Contrary to what you may think, managing your finances doesn’t have to feel overwhelming. Financial stability is most likely within your grasp; it just takes a little forethought, planning, and some clear goals.

Whether you’re saving for a vacation, building an emergency fund, or paying off debt, everyone needs something to work towards. When you know what you want to achieve, creating a budget becomes easier, and you’ll be more motivated to do so in the first place.

If you want to use a budget to stay on track financially, you need to understand some budgeting basics, know how to prioritize, and build some new habits and self-discipline.

With a solid budget in place, financial stability becomes a more attainable goal.

Understanding the basics of budgeting

Having a budget is non-negotiable for effective personal finance management. By creating a spending plan, you ensure you always have enough for essentials and can set some money aside for savings and future goals. This way, you’ll be able to build a strong foundation for financial stability and bring a sense of peace to your money management.

Budgeting gives you a clear picture of your finances, helping you track your income and expenses so you know exactly where your money goes every month. Simple awareness can help you avoid overspending and encourage smarter choices. By prioritizing your goals — like saving for retirement or paying off debt — having a budget helps you make informed decisions about your spending.

However, there are different ways to go about this. Choosing a budgeting method that aligns with your lifestyle is key. Whether it’s the hands-on envelope system or the convenience of digital apps, having the right system in place will make budgeting a more sustainable habit. Budgeting isn’t about restriction — it’s about using your money to create a financially stable, stress-free life.

Why budgeting is important

Why does budgeting matter? Simply put, it’s a guide towards your goals. Your budget is like a financial roadmap, guiding your spending and helping you make the most of your monthly income. Without a budget, it’s easy to lose track of where your money goes, accidentally overspend, and end up stressed about your finances. Budgeting is a really simple solution to all of this.

With this in mind, budgeting becomes essential for reaching any financial goals you may have. Whether you’re saving for a down payment or a vacation, a budget helps you allocate funds toward your priorities. It also prepares you for the unexpected, helping you to create a financial cushion that minimizes stress when life throws surprises your way.

Common budgeting methods

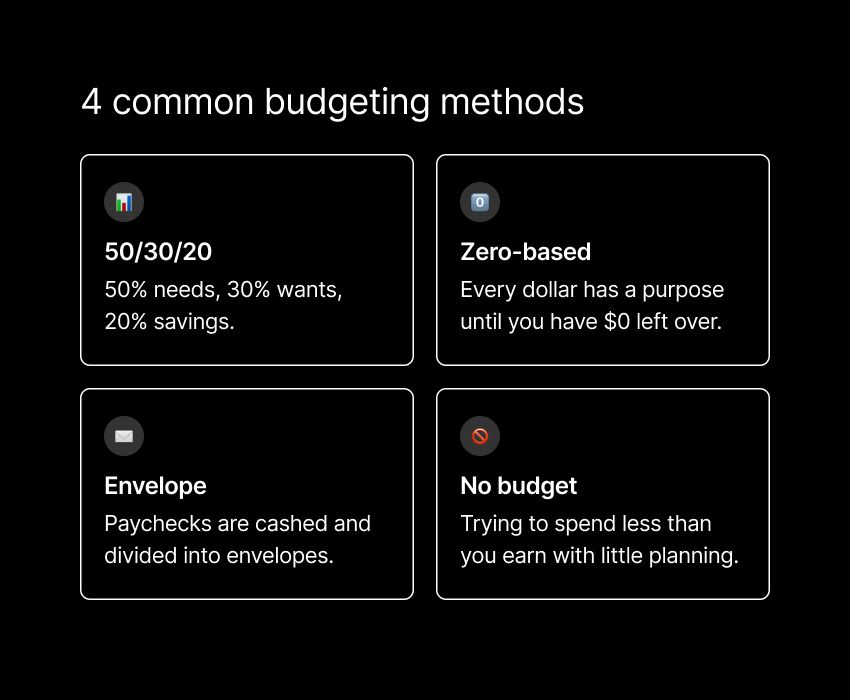

We’re all different, and very few things in life are truly one-size-fits-all — budgeting certainly isn’t one of them. Fortunately, there are loads of ways to go about this, including:

The envelope system: This method divides cash into separate envelopes for different spending categories (like groceries, dining, or entertainment). Once the cash in an envelope is gone, you have to stop spending in that category. This approach is a good option for those who prefer using cash and want a physical way to manage their money.

Zero-based budgeting: Here, every dollar of income is assigned to a specific expense or savings category until your income minus expenses equals zero. This method helps you make sure that every dollar is accounted for, and it requires careful planning and regular adjustments.

The 50/30/20 rule: The 50/30/20 rule is an incredibly simple method that allocates 50% of income to needs, 30% to wants, and 20% to savings. It offers a balanced budgeting approach adaptable to most financial situations.

These are just a few examples of how you can set up your budget, and there are countless other ways to do it. Your budget needs to suit your specific lifestyle and goals, so you might need to try out a few different methods to see what fits.

Setting clear financial goals

Setting clear goals is the key to managing your money confidently. When you know what you want to achieve, it’s easier to make budgeting decisions that keep you on track and give purpose to your financial choices. Having a clear focus can make it simpler (and easier) to stick to your budget, even when things get tough.

You’ll need to start by breaking down your goals into short-term and long-term categories. Short-term goals are those you can accomplish within a year, while long-term goals require more time and planning.

Next, you have to think about how to prioritize your expenses. All of your monthly expenses, from housing and groceries to dining out or entertainment, will have a space in your budget. It’s up to you to decide how much of your income is being allocated to these categories.

Short-term vs. long-term goals

Knowing the difference between short-term and long-term goals is crucial for planning effectively.

Short-term goals: These are usually achievable within a year and offer quick wins that can keep you motivated. These may include saving for a gadget, paying off a small credit card balance, or setting aside money for a weekend trip. Because they’re immediate and specific, short-term goals can provide that needed sense of accomplishment.

Long-term goals: These are bigger commitments – like saving for retirement, buying a home, or funding your child’s education. These goals require a consistent, strategic approach, often involving investments or long-term savings plans. They also take more patience and discipline, but sticking to them can have major payoffs.

Balancing both types of goals in your budget helps you make sure you’re making progress on all fronts. As you contribute regularly to a retirement fund, you can also allocate smaller amounts to short-term goals, like an annual vacation. All it takes is setting your priorities and being intentional with your spending.

Prioritizing your expenses

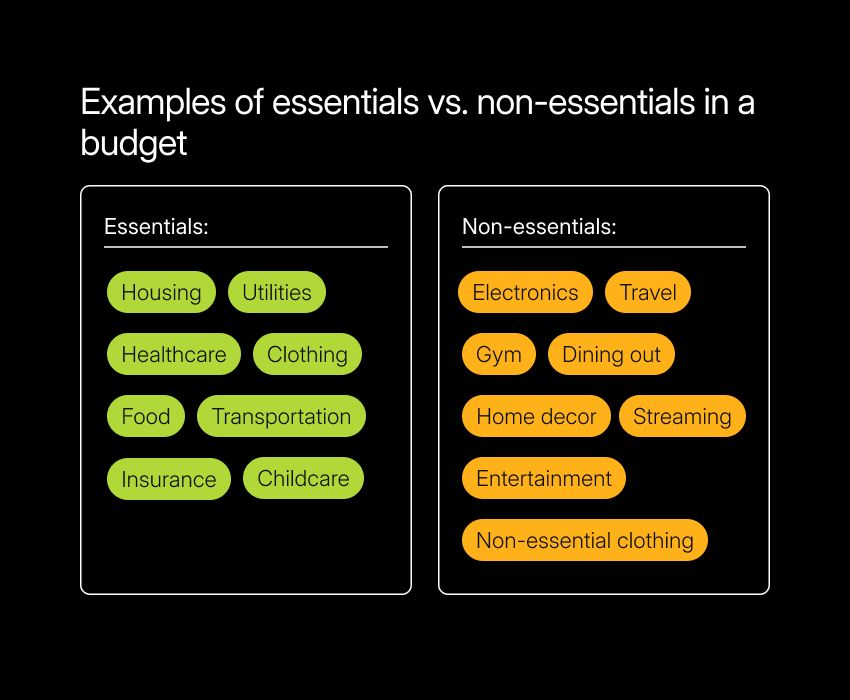

Effective budgeting always starts with learning to prioritize spending where it matters. This will help you meet your essential obligations first, keeping your basics covered and your financial foundation strong.

Start by listing your monthly expenses and distinguishing between essential costs:

Housing

Utilities

Groceries

Transportation

Healthcare

Next, list your non-essential ones:

Dining out

Streaming services

Tech upgrades

Weekend getaways

Only once essentials are covered can you start directing leftover funds toward non-essential spending and savings. This way, your budget reflects your real needs and goals, helping you avoid impulse purchases and align your spending with what matters most to you.

Regularly reviewing your expenses is also an important part of budgeting. Life happens, things change, and your budget may need to adapt. If you get a salary increase, you might boost your savings or pay down debt more aggressively. If money becomes tight, you can scale back on unnecessary expenses. Staying flexible keeps your budget effective and relevant as your needs shift.

Creating a realistic budget plan

It's crucial to have a realistic budget plan that reflects your actual income and expenses while being flexible enough to adapt to life’s changes.

Start by tracking your income and expenses so you can understand your cash flow. Albert’s “a utomatic budgeting” feature can help you track your spending and monitor your bills without the hassle of needing to write them down or make calculations on your own.

Tracking your income and expenses

Accurately tracking your income and expenses is the cornerstone of any successful budget. Creating a budget that reflects your financial situation is impossible without this information.

Document all your sources of income, including your salary, freelance work, and any side hustles you may have. This will give you a clear picture of the funds you have available to work with every month.

Next, categorize your expenses into fixed and variable costs. Fixed expenses — like rent or mortgage payments, utilities, and insurance premiums — don’t change from month to month. Variable expenses fluctuate, including groceries, dining out, and entertainment. By tracking these expenses (every single one), you’ll be able to see spending patterns and identify where you can cut back a little.

Adjusting your budget as needed

Your budget needs to be flexible enough to accommodate life’s unexpected changes. Whether it’s a job change, an unexpected medical expense, or a new financial goal, adjusting your budget is essential to maintaining your financial health. When you review your budget regularly, it keeps you aligned with your plans and helps you adapt without feeling overwhelmed.

Start your review by assessing your current financial situation to identify any changes in your income or expenses.

If you’ve received a raise or have a new source of income, think about how this affects your budget. You might want to allocate some extra funds toward savings, debt repayment, or a financial goal you’ve been thinking about.

On the flip side, if you’ve encountered unexpected expenses like medical bills or car repairs, it’s wise to temporarily cut back on non-essential spending to stay on track with your budget.

Tips to stay committed to your budget

Staying committed to your budget can be challenging, but certain strategies can help you stay disciplined and focused. It’s all about creating spending habits that support your financial goals and taking advantage of tools that’ll make it easier for you.

Automate your savings

Automating your savings is a really simple yet powerful strategy for making sure that saving becomes a consistent habit – because you’re not giving yourself a choice or the opportunity to forget. By setting up automatic transfers to a savings account, you’ll remove the temptation to spend money that could otherwise be saved.

The benefit of automating savings is that it requires almost no effort once you’ve set it up. Each payday, a set amount is transferred straight into your savings account, and you won’t even have to think about it. Even if it’s just a small amount, this can lead to big savings over time.

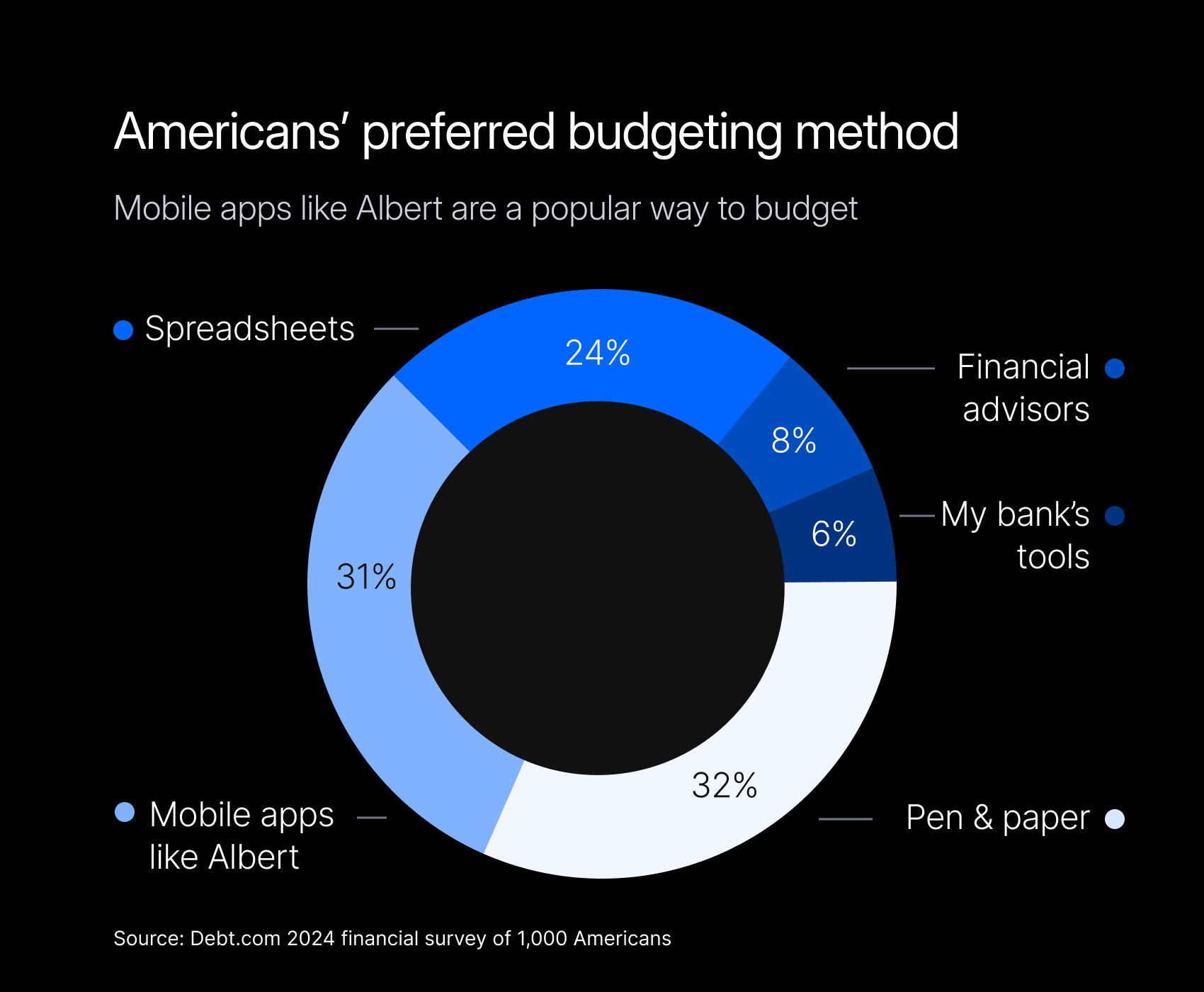

Use budgeting apps and tools

Leaning on a budgeting tool can be a big help if you want to learn to manage money effectively. Budgeting tools like apps and websites give you a single platform to track your expenses, set financial goals, and monitor your cash flow in real time. Taking a digital approach to your budget not only makes things more convenient but also makes it easier to stick to your budget.

One major advantage of using budgeting features in apps like Albert is having the ability to automate and categorize your expenses. This saves you from manually tracking spending and gives you a clear picture of where your money is going each month. With these insights, you can spot trends, fine-tune your budget, and make better-informed financial decisions.

Many of these apps also include helpful features like bill reminders and spending alerts. These are small but powerful features that will keep you on top of your financial commitments and help you avoid late fees or missed payments.

Avoiding common budgeting mistakes

Even with good intentions, it’s easy to slip up regarding finances and budgeting. When you know the common pitfalls and mistakes that others often make, you’ll be better prepared to avoid them yourself. Some include:

Forgetting to plan for all expenses

Not tracking everything you spend accurately

Ignoring irregular expenses like holiday spending

Not accounting for all expenses

Two of the biggest mistakes people make are not planning for all their expenses in their budget and not tracking every payment they make.

Even small oversights can lead to unexpected shortfalls and financial stress. Small, irregular expenses, like last-minute coffee, birthday gifts for family members, or an annual subscription, often get overlooked. This is why absolutely everything needs to be accounted for.

To avoid this, make it a point to track every single expense, no matter how small. This includes those occasional costs like car maintenance, home repairs, or holiday spending. By including everything in your budget, you’ll have a clearer picture of your financial situation, which helps you dodge surprises.

Ignoring irregular expenses

Another common budgeting pitfall is neglecting irregular expenses. These include annual insurance premiums, holiday gifting and decorating, or unexpected medical bills. If you don’t plan for these somehow, they can catch you off guard and throw your budget out of whack.

This is why having a buffer or a specific saving category in your budget for these kinds of expenses matters. Set up a savings account for these “maybe” or “eventually” expenses, or find another way to be proactive. From time to time, look ahead in your calendar so you can come up with a financial plan for any birthdays, holidays, vacations, or routine car services coming up.

The role of discipline and habits in budgeting

Developing self-discipline and building consistent habits form the backbone of successful budgeting. Without healthy financial habits, goals will be forgotten, and spending can easily slip out of your control.

Building consistent saving habits

Habit building isn’t easy, but it’s worth it when you start seeing the results of your efforts. Saving consistently will help you achieve long-term financial stability and reach those smaller, short-term goals. If you want to save money, even small amounts add up over time.

Here are some healthy savings habits to help you along:

Set specific goals: Start by defining a specific savings goal – whether it's building an emergency fund or saving for a vacation.

Automate your savings: Automating savings is an easy and effective way to build discipline. By setting up an automatic transfer to your savings account, you ensure that saving becomes a priority and reduce the temptation to spend.

Review and adjust: Regularly review your savings goals and track your progress. This can help you stay motivated and focused, allowing you to gradually increase your savings as your financial situation improves.

Staying motivated and focused

Staying motivated and focusing on your financial goals can be challenging, too, especially when life happens. Here are some strategies to help you stay on track:

Set clear milestones: Break down your financial goals into clear, achievable milestones. Use these as checkpoints to track your progress.

Celebrate small victories: Acknowledge and celebrate small wins like paying off your credit card or reaching a savings milestone. This will boost your confidence and keep you motivated.

Visual reminders: Keep visual reminders of what you’re working towards — pictures of your dream home or a collage of vacation destinations.

Be flexible: Keep reviewing and adjusting your goals as needed. Life circumstances change, and your financial objectives should adapt accordingly. Being flexible and adaptable will help maintain your motivation and allow you to keep making progress.

Staying on track financially with effective budgeting tips

Staying on track financially requires thoughtful planning, consistent habits, and the right tools. Albert offers an all-in-one solution for anyone looking to manage their money more effectively.

Integrating these budgeting tips with the app's powerful features lets you make your financial journey simple and manageable.

Understanding the fundamentals of budgeting, setting clear financial goals, and creating a realistic plan are essential steps toward success. With the right tools and a little self-discipline, you’ll be well-equipped to achieve your financial goals without sacrificing everything you enjoy.

⚡️ Learn how Albert can help you take charge of your finances and meet your personal goals.