Financial success isn’t about how much money you have — it’s about having control over your finances so you can focus on what matters most in life.

By managing your income, expenses, savings, and investments effectively, you can reduce financial stress, handle life’s surprises, and work toward your biggest goals.

Understanding financial success

Understanding the true meaning of financial success is the first step to achieving it. In short, it means comfortably covering your daily needs, preparing for emergencies without added stress, and working toward long-term goals like owning a home or retiring on your own terms.

What does financial success mean?

This concept is all about control, security, and freedom. It means having enough to meet your daily needs, handle emergencies, and make steady progress toward long-term goals like homeownership, retirement, or travel. It’s less about the size of your paycheck and more about how you manage your money.

The concept is also personal — for some financial success means being debt-free, while for others, it involves building investments or creating passive income streams. Whatever your goals, success starts with making intentional choices and taking practical steps, like budgeting, saving, and planning ahead.

Key elements:

Being prepared: Having an emergency fund for unexpected expenses.

Setting goals: Knowing what you want to achieve financially and having a clear plan to get there.

Building smart money habits: Tracking spending, sticking to a budget, and making informed financial decisions.

Using the right tools: Budgeting apps and expense trackers make managing money easier and more effective.

Why is financial success important?

Achieving your version of financial success can directly impact your overall well-being. When you’re financially stable, you’ll likely experience less stress, leading to better mental and physical health.

Financial security allows you to enjoy life, pursue your passions, and take advantage of opportunities without being held back by money worries.

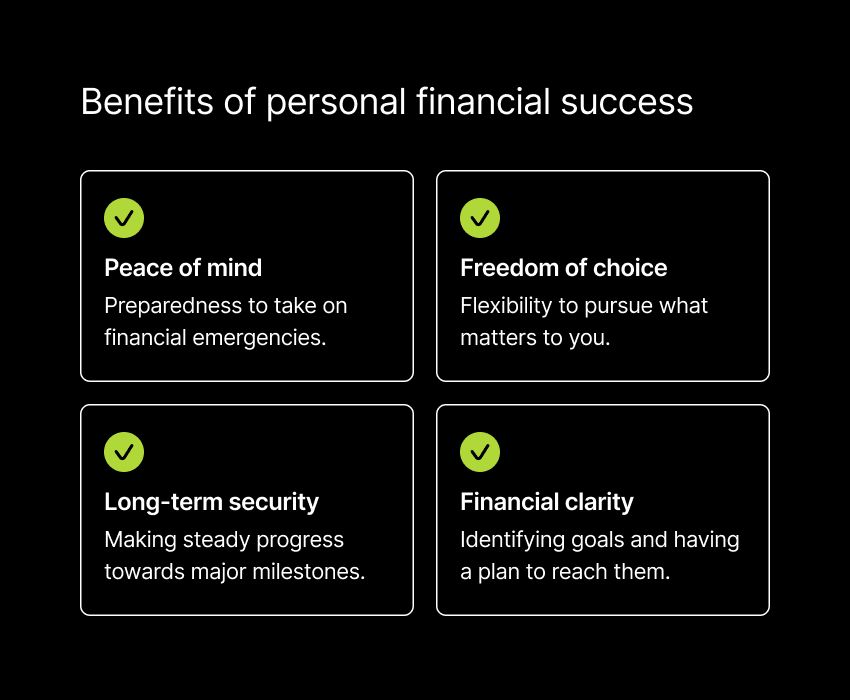

Benefits:

Peace of mind: Knowing you’re prepared for emergencies reduces stress and worry.

Freedom of choice: Financial stability gives you the flexibility to pursue what’s important to you — whether that’s traveling, starting a business, or furthering your education.

Long-term security: Building savings and investments helps you prepare for big milestones and retirement.

Setting financial goals

Setting clear financial goals will help you determine what financial success means for you and how to achieve it. Goals give you direction, keep you motivated, and help you focus on what matters most.

By identifying some short-term and long-term objectives for your finances, you can create a plan that aligns with your priorities and guides your decisions.

Here’s how to define your goals and set yourself up for success.

Short-term vs. long-term goals

Financial goals generally fall into two categories: short-term and long-term.

Short-term goals are those you can achieve in a year or two, like building an emergency fund, paying off smaller debts, or saving for a large purchase. These provide quick wins and create momentum toward larger milestones.

Long-term goals take more time and commitment — often years or decades to achieve. Examples include saving for retirement, buying a home, or reaching financial independence. These goals require consistent saving, strategic planning, and patience.

Understanding the difference between these two types of goals will help you allocate your resources in a way that makes sense for you. Consider your current financial situation and balance your short-term needs with long-term aspirations so you can cover immediate priorities while staying focused on the bigger picture.

How to prioritize your financial goals

Not all goals carry the same weight, so prioritization is key. Start with these steps:

List and categorize your goals. Identify all your financial goals and separate them into essential and optional categories. Essential goals include building an emergency fund or saving for retirement, while optional ones might involve leisure activities or non-critical purchases.

Evaluate time frames and resources. Consider how much time and money each goal requires. For instance, high-interest debt should often take priority since it can derail progress toward other goals.

Create a realistic budget. Use your budget to allocate funds toward your goals. Tracking your income and expenses clarifies how much you can set aside for savings or investments.

Seek advice. Financial experts can provide guidance, helping you prioritize effectively and stay on track.

Stay flexible. Life changes, and so do financial circumstances. Regularly review and adjust your goals to ensure they remain relevant and achievable.

Budgeting for financial success

Achieving any financial goals will be easier with a solid budget in place. This will help you clearly manage your income and expenses, giving you a better understanding of your spending habits and helping you spot opportunities to save.

Here’s how to create a budget that works for you and strategies to help you stick with it.

Creating a realistic budget

A realistic budget starts with knowing where your money is coming from and where it’s going.

Begin by tracking all sources of income, including wages, side gigs, or financial aid. Then, categorize every expense, from fixed costs like rent and utilities to variable ones like groceries, dining out, or streaming subscriptions. This full picture will help ensure that nothing is overlooked.

Once you’ve tracked your income and expenses, analyze your spending patterns to look for areas where you might cut back. Whether dining out less or finding lower-cost alternatives for everyday purchases, it’s important to set clear spending limits for each category to stay in control.

Using a budgeting app like Albert can simplify this process. Albert can help you track your expenses, categorize transactions, and offer real-time insights to make budgeting easier and more effective.

Finally, build in flexibility. Life is unpredictable, so include a buffer for unexpected expenses like car repairs or medical bills. Review your budget regularly to ensure it aligns with your financial goals and adjusts as your circumstances change.

Sticking to your budget

The real challenge can often be staying consistent. To stick to your budget, track your spending regularly and review it to confirm that it matches your budget. Adjust where needed to avoid overspending.

Setting up reminders can be helpful. Use calendar alerts or app notifications to track your bill payments and spending limits so you’re never caught off guard.

Automating savings is also an effective strategy. Arrange automatic transfers to savings or investment accounts — what’s out of sight is less likely to be spent.

Lastly, stay motivated by focusing on the payoff. Remind yourself why you’re budgeting: to reduce stress, achieve your financial goals, and enjoy long-term security.

With the right tools and mindset, your budget can become a powerful tool to manage your finances and build a financially secure future.

Saving and investing wisely

Saving and investing are key to building wealth and reaching your long-term financial goals.

Saving gives you a safety net for emergencies while investing gives your money the opportunity to grow over time.

Building an emergency fund

An emergency fund is money to cover unexpected costs like medical bills, car repairs, or sudden job loss. Financial experts recommend saving enough to cover three to six months of living expenses.

To build your emergency fund, allocate a portion of your income specifically for this purpose. Consistent, regular contributions — even small ones — add up over time. Keeping these funds in a separate, easily accessible account makes it simple to use when needed.

Automating your savings can make the process even easier. Set up automatic transfers to your emergency fund so you’re less likely to skip a contribution. Tracking your progress will help keep you motivated and give you a sense of accomplishment as you work toward your goal.

Building an emergency fund can offer you newfound financial security and peace of mind. It can help you avoid relying on credit cards or loans during emergencies, which can lead to debt. This is why prioritizing your emergency fund is such an important step toward achieving financial stability and success.

Basics of investing for beginners

Investing can help your money grow over time, which is crucial for building wealth. For those new to investing, understanding the basics is the first step. Basic investments include:

Stocks

Bonds

Mutual funds

Exchange-traded funds (ETFs)

Diversification is an important component of reducing investment risk. By spreading your investments across different assets, you can protect yourself from major losses if one investment underperforms.

When choosing your investments, it's important to consider your risk tolerance and time horizon — how long you plan to keep your money invested.

For beginners, starting small is perfectly fine. With compound interest, even modest investments can grow over time. To get started, look for investment platforms that offer educational resources to help you make smart choices and build your knowledge.

Managing debt effectively

Managing your debt effectively is crucial. When debt isn't managed properly, it can prevent you from saving and investing, leading to added financial stress.

Understanding different types of debt

Debt comes in many forms, including credit card debt, student loans, mortgages, and personal loans. Credit card debt typically has high interest rates and can quickly add up if not managed well. Debt like student loans and mortgages generally has lower interest rates and longer repayment terms.

To manage debt effectively, it’s important to understand the terms of each type, such as interest rates, repayment schedules, and penalties for missed payments. Prioritizing debts with higher interest rates — like credit cards — can save you money in the long run.

It’s also helpful to distinguish between good debt and bad debt. Good debt includes loans that contribute to your financial future, like a mortgage or student loan. Bad debt includes high-interest debt that doesn’t help you build wealth, such as credit card balances.

Strategies for paying off debt

Paying off debt requires a clear plan.

One effective approach is the debt snowball method, where you focus on paying off smaller debts first. This can help build momentum and keep you motivated.

Another strategy is the debt avalanche method, where you prioritize paying off high-interest debts first to save on interest costs.

Creating a budget with extra funds for your debt repayment is also key. You can make progress by reducing unnecessary spending and using those savings to pay down debt. Leaning on resources like a budgeting app will help you monitor your spending and keep you on track.

Keep in mind that debt consolidation is another option. Combining multiple debts into one loan with a lower interest rate can simplify payments and reduce interest charges. But before consolidating, make sure you consider any fees or potential impacts on your credit score.

Improving your financial knowledge

The more you understand personal finance, the better equipped you'll be to build a strong financial future. When you learn continuously, you’ll be able to make more informed decisions and handle your financial challenges and choices more confidently.

Learning personal finance basics

To take better control over your finances, start by learning the fundamentals — budgeting, saving, investing, credit management, and various financial products. Having a solid grasp of these concepts will help you make smarter choices and plan for your future.

There are plenty of ways to learn what you need to know. Books, online courses, workshops, and reputable websites are all great resources. Engaging with financial content regularly will help you keep your knowledge up-to-date and motivate you to stay on track.

Many financial apps also provide educational tools, articles, and tips that break down complex topics into simple, actionable advice.

When you continue to educate yourself, you'll feel more confident managing your finances and be prepared for changes in the financial landscape, whether that’s new laws or relevant shifts in the market.

Using financial tools and resources

Financial tools are very effective in helping you better manage your money. Budgeting apps, investment platforms, and financial calculators can give you insights that may be hard to see on your own. These tools can help you track your progress and make smarter, data-driven decisions.

Input from experts is another valuable resource to try and take advantage of. Many platforms offer access to financial experts who can provide personalized advice for your unique situation.

Regularly using these tools to review your financial data helps you stay on top of your financial health. By making adjustments as needed, you can stay on track toward your financial goals.

Planning for retirement

Starting your retirement planning early will help you build long-term financial security. Making consistent contributions as soon as you can will set the foundation for a comfortable, low-stress retirement.

The importance of early retirement planning

The earlier you start planning for retirement, the longer your money has to grow through compound interest. Investing early means your contributions have more opportunity to grow, which can potentially result in a larger retirement fund. Plus, starting early allows you to make smaller, more manageable contributions over a longer period of time.

Planning for retirement also involves thinking about how much money you’ll need to maintain your lifestyle in the future. Consider factors like your living expenses, inflation, and healthcare costs. The earlier you plan, the more flexibility you’ll have to adjust your strategy as your financial situation changes.

To make the process easier, you can automate your retirement contributions. Setting up regular transfers can help ensure you’re consistently saving for the future. Be sure to regularly check your retirement progress to stay on track toward your goals.

Choosing the right retirement accounts

Choosing the right retirement account is essential for meeting your financial goals. Here are the most common options and their key features:

Employer-sponsored 401(k):

Contributions are tax-deferred (taxes paid upon withdrawal)

Employers may match a portion of your contributions

Higher contribution limits than IRAs

Traditional IRA:

Contributions are tax-deductible, with taxes paid on withdrawals in retirement

Lower contribution limits than 401(k)s

Available to anyone with earned income

Roth IRA:

Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free

No required minimum distributions (RMDs) during your lifetime

Contribution limits apply based on income

Each account type has its own benefits, depending on your situation. Understanding how these accounts work will help you choose the best option for your retirement strategy. To maximize your savings, consider diversifying your contributions across different account types.

Protecting your financial future

Securing your finances against risks is another key part of financial planning and success. This involves getting the right insurance and protecting yourself from fraud and identity theft.

The importance of insurance

Insurance offers protection from unexpected events that can create significant financial strain. There are different types of insurance, including:

Health insurance: Covers medical expenses

Life insurance: Provides financial support to dependents in case of death

Disability insurance: Protects your income if you're unable to work due to illness or injury

Auto insurance: Covers damages and liabilities related to car accidents

Property insurance: Protects your home and belongings from loss or damage

To figure out what coverage you need, consider potential risks and the financial consequences of these events. Budgeting for adequate insurance coverage helps to protect you and your family against financial hardship.

Safeguarding against financial fraud

Protecting your personal and financial information is critical. Fraud and identity theft are challenges faced by more and more people in the digital age. Fortunately, there are security measures that can help you quickly catch unauthorized access and avoid additional loss of funds.

To be proactive, monitor your credit report and financial accounts regularly for suspicious activity, use strong, unique passwords for all accounts, and limit sharing of personal information. Set up alerts to notify you of any unusual transactions or activity in your accounts.

You can also consider using identity protection services. These services offer monitoring and fraud alerts, letting you know if something goes wrong.

Proactively protecting your financial health is an important step in maintaining financial stability. It helps you avoid the setbacks that come with fraud and helps to keep your accounts secure.

Achieving financial success, your way

Achieving financial success begins with a solid understanding of your personal finances.

You can work toward a more secure future by setting clear goals, making informed decisions, and consistently managing your money. This includes budgeting effectively to save for the unexpected, investing wisely, and protecting your financial well-being along the way.

Success is within reach with the right strategies, dedication, and consistency. By taking control of your financial journey, you can reach your goals and enjoy the peace of mind that comes with financial stability.

⚡️See how our finance experts at Albert can help simplify your budgeting journey.