Stuck without loan options? Don't panic. Your financial lifeline isn't just about borrowing — it's about creative problem-solving and resourcefulness.

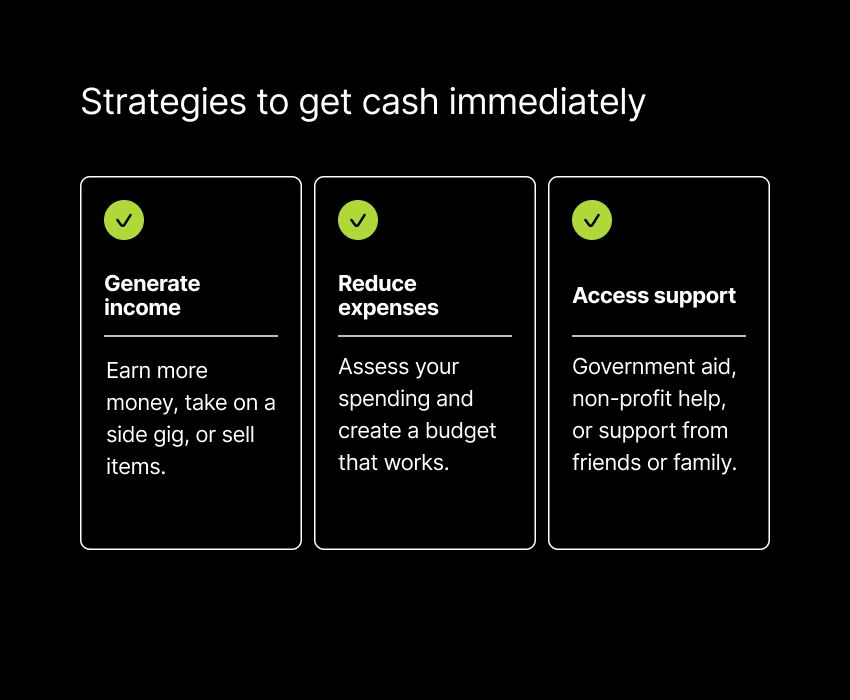

Immediate cash strategies fall into three key categories: generating income, reducing monthly expenses, and accessing support resources. All of these could be a potential solution to your financial needs.

The goal isn't just surviving this moment. It's building a more resilient financial foundation. Each step you take is a move toward greater financial control and confidence.

Understanding your financial situation

When money’s tight, knowing exactly where you stand is key. Start by reviewing your income, expenses, debts, and assets. This clear snapshot will help you pinpoint where to cut back, where to adjust, and what to prioritize. It’s the first step to making smarter decisions and taking control of your finances.

Assess your immediate needs

Start by identifying your most urgent financial priorities. Focus on essentials like rent, utilities, and groceries — bills that can’t wait.

If certain expenses can be delayed without serious consequences, set them aside for now. Prioritizing necessities ensures that you’re addressing what matters most.

It’s also worth reaching out to service providers to ask about payment plans or extensions. Many companies are willing to work with customers who communicate their situation. By taking these steps, you can ease short-term financial pressures and create a plan to move forward.

Create a budget that works

Once you’ve addressed your immediate needs, build a budget to take control of your finances.

Start by listing your income sources — whether it’s wages, benefits, or side gigs — then break down your expenses into essentials and non-essentials. This can help you spot areas where you can cut back and free up money for what matters most.

Budgeting tools can make this process easier. For example, Albert offers automated features that track your spending, monitor bills, and help you create a custom budget based on your habits. With a clear plan in place, you’ll feel more prepared to handle financial challenges, even when borrowing isn’t an option.

Alternative ways to access cash quickly

If traditional loans aren’t an option, you can still get the funds you need without adding to your debt.

Exploring these alternatives can help you navigate challenging times while building financial resilience for the future.

Borrow from friends or family

Asking loved ones for financial help can feel daunting, but it’s often a practical solution. This is often a better route than a traditional personal loan, as you may be able to avoid interest and strict monthly payments. Approach the conversation with honesty — explain your situation, how much you need, and how you plan to repay them.

To avoid misunderstandings, consider setting a clear loan agreement in writing, such as repayment timelines or small installments. Borrowing money from someone you trust means skipping formalities like credit score checks and high interest rates, and it can foster deeper trust and support within your relationships.

Albert’s Instant Advance feature

Albert’s Instant Advance feature is another option for fast cash without the high fees. It allows you to access up to $250 if you qualify. Unlike payday loans, your credit history won't hinder you as there’s no credit check, and you won’t pay high interest rates or late fees.

This can be a great option for managing unexpected expenses without getting stuck in a cycle of debt. Plus, you can choose automatic repayment to have the cash advance automatically deducted from your bank account, keeping the process simple and transparent.

Sell unused items

Sometimes, quick cash is sitting right at home. Look around for items you no longer use — electronics, furniture, clothing, or even collectibles — and sell them online.

Platforms like Facebook Marketplace, Craigslist, or eBay make it easy to connect with local buyers. High-quality photos and clear descriptions will help you sell faster. This method provides immediate funds and declutters your space, creating a more organized and stress-free environment.

Explore community resources

Local organizations and non-profits are valuable allies during financial challenges. Food banks, churches, and charities often provide essentials like groceries and clothing or can help with utility bills at no cost.

Community centers may also offer financial counseling, job placement programs, or assistance with other expenses. Reaching out to these resources can provide immediate relief while connecting you with supportive networks that understand your situation.

Side gigs and part-time jobs

When loans aren’t an option, picking up side gigs or part-time work can provide a quick boost to your income. Many of these opportunities offer flexibility and short-term commitments, making them ideal for addressing immediate financial needs. Plus, they can help you develop new skills and experiences that may benefit you in the future.

Quick freelance work

Freelancing lets you use your skills to earn money on short-term projects. Platforms like Upwork, Fiverr, and Freelancer connect you with clients seeking writing, graphic design, programming, or administrative support.

By setting up a strong profile showcasing your abilities and experience, you may be able to secure some additional work. Payments are often made once projects are complete, ensuring a relatively fast turnaround for your efforts.

Beyond immediate income, freelance work can also help you expand your portfolio and build professional connections, opening doors to ongoing opportunities.

Odd jobs in your area

Doing odd jobs is another effective way to earn fast cash. Babysitting, pet sitting, house cleaning, lawn care, or running errands are always in demand locally.

Platforms like TaskRabbit or community boards can help you find people looking for help with one-time or ongoing tasks. These jobs typically pay immediately and allow you to choose when and how much you work.

Selling handmade goods or services

If you’re creative or skilled in crafting, consider selling handmade goods or services to generate extra income. Platforms like Etsy or social media marketplaces allow you to reach a broad audience for items like jewelry, art, or customized gifts.

Additionally, depending on your expertise, you can offer services such as event planning, photography, or tutoring. Promoting your offerings locally or online can help you quickly connect with buyers or clients, bringing in additional cash while allowing you to showcase your talents.

Government assistance programs

Government assistance programs are a lifeline for individuals and families experiencing financial challenges. These initiatives offer temporary relief, helping you manage your essential expenses and regain stability without relying on loans. Knowing what’s available and how to apply is the key to making the most of these resources.

Apply for emergency aid

Federal, state, or local emergency aid programs provide support for critical expenses like housing, utilities, and medical expenses.

For example, programs like Temporary Assistance for Needy Families (TANF) are designed to assist low-income families with children. Eligibility typically depends on factors such as income, family size, and your specific hardships.

The application process usually involves submitting forms and proof of your financial situation, which can take time but is well worth the effort. The relief these programs offer can help you manage immediate challenges without falling into debt.

Check government websites or contact local social services offices to explore your options.

Food banks and shelters

Food banks and shelters also provide crucial resources to help ease financial burdens.

Food banks supply free groceries, ensuring access to nutritious meals and reducing a family’s monthly costs

Shelters offer temporary housing solutions for those at risk of eviction or homelessness, often including additional services like meals, clothing, and counseling.

Local community action agencies frequently coordinate these services and can direct you to other support programs in your area. Using food banks or shelters addresses your immediate needs and connects you with broader support networks during tough times. These resources are here to assist; seeking help is a responsible way to protect your well-being and move toward stability.

Managing financial stress

Financial struggles can weigh heavily on your mental health, and that also matters. Use these simple strategies to reduce stress and stay focused:

Practice mindfulness:

Try deep breathing, meditation, or guided imagery to reduce anxiety.

Apps like Calm or Headspace offer quick, guided exercises.

Get moving:

Physical activity, like walking or yoga, boosts mood and relieves stress.

Even 10 minutes a day can help clear your mind and improve focus.

Lean on your support system:

Talk to friends, family, or support groups for encouragement.

Consider a financial counselor or therapist for professional guidance.

By taking care of your mental and physical health, you’ll stay better equipped to handle financial challenges with clarity and confidence.

Moving forward with financial stability

Facing financial challenges without access to loans can feel overwhelming, but it’s important to recognize that there are practical ways to regain control and build long-term stability. By taking the time to understand your financial situation, assess your immediate needs, and create a budget, you can begin to manage your finances more effectively.

With the right tools, such as Albert’s all-in-one money app, you can streamline budgeting, ways to find savings, and even accessing quick cash advances without needing traditional loans. This approach isn’t just about getting through a challenging moment — it’s about building habits and strategies that set you up for financial stability in the long term.

Remember, you don’t have to face financial hardships alone. With resourcefulness, the right support, and a proactive mindset, you can work through this period and emerge with greater control over your financial future.

⚡️ Take control of your money — try Albert today.