Extreme frugal living is all about minimizing your expenses as much as possible to save faster.

It’s a strategy commonly used by people who want to prioritize paying off their debt, saving for retirement, or achieving financial freedom.

The goal is to cut unnecessary costs and focus on what matters most. This could mean only cooking at home, buying secondhand, or finding smarter ways to spend. This lifestyle involves being extra intentional with your spending and prioritizing long-term financial goals.

While it takes discipline, the payoff can be worth it: more savings, less stress, and greater financial control.

Understanding extreme frugal living

Extreme frugal living is about minimizing expenses to prioritize long-term financial goals. It’s not just about budgeting; it’s about rethinking needs versus wants and making deeply intentional choices that align with your financial priorities.

To start, it’s crucial to shift your mindset. You’ll have to evaluate each expense carefully — think about small daily habits that might be holding you back financially, like not taking your own lunch to work or keeping unused subscriptions.

When you want to live extremely frugally, your financial goals should always drive your decisions. Knowing your goals will keep you on track, whether you're paying down debt or contemplating large purchases. Tools like the Albert app can help you by tracking your spending, budgeting for you automatically, and offering advice to make your journey easier.

Extreme frugality isn’t about living “without” — it’s about drastically simplifying your life and focusing on what matters most to you. You can still enjoy free activities, make homemade gifts, or find value in everyday moments.

Ultimately, this is a very personal journey. What works for one person may not work for another, but the goal is the same: balance financial progress with a fulfilling lifestyle. With commitment and the right support, you can embrace this approach to personal finance and see real benefits.

The essential strategies for extreme frugality

If you want to start your extreme frugal living journey, you’ll need to implement practical strategies as soon as possible. These methods focus on reducing expenses while staying intentional and disciplined to accelerate your financial progress.

Creating a strict budget

A clear budget is the foundation of extreme frugality. Track every expense and document all sources of income to see where your money goes. Having transparency about this will make cutting back on unnecessary costs easier.

Budgeting tools can make this process easier. Apps like Albert help create a custom budget, monitor spending, and track bills. Albert will categorize your expenses, give insights into your spending habits, and help you set realistic financial goals.

Be sure to set very clear limits for categories like groceries, utilities, and entertainment, and regularly review your spending to keep it on track. Even when you’re living frugally, a budget isn’t static; it’ll need to change as your circumstances evolve. Flexibility here will actually help you stay on top of unexpected expenses and continue making progress.

Cutting unnecessary expenses

To practice extreme frugality, you have to focus on eliminating non-essential costs. Cancel unused subscriptions, eat out less (or not at all), and find lower-cost alternatives for your daily needs. Take the time to examine each expense to determine its true necessity.

A minimalist mindset can help here. Before making a purchase, ask if it adds value or is just an impulse. Delay gratification by waiting a few days before buying any non-essential items to see if the urge fades.

Negotiating bills is another effective way to cut costs. Many service providers will offer discounts to retain customers, and you may be able to get better rates from your internet, phone, or insurance providers. Actively seeking opportunities to reduce expenses can free up more money for your goals.

Smart shopping habits

Smart shopping is another cornerstone of extreme frugality. Plan your purchases, always use a shopping list to avoid impulse buys, and try to compare prices before making a purchase.

Buying in bulk for non-perishable items is a great way to save, and you can also choose generic or store brands instead of name brands to maintain quality while cutting costs. Look for coupons, discount codes, and cashback deals to further stretch your budget.

Another smart choice is to shop second-hand where you can. Thrift stores and online marketplaces are a great way to find quality items at a fraction of retail prices. From clothing to furniture, buying used items can give you the same value at a much lower cost.

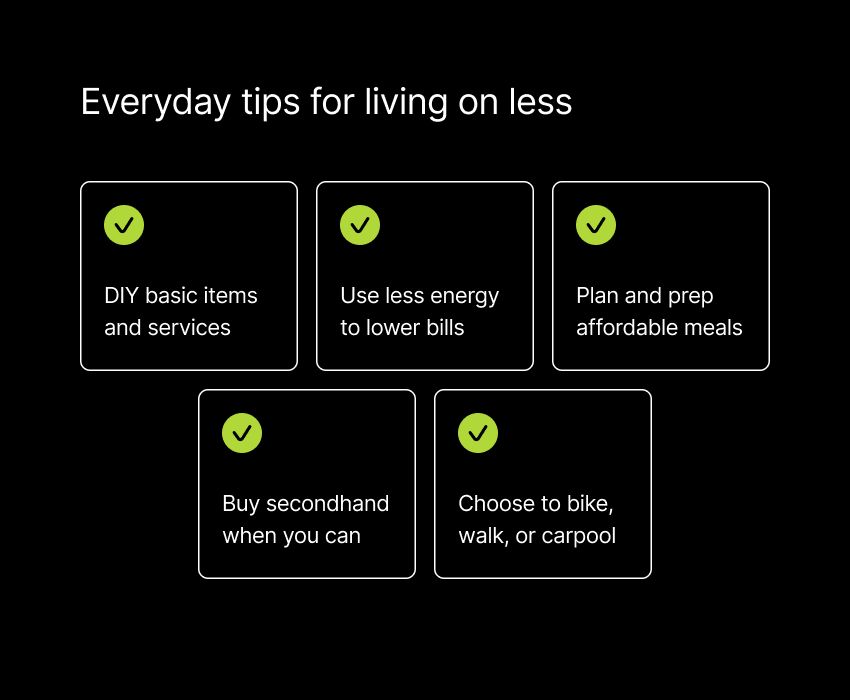

Everyday tips for living on less

Adopting extreme frugality also means making some smart changes to your daily routines. You’ll need to rethink your habits and find some more efficient ways to save so you can live well on less without feeling deprived. Here are some frugal living tips to apply to your routines.

DIY solutions

Turning to a DIY approach is an effective way to cut costs in certain areas of your life. Instead of paying for services or buying new items, try tackling tasks yourself.

From doing your own home repairs to making your own cleaning solutions, DIY projects will help you save money and also gain newfound self-sufficiency.

Learning basic skills — like sewing, gardening, or simple carpentry — can reduce your spending and boost your independence. You can use online tutorials to guide you through these tasks, helping you avoid paying for labor and unnecessary markups.

DIY can also apply to personal care. Making your own skincare products, doing your nails, and cutting your hair can all be more cost-effective options than paying for the same products and services.

Energy and resource conservation

Cutting back on your energy use lowers utility bills and helps the environment. Small frugal habits, like turning off lights when not in use, unplugging your devices, and using energy-efficient appliances, can help increase savings.

Simple habit changes like taking shorter showers, fixing leaks, and running full loads in the dishwasher or washing machine can also reduce water and energy costs. Adjust your thermostat, use ceiling fans, and ensure proper insulation to save on heating and cooling.

If possible, consider renewable energy solutions. Solar-powered devices and solar panels may require an upfront investment, but they may provide long-term savings and align with extreme frugality by reducing reliance on traditional power sources.

Affordable meal planning

Food is a major expense, but with planning, it’s possible to still eat well on a strict budget. Meal planning will help you buy only what you need, reducing waste and unnecessary spending.

Buying in bulk, especially for non-perishable items like grains and canned goods, can help lower your grocery costs. When it comes to fresh produce, try to opt for seasonal picks that are typically cheaper and fresher, offering health and financial benefits. Combining these two shopping tips will allow you to cook at home rather than dining out so you can control your costs and portion sizes.

To make this process even easier and more affordable, focus on simple recipes that don’t require expensive ingredients. You can also prepare meals in larger quantities and freeze extra portions to ensure you always have budget-friendly options, reducing the temptation to get takeout.

Money-saving hacks for your home

There are always opportunities to save money on how you live in your home. You can reduce expenses by making wise choices about maintenance, décor, and resources while maintaining a comfortable and functional living space.

Home maintenance

Keeping up with regular home maintenance can help prevent larger, more costly repairs down the line. Simple tasks like changing your air filters, cleaning the gutters, and checking for leaks are all minor issues that need to be kept up with. These can all be done yourself for a fraction of the cost.

Create a maintenance checklist to stay organized and ensure that key tasks aren’t overlooked. There are plenty of online resources to guide you through DIY projects safely and effectively if you have the right tools on hand. While investing in these tools may have an upfront cost, they’ll pay off by allowing you to handle most repairs yourself.

For larger repairs that do require professional help, take the time to get multiple quotes and try negotiating prices. You can also try combining projects or scheduling them during off-peak times to see if you can get discounts.

Thrifty home décor

If you want to enjoy your space — which is natural — you can use your creativity to enhance your home without overspending. This could look like repurposing items you already own, shopping at thrift stores, or creating your own décor pieces.

A fresh coat of paint on walls or furniture is an affordable way to change the look of a room if you really need a change. Incorporating natural elements, like plants, can add life to your space and is often low-cost since you can grow plants from cuttings.

Swapping décor with friends or family is another great way to refresh your home without spending anything. Some online communities offer opportunities to exchange or buy gently used items with people in your local area.

Upcycling and reusing

Upcycling and reusing items in your home are just a few frugal living ideas to consider.

Upcycling turns old, unwanted items into something useful, saving you money and reducing waste.

For example, you could turn old clothes into cleaning rags, repurpose glass jars as storage, or fix up and refinish furniture instead of buying new pieces.

Reusing involves extending the life of the things you already have. Simple practices like using both sides of a piece of paper, reusing containers for organization, or making the most of leftover materials can add to savings.

By making upcycling and reusing part of your frugal lifestyle, you’re saving money and supporting sustainability.

Transportation tips

Transportation can be a major expense, but if you make the right choices, you can cut costs without sacrificing convenience. To truly live frugally, you may need to rethink your travel habits and vehicle ownership, but this can allow you to reduce your expenses and support a more sustainable lifestyle.

Carpooling and public transit

Carpooling is a great way to reduce both fuel costs and vehicle wear. Sharing rides with coworkers or neighbors saves money and makes commuting more economical. It also helps you build connections while reducing your environmental impact.

On the other hand, public transit offers a cost-effective alternative to car ownership. Buses, trains, and subways are often cheaper than maintaining a car, especially when you add in insurance and parking. Many cities offer discounted passes or special programs to make public transit even more affordable.

To get the most out of either of these options, you’ll need to plan your routes and schedules efficiently, but the savings will be worth the effort.

Biking and walking

For shorter distances, biking and walking are not only cost-effective but also great for your health. This way of getting around completely eliminates fuel costs and requires little more than a decent bike or a good pair of shoes.

Many communities support cyclists and pedestrians with dedicated lanes or trails, so take advantage of these resources to further cut transportation costs while improving your overall well-being.

Vehicle maintenance

Regular maintenance can save you money if you own a vehicle. Basic tasks like checking your tire pressure, changing the oil, and doing routine inspections help extend the life of your car and prevent expensive repairs. Plus, learning simple automotive skills means you can handle minor issues yourself.

Use a maintenance tracking app to ensure you never miss important tasks. You can also save money by buying parts on sale or using coupons. When it comes to insurance, take the time to shop around for the best rates.

Finally, keep in mind that your driving habits affect your overall vehicle costs. Accelerating slowly, driving at a steady speed, and avoiding idling can boost your car's fuel efficiency and allow you to stretch your fuel budget. Consider other tactics like combining errands or opting to meet up with friends at a halfway point to cut down on mileage.

Achieving long-term financial goals

Extreme frugal living isn’t just reducing your spending for no reason. Living a more frugal lifestyle is a strategy to help you reach your long-term financial goals.

By saving aggressively and making smart investment choices, you can create a strong financial foundation that frees up money and mental energy in the future. Here's how frugality can play a key role in your financial planning efforts.

Building an emergency fund

An emergency fund is a financial safety net for unexpected expenses like medical bills or car repairs — aim to save three to six months' worth of living expenses. Having this fund in place is essential for financial stability.

It’s also a good idea to keep the emergency fund in a separate, accessible account to avoid the temptation to use it for non-emergencies. Review your contributions regularly, especially if your income changes, to ensure your fund remains adequate.

Saving for retirement

Living frugally can help create room in your budget so you can prioritize saving for retirement.Contributing to retirement accounts like 401(k)s or IRAs will allow you to take advantage of tax benefits and compound interest. This means the earlier you start, the more you’ll benefit.

Maximize your employer-sponsored retirement options, such as matching contributions, to boost your savings without any extra cost to you. Increase your contributions when you get a raise or bonus to fast-track your retirement savings.

Investing wisely on a budget

Investing isn't just for the wealthy. Even small amounts can grow over time, as long as you start with what you can afford and stay consistent, so it’s still a good idea for those living extremely frugally.

It’s also a good idea to diversify your investments. This reduces risk and increases the growth potential. Now, certain platforms allow for low or no minimum investments, making it easier to get started. Apps like Albert let you invest in stocks, ETFs, and managed portfolios with just a few clicks.

Educating yourself is key when investing on a budget. Make sure you understand basic investment principles and know your risk tolerance to make smart decisions.

Thriving through extreme frugal living

The concept of extreme frugal living is more than just a money-saving tactic. It’s a lifestyle that lets you control your finances and leads to long-term peace of mind.

By being intentional with your spending, you can align your daily choices with your bigger financial goals. This approach isn’t about sacrificing your quality of life; it’s about making room for what truly matters so you can feel freer in the future.

A budget tracker app like Albert can help simplify the process with budgeting, spend tracking , and investment tools.

At its core, extreme frugality can empower you to take control of your finances, reduce your stress, and live a more fulfilling life. With the right strategies and commitment, living frugally isn’t just doable — it’s incredibly rewarding.

⚡️Ready to start living smarter and spend less? Download the Albert app today.