Personal financial planning is your guide to achieving financial security and peace of mind. In a world where economic uncertainties are part of life, taking charge of your finances is more important than ever.

Financial planning goes beyond numbers. It involves aligning your financial decisions with your personal values and long-term aspirations, starting with understanding your financial habits. When you do, you can make intentional choices to improve your financial health.

Whether your goal is to pay off debt, save for a home, or prepare for retirement, personal financial planning can provide the guidance you need to succeed.

Fortunately, technology has made financial planning easier and more accessible than ever. Various financial apps and other tools allow you to track your spending, set financial goals, and get tailored advice for managing your money. Taking advantage of these resources can simplify the planning process and help you take control of your financial journey.

The importance of personal financial planning

Personal financial planning is important because it gives you a structured approach to achieving financial security. Without a plan, it’s easy to lose track of your spending, accumulate unnecessary debt, or miss out on opportunities to save and invest. A clear plan can help you avoid all of this.

Another key advantage of financial planning is that it helps you prepare for the unexpected. Life is unpredictable, and an emergency fund or proper insurance can shield you from the financial strain caused by job loss, medical emergencies, or other unforeseen challenges.

Planning also helps you set priorities, whether saving for a short-term goal like a vacation or working toward long-term ambitions like buying a home.

When you effectively manage your income and expenses with a solid plan, you may discover opportunities to save more and invest strategically to grow your wealth over time. A proactive approach allows you to take control of your financial future instead of constantly reacting to challenges.

Steps to create a personal financial plan

Building a financial plan starts with a structured approach to managing your money and setting yourself up for long-term success. Each step provides a foundation for the next, creating a cohesive and tailored strategy for your financial future.

Assess your current financial situation

To understand where you stand financially, list your personal assets (like savings accounts, investments, and property) and liabilities (such as credit card debt, student loans, or a mortgage). Subtracting your liabilities from your assets gives you your net worth — a snapshot of your financial health.

This process will highlight areas for improvement, such as cutting back on non-essential spending or redirecting funds to savings. Tools like the Albert budgeting tool can make this simpler by helping you track your income and expenses automatically.

Set financial goals

Once you have clarity on your current finances, define your goals. These can be short-term (like budgeting for a vacation or paying off a small debt) or long-term (like retiring comfortably or buying a home).

Short-term goals

Make short-term goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, rather than saying, "I want to save money," aim for "I will save $1,000 in six months by reducing my dining-out expenses."

These goals can typically be achieved within a year or less, and they’re important because they help you build momentum and offer quick wins to boost your motivation.

Long-term goals

Long-term goals typically take longer to achieve, think years or decades, and require more planning. For example, if you aim to retire in 30 years with $1 million saved, calculate how much you’ll need to invest each month and account for returns on investment. It may also include major life milestones such as budgeting for a baby.

You can adjust these goals as your life changes to keep them realistic and aligned with your evolving priorities.

Develop a budget

Creating a budget helps you allocate your income wisely by balancing necessary expenses, discretionary spending, and savings.

Begin by listing all your sources of income and expenses, both fixed (like rent and utilities) and variable (like entertainment or dining out).

Compare your income to your expenses, and if you’re spending more than you earn, identify areas to cut back.

A popular method is the 50/30/20 budget rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. Adjust these percentages as needed to fit your financial situation.

Apps like Albert offer budgeting features that can simplify the process by categorizing expenses and providing insights into spending habits, helping you stay on top of your money.

Build an emergency fund

An emergency fund is a financial safety net for unexpected expenses, such as medical emergencies or car repairs.

Try to save three to six months' worth of living expenses, focusing on essentials like housing, groceries, and transportation.

Start small with a realistic goal and automate your savings to stay consistent. Keep this fund for emergencies only and replenish it quickly if you need to use it.

Plan for retirement

Retirement planning helps you maintain your lifestyle and live comfortably after you stop working. Begin by estimating your future needs, and don't forget to factor in living expenses, healthcare, and inflation.

For your savings plan, you can explore retirement savings accounts like 401(k)s, traditional IRAs, or Roth IRAs. Diversify any investments you may have across asset classes to manage risk and adjust your strategy as you age to prioritize stability.

Manage debt effectively

Debt management plays a key role in financial health. If possible, prioritize paying off high-interest debts first, as they cost the most over time.

Popular strategies for debt repayment include the debt avalanche (tackling high-interest debts first) and the debt snowball (paying off smaller debts first for motivation).

You can also consider consolidating your debts to lower interest on accounts or loans. Commit to a repayment plan that fits your budget and avoid accumulating new debt as far as possible.

Invest wisely

Investing can grow your wealth over time, helping you achieve your long-term goals. If you start investing, try to diversify your portfolio across different asset types, such as stocks, bonds, and real estate, to balance risk and reward.

Begin with low-cost index funds or ETFs (Exchange-Traded Funds) for broad market exposure. Regular contributions, or dollar-cost averaging, can help you invest consistently and reduce the impact of market fluctuations.

Remember, investing involves risk and requires patience. Avoid reacting to short-term market changes.

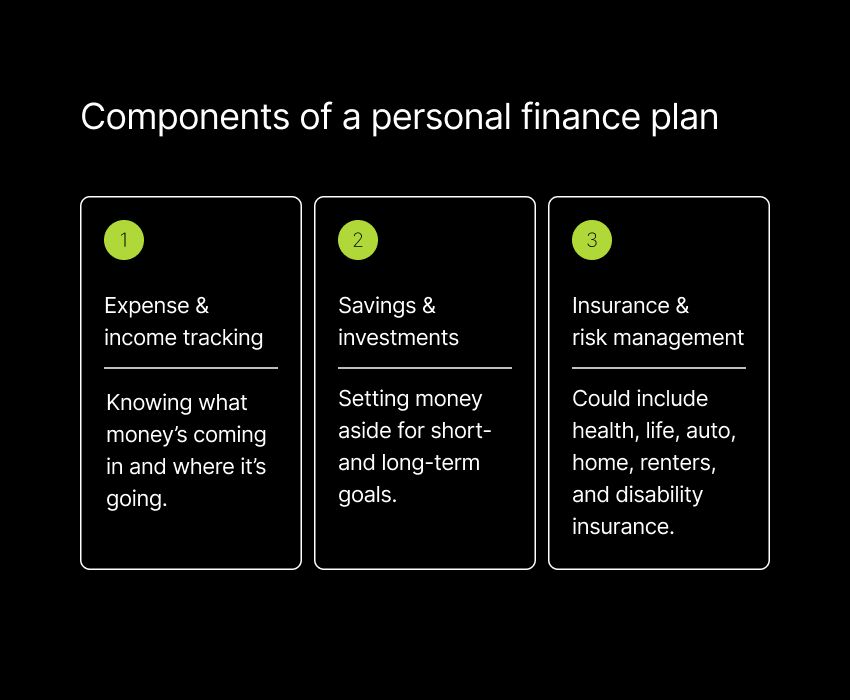

Components of a successful personal financial plan

A solid personal financial plan comprises a few key factors that work together to support your financial well-being. By understanding and managing each component, you can create a roadmap that aligns with your goals and sets you up for long-term stability.

Income and expense tracking

The first step to gaining control over your finances is understanding where your money comes from and where it’s going. Tracking every dollar can give you a clear view of your cash flow.

This understanding can help you pinpoint areas where you’re overspending or uncover opportunities to save. For instance, you might realize that small, frequent purchases like takeout or coffee add up quickly.

There are plenty of tools to simplify this process for you. Apps like Albert will categorize your transactions, send spending alerts, and generate reports, so you always know exactly what’s happening with your money. You can build awareness and make smarter spending decisions when you're consistent with tracking.

Savings and investments

Your savings strategy and investments work hand-in-hand to secure your financial future. Savings provide a safety net for emergencies and short-term goals, while investments grow your money over time for larger, long-term objectives.

Start by saving regularly, even if it’s just a small amount. Automate your savings so it happens effortlessly — think of it as paying yourself first.

For investments, familiarize yourself with the basics: how different options (like stocks, bonds, and real estate) work and how risk and return are connected. Choose investment options that align with your goals and comfort with risk.

Diversification is essential, too. By spreading your money across different types of investments, you can reduce the impact of any one investment’s poor performance.

When investing, remember to check your portfolio periodically to make sure it’s still aligned with your goals. Rebalancing or adjusting your investments so they continue to match with your strategy and values is a simple way to stay on track.

Insurance and risk management

Unexpected events can derail even the best-laid financial plans, which is why insurance is one of those must-have financial products. Think of it as a way to protect yourself and your family from major financial setbacks.

Here are the key types of insurance to consider:

Health insurance: Covers medical costs that can otherwise be overwhelming

Life insurance: Ensures your loved ones are financially supported if something happens to you

Disability insurance: Replaces your income if you’re unable to work due to illness or injury

Homeowners or renters insurance: Protects your home and belongings from theft or damage

Auto insurance: Covers liabilities and damages related to driving

Take the time to review your coverage regularly to ensure it still meets your needs. Life changes like marriage, having kids, or buying a house might require you to adjust your policies.

While paying for insurance can feel like another expense, it’s an investment in peace of mind. The right coverage protects your assets and ensures you and your family are financially prepared for any setbacks.

Tips for maintaining your personal financial plan

A good financial plan is one that’s regularly maintained. It is an ongoing process that needs to grow and change with your life. Here are some financial planning tips to keep your plan effective and aligned with your goals.

Review and adjust regularly

Life happens, and your financial plan should reflect that. Commit to reviewing it at least once a year — or more often if big changes come your way, like a new job, getting married, or having kids.

During your review, take a close look at your:

Budget: Are you staying within your limits?

Savings and investments: Are you on track to hit your goals?

Insurance coverage: Do you have the protection you need?

Debt repayment: Are you paying off your balances effectively?

Adjustments might include shifting your savings priorities, spending plan, or rebalancing your investments. Think of your plan as a living document that evolves with you, helping you handle challenges and seize opportunities as they come.

Stay informed about financial trends

The financial world moves fast, and staying in the know can make a big difference. Keep an eye on trends like:

Changes in interest rates or tax laws

Market conditions that affect your investments

Economic shifts that might impact your goals

Stick to reliable sources. Think reputable financial news outlets, trusted analysts, or educational podcasts and books. Focus on information directly relevant to your goals.

If you’re unsure about what a trend means for your finances, seek guidance or other tools for expert insights. Staying informed can help you adjust your strategies, avoid pitfalls, and make smarter moves with your money.

Seek guidance

Sometimes, the best way to strengthen your financial plan is by asking for advice from an expert. Financial experts can offer you personalized guidance for retirement planning, tax optimization, and more.

Their expertise can help you make complex decisions, uncover opportunities, and avoid costly mistakes.

Services like Albert Genius can connect you with experts who can answer your money questions and offer financial insights. Seeking help isn’t about handing over control — it’s about empowering yourself to make better financial decisions.

Achieving financial peace of mind

Financial planning isn’t just about managing your money; it’s about creating a life that makes you feel more secure and confident about your future.

With tools like Albert, you can simplify the financial planning process and reduce the overwhelm commonly associated with money management. From budgeting tools to expert guidance, Albert offers resources to help you confidently achieve your financial objectives.

Remember, financial planning is a continuous journey. Stay committed, ask for help when needed, and embrace the process. With the right approach, you can build a secure financial future that supports what matters most to you.

⚡️ Start today and see how Albert can help you achieve financial peace of mind.