, one at 12%, and another at 7%. You’ll focus on paying off the debt with the 18% interest rate first.

By eliminating the high-interest debts early, you’ll reduce the amount of interest accumulating over time, which can lead to significant savings and a faster debt repayment process.

This method is all about financial efficiency. While it may take longer to see individual debts eliminated, the overall repayment period can be shorter, and the total interest paid will be much lower. This method requires discipline and patience, as it may feel slower at the start compared to other strategies like the snowball method.

Pros and cons

The

avalanche method offers a different set of advantages and challenges. Here’s a breakdown:

Pros:

Saves money on interest: You’ll pay less interest overall by tackling high-interest debts first.

Faster overall debt elimination: This strategy can shorten the time it takes to pay off your debt.

Maximizes financial efficiency: Your payments are applied where they will have the biggest impact on reducing your debt.

Cons:

Less immediate satisfaction: It may take longer to pay off individual debts, making progress slower.

Requires careful tracking: You’ll need to monitor interest rates and payments more closely.

Demands discipline: It can be harder to stay motivated without the small wins that come with the snowball method.

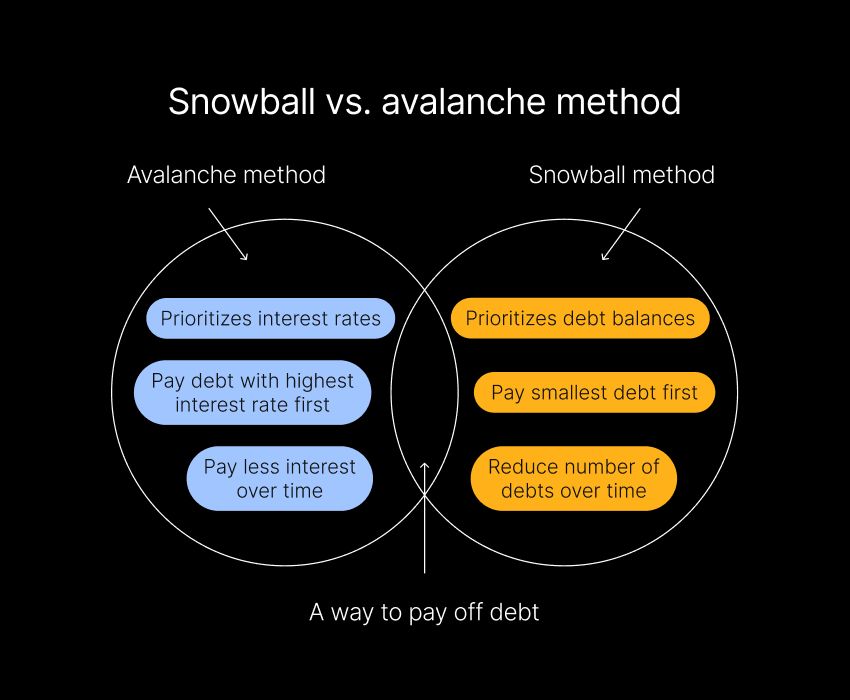

Comparing the snowball and avalanche methods

Choosing between the snowball and avalanche methods depends on your personal preferences, financial situation, and goals. Both strategies can help you pay off debt, but understanding their key differences is important when deciding which works best for you.

The main difference between these two methods is how they prioritize debt:

Snowball method: Focuses on paying off debts starting with the smallest balance, regardless of interest rates. This method helps build momentum through quick wins.

Avalanche method: Focuses on paying off debts with the highest interest rates first, helping you save money on interest and pay off debt more efficiently.

Motivation plays a big role, too:

Snowball method: This can motivate you by clearing smaller debts first, which can incentivize you to keep going.

Avalanche method: It may feel slower at first because higher-interest debts often have larger balances, but it's more efficient in the long run.

The financial impact also differs:

Snowball method: This could result in higher total interest payments over time since it ignores interest rates.

Avalanche method: Typically saves more money by reducing the total interest paid, shortening the overall time it takes to become debt-free.

Which method saves more money?

From a purely financial standpoint, the avalanche method saves you more money by addressing high-interest debts first. This reduces the total interest you pay over time and helps you become debt-free faster.

However, if staying motivated is a challenge for you, the snowball method might be a better fit. The satisfaction of paying off smaller debts quickly can keep you engaged and motivated, ultimately helping you stick with your plan and pay off all your debt.

How to choose the right method for your financial situation

Everyone is different, and the right strategy for you depends on your unique financial situation, goals, and motivation. It’s not a one-size-fits-all approach — what works for one person might not work for another. Here's how to find the method that fits you.

Assess your debt

Start by taking a close look at all your debts. List the balances, interest rates, and minimum payments for each to get a clear snapshot of where you stand.

When reviewing your debts, consider the total amount you owe, how much interest each debt will cost over time, and whether the debts are secured (like home or auto loans) or unsecured (like credit cards). Additionally, think about whether the interest rates are fixed or variable.

Knowing these details helps you decide which strategy could work best. If your high-interest debts are making the total repayment amount balloon, the avalanche method might save you more money in the long run. If your debts are smaller with lower interest rates, the snowball method might motivate you to keep going.

Personal financial goals

Your personal goals and financial habits should also factor into your decision. Consider your motivation style — do you find it easier to stay on track by celebrating small victories, or can you stay focused on long-term gains without immediate rewards?

Consider whether saving on interest is more important than gaining motivation from knocking out small debts. Also, consider any future plans, like buying a home or saving for retirement, that could influence how quickly you want to pay off your debts.

Consider using tools like Albert’s investing features to help you balance debt repayment with your investment goals. Paying down debt is important, but keeping an eye on the future growth of your investments — helps ensure your overall financial health.

Tips for successfully paying down debt

No matter which repayment method you choose, certain practices can make your debt payoff journey smoother and more successful. These tips will help keep you on track and reach your financial goals more efficiently.

Stay motivated

Staying motivated is key to staying committed over the long term. Some strategies to help keep your momentum going include setting clear milestones to break the process into smaller, achievable goals and celebrating progress when you hit those milestones.

Tracking your progress visually through charts or apps can also provide a sense of accomplishment. Building a support system by sharing your goals with friends or family can also keep you accountable and motivated.

Albert makes setting financial goals and tracking debt repayment progress easier. The visual tools help you keep track of your spending to see how far you’ve come, giving you that extra motivation to keep moving forward.

Avoid common missteps

There are a few common pitfalls that can slow down debt repayment efforts.

One of the biggest is unnecessary spending. Sticking to a realistic budget is crucial to avoid overspending.

It's also important to budget money for emergencies – unexpected expenses could force you back into debt.

Make sure you automate your debt payments whenever possible to avoid missing any and stay flexible by being prepared to adjust your plan if life circumstances change.

Making the right choice for your debt repayment strategy

Becoming debt-free is a major financial milestone that requires focus and the right strategy.

Both the snowball and avalanche methods are effective ways to tackle debt. By understanding how each method works and evaluating your personal financial situation, you can choose the one that best fits your goals and motivation style.

The goal is to regain financial freedom, and no matter which method you choose — whether it's the motivation-driven snowball or the interest-saving avalanche — the key is consistency and discipline. Tools like Albert can help you stay on track by offering budgeting assistance, spending tracking, and personalized guidance.

⚡️Try Albert today and take action toward a debt-free future.