Albert is not a bank. Banking services provided by Sutton Bank, Member FDIC. Albert Savings accounts are held for your benefit at FDIC-insured banks, including Coastal Community Bank, and Wells Fargo, N.A. The Albert Mastercard® debit card is issued by Sutton Bank, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

When you join Albert, you’ll set up an Albert Cash account and a 30 day trial as part of the sign-up process. Albert account holders will be charged a Genius account fee. Genius fees cost $12.49/month billed yearly or $14.99/month billed monthly. If you deactivate or close your account within 30 days of opening an account, you will not be charged the fee. The Genius fee will auto-renew until your account is deactivated or closed. Deactivate or close your account any time in the app.

With Instant overdraft coverage, eligible members can overdraw their Albert Cash account for ACH transfers, ATM withdrawals, debit card purchases, and other electronic transfers. Overdraft limits range from $25 to $250. The average approved overdraft limit is approximately $80 as of 11/1/23. Genius is required to access Instant overdrafts but you may cancel any time. Not all Genius customers will qualify for Instant overdraft. Fast transfer, ATM, and other applicable fees may apply. See app for details.

Early access to direct deposit funds depends on the timing of the payer’s submission of deposits. We generally post such deposits to Albert Cash accounts on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

Cash back rewards are subject to terms.

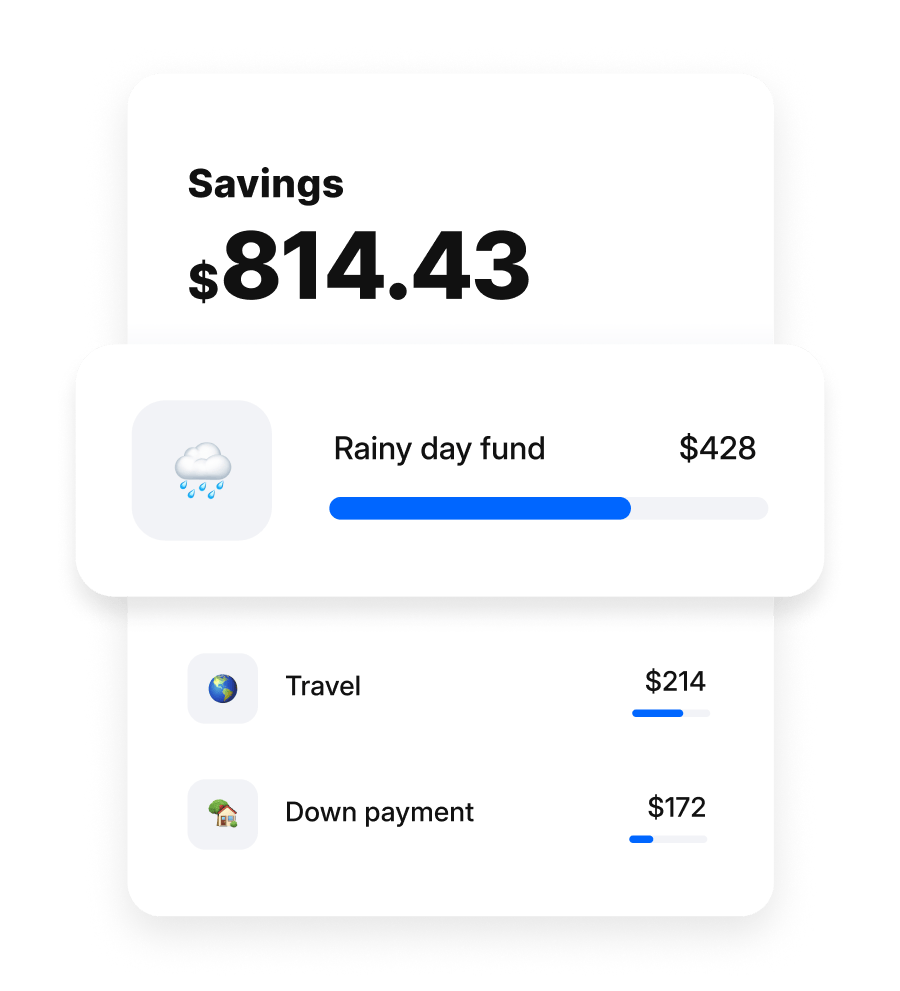

To be eligible for savings bonuses, you must have Genius and maintain a monthly average and ending balance of $10 or more. Bonuses for the month prior are paid by the 3rd of the following month.

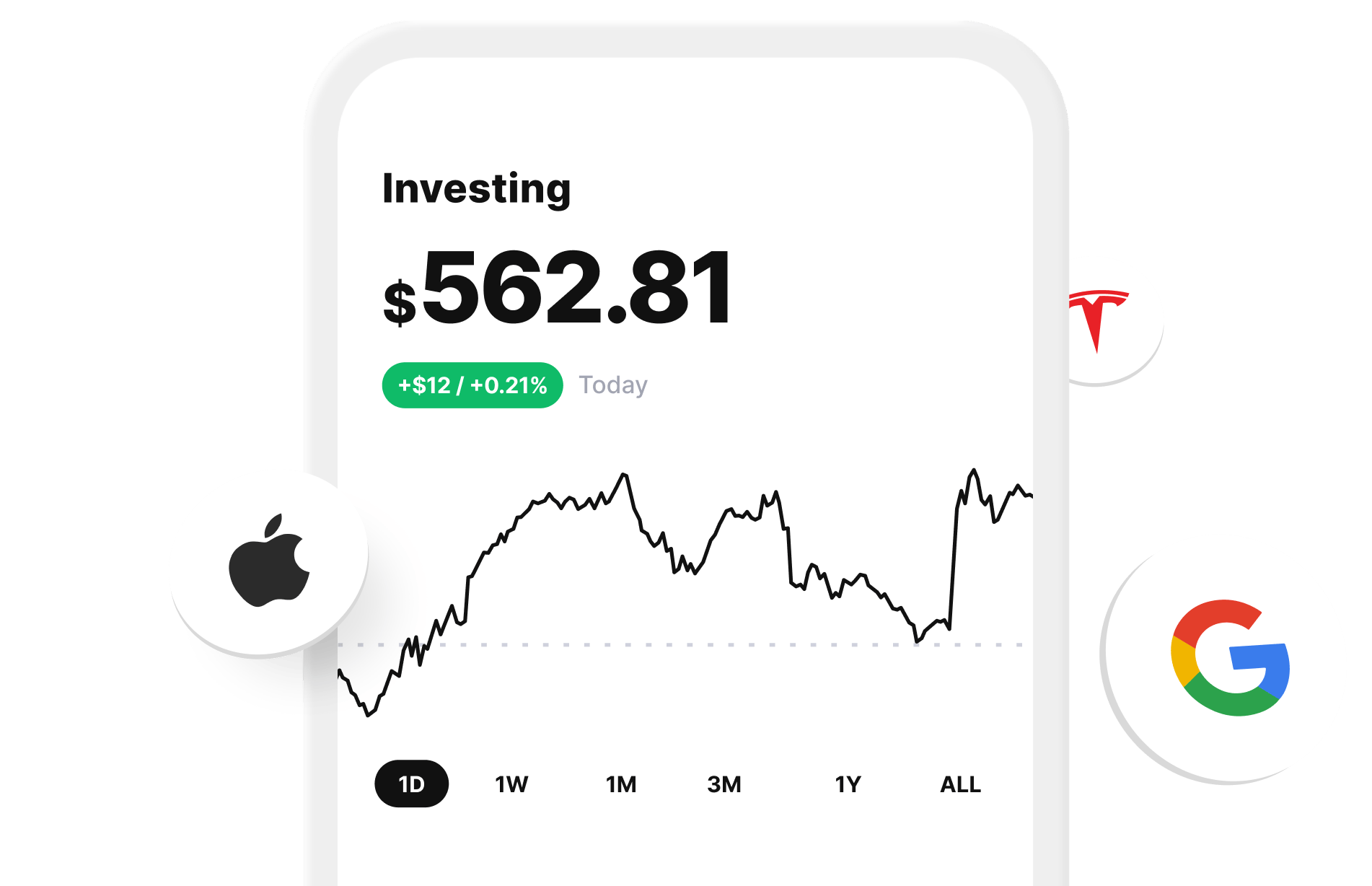

Investment advisory services are provided by Albert Investments, LLC, a Registered Investment Advisor. Brokerage services are provided by Albert Securities, LLC, Member FINRA/SIPC. Securities products are not FDIC insured or bank guaranteed, and may lose value. Additional disclosures available here.

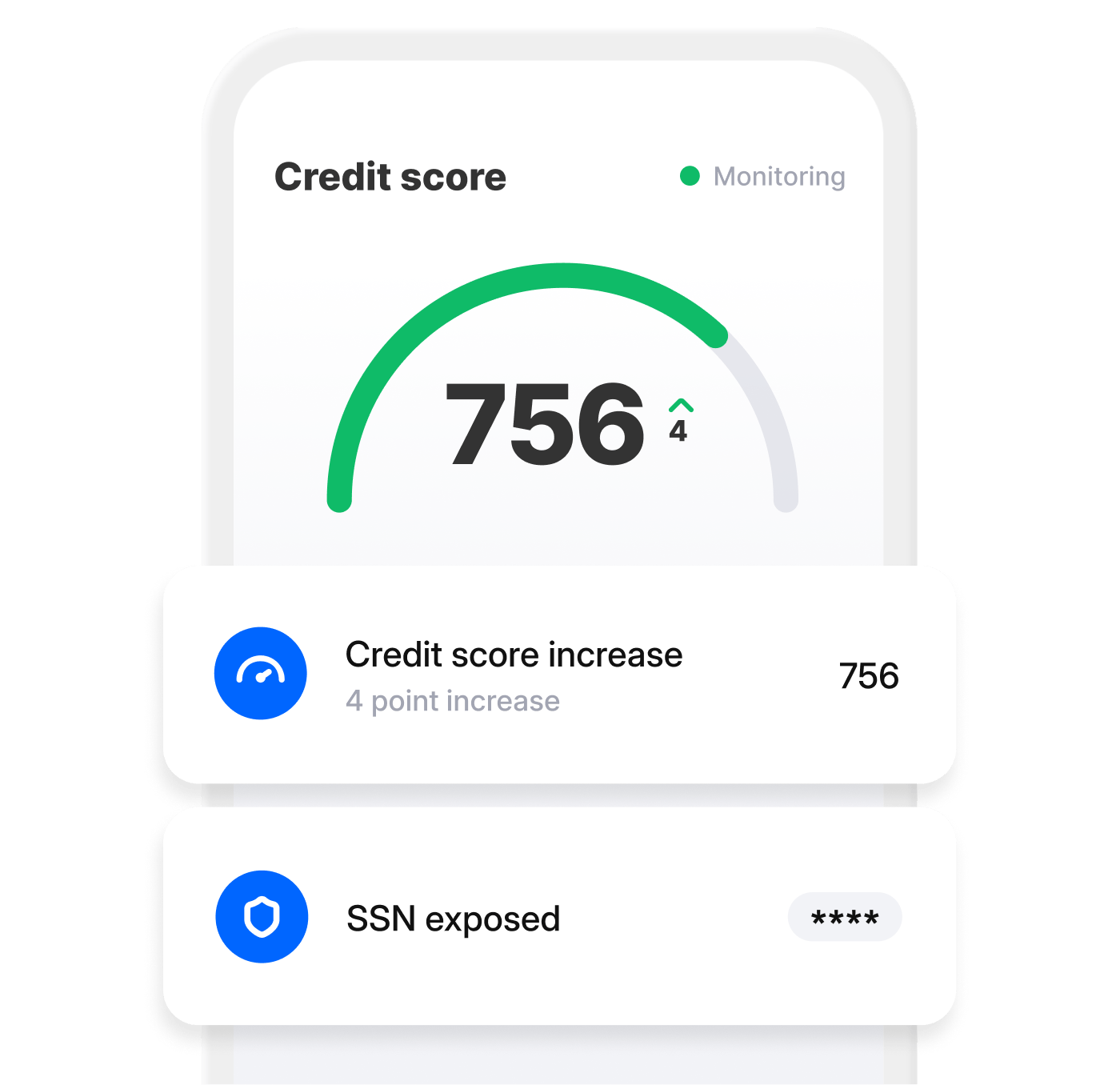

Credit score calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore 3.0. Click here to learn more.

All displayed trademarks and logos are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.

Any displayed trademarks or logos are the property of their respective owners and do not represent endorsements of any kind.

Please see our Terms of Use and Privacy Policy for more details.